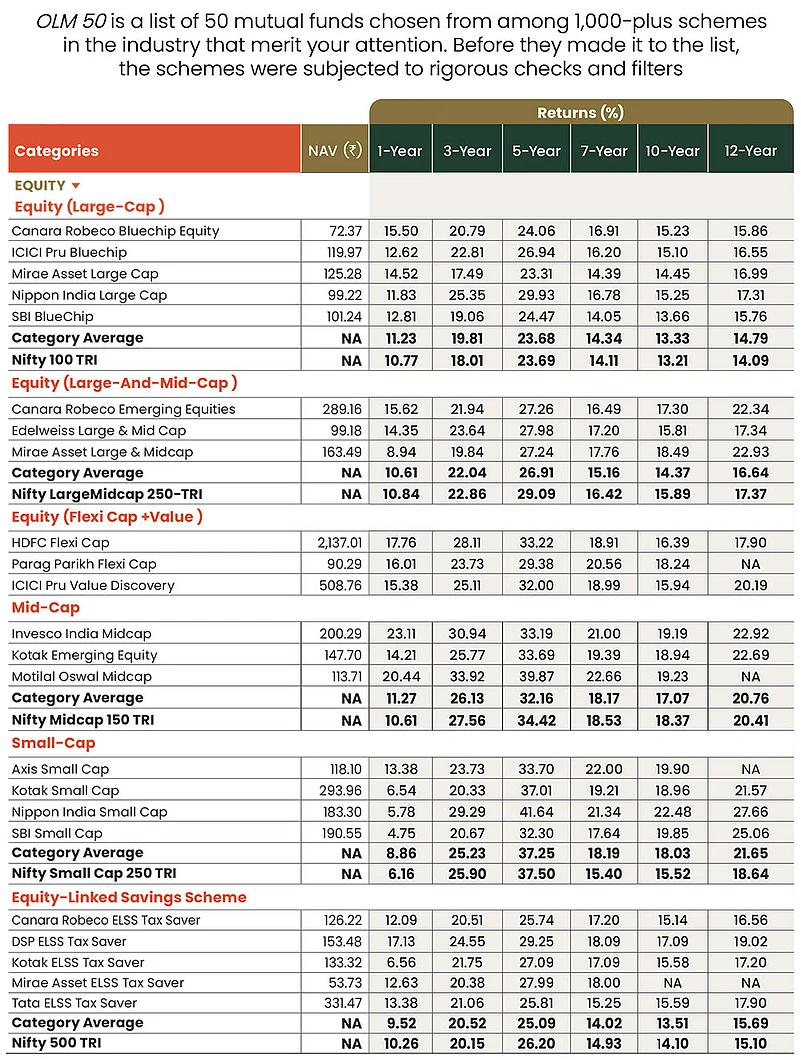

Last year, when we came up with the OLM 50 review around the same time, many readers wrote back to us, asking why the top performing funds were not a part of OLM 50, our curated list of well-researched and handpicked mutual funds.

When it comes to investing, most people are drawn to one key metric: returns. This is quite understandable because higher returns mean faster wealth creation. But the reality is that returns tell only half the story. What often gets overlooked, especially by retail investors, is a fund’s ability to manage risk against market downside. In simple terms, the fund manager’s ability to protect the investors’ capital during market downturns.

Here’s an example that a reader highlighted. The one-year return of Quant Mid Cap fund was 71 per cent, but the returns of the mid-cap funds in our list were in the range of 52-60 per cent. Now when we are reviewing our list, on a yearly basis, the average return from OLM 50 mid-cap funds is 19.26 per cent, while Quant Mid Cap has fallen 3.47 per cent. This is why when preparing the OLM 50 list, we do not just look for the best performer, but rather the consistent performer, along with other parameters, one of them being protection against the downside (see Methodology).

Let’s understand with another example. Suppose two funds, Fund A and Fund B have net asset values (NAVs) of Rs 100 each. Fund A delivers a 50 per cent return in the bull market (bumping up the NAV to Rs 150), but loses 40 per cent the next year (eroding the NAV to Rs 90). Fund B gains only 20 per cent during the bull run, but loses just 10 per cent next year, bringing the net NAV to Rs 108. Clearly, in this case, Fund B has outperformed Fund A.

Achievements

Notably, in keeping with tradition, all equity funds in the OLM 50 list contained the downside well during the market fall from October 2024 to March 2025. At the same time, out of the three mid-cap funds we chose, two are at the first and second positions in terms of returns. Even in the large-cap category, four out of five funds are in the top 10 list.

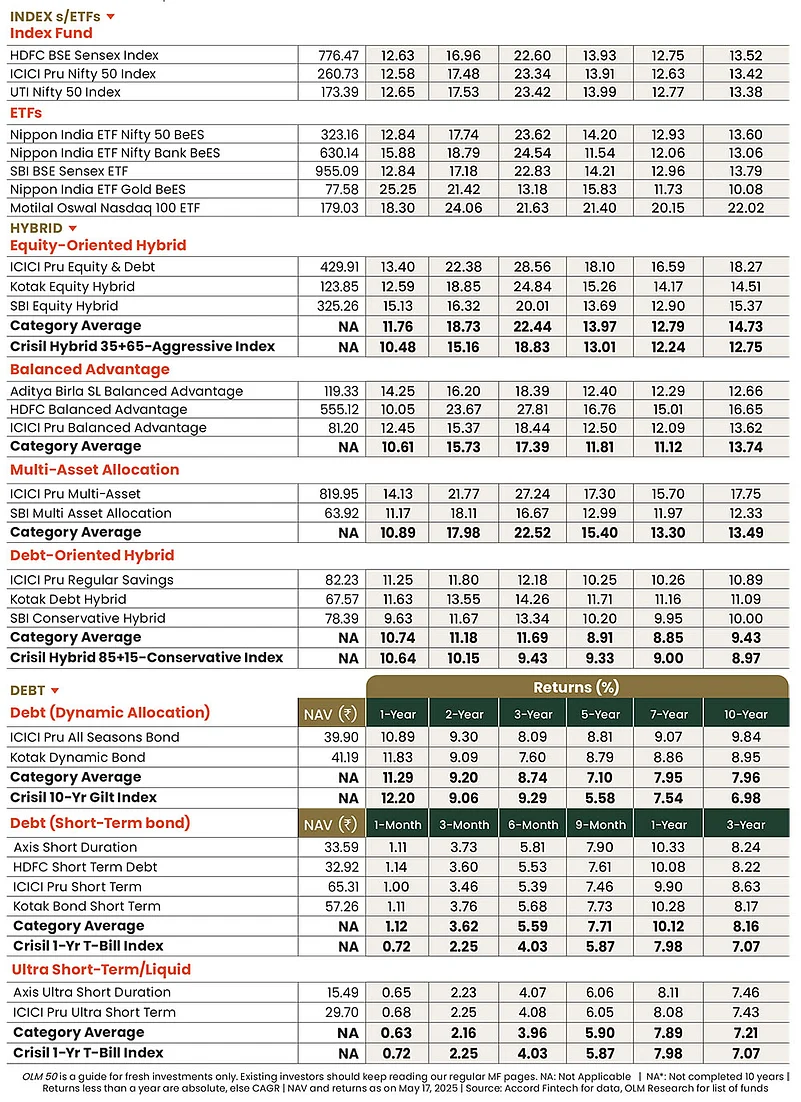

Similarly, funds in the hybrid and debt categories also proved their mettle. For instance, in the dynamic hybrid category, two of the three funds are in the top-five best-performing list on a one-year basis. Among short-term debt funds, three of the four secured a position among the top-five funds.

What Has Changed?

This time, we have introduced a new category in the OLM 50 list: multi-asset allocation funds or MAAFs (see page 56). The idea behind introducing this category is to provide our readers with a one-stop solution for all their investment needs, as the funds in this category take on the task of diversifying between multiple asset classes on behalf of the investor.

To make space for the two MAAF schemes, we had to reduce the number of funds and two other categories, Hybrid-Conservative (Aditya Birla SL Regular Savings) and Ultra Short Term (Aditya Birla Sun Life Liquid).

What Should You Do?

Not all schemes that are not in the OLM 50 list are bad. The list has been created as per our own parameters and criteria to feature the best picks as per our objective analysis. So, if you don’t find a scheme you own in the OLM 50 list, do not dismiss or exit it straightaway. Look at factors, such as asset allocation, diversification, and performance, before deciding on the next course of action.

New investors who want to pick a scheme afresh can build their portfolio by picking schemes from multiple categories to make sure their asset allocation is in place.

New Arrivals

ICICI Prudential Multi-Asset Fund

It’s one of the oldest schemes with a proven track record

SBI Multi Asset Allocation Fund

The scheme has a decent long-term performance track record

Departures

Aditya Birla SL Regular Savings

Aditya Birla Sun Life Liquid

Both schemes have left the OLM 50 list because of the addition of a new category. Existing investors may continue to hold them, as both of them are decent choices in their respective categories

Methodology

The OLM 50 basket of 50 funds has been chosen after much care and deliberation. The cut-off date for our analysis was March 31, 2025, and we have considered categories defined by the capital markets regulator, the Securities and Exchange Board of India (Sebi). We have only considered direct growth plans. Accord MF database was used for all the data and analysis.

Filters

We used two filters to reduce the number of funds. We have only taken schemes with assets under management (AUM) of at least 10 per cent of the respective category’s average corpus. If the category average AUM was Rs 1,000 crore, we did not consider schemes with an AUM size of less than Rs 100 crore in that category.

The other filter that we used is the number of years considered for the performance track record. We have only taken funds that have at least three years of track record.

Parameters

Equity and Equity-Oriented Funds: Equity funds were evaluated on three key parameters: risk-adjusted returns, downside risk and the fund manager’s stock-picking acumen. We considered these keeping in mind the retail investors’ risk-averseness and the fund manager’s ability to deliver returns.

We considered the fund managers’ track record. For this, we also evaluated other schemes under the fund manager to ensure consistency of performance and strategy. For those who started managing funds only in the last one year, we evaluated the past track record using their other funds.

Debt and Debt-Oriented Funds: We evaluated all debt funds on risk-adjusted returns and their credit quality (the score of investments in sovereign plus AAA/P1+ rating was evaluated and given due weightage) for three years. These ratings stand for high safety and less risk.