Summary of this article

Investor behaviour, not theme, drives most thematic investing underperformance.

Structural themes suit patient investors; cyclical themes demand timely action.

Align holding strategy, time horizon, and temperament for full value.

By Chakrivardhan Kuppala

Thematic investment is generally seen as a method to take part in long-term changes in the structure of society, such as formalisation, financial inclusion, digitalisation, defence, or decarbonisation. It’s easy to see why: support a good idea, keep your money in, and benefit from big trends as they happen. But in real life, a lot of investors have a hard time getting the returns these themes can bring. The issue seldom resides in the selection of ideas. It typically has to do with how the concept is held.

When a theme doesn’t do well or stays the same, investors start to wonder if it’s still relevant. They worry they have missed the upside as it goes up. Over time, these emotions form a pattern: investors leave early, come back late, and switch ideas often, even while they support concepts that are essentially excellent. The topic is not the problem. It is the difference between how a theme works and how it is run.

Structural vs Cyclical Themes: Two Distinct Journeys

Thematic strategies broadly fall into two categories – structural and cyclical.

Structural themes are driven by long-term shifts that unfold gradually. These may include formalisation of the economy, infrastructure creation, domestic manufacturing, or demographic transitions. Their pace is steady. Momentum builds slowly. Performance often comes in clusters after long periods of silence.

Cyclical themes, in contrast, are driven by near-term economic, regulatory, or liquidity shifts. These may include credit growth, interest rate cycles, commodity pricing, or policy-driven sectoral rotation. Here, timing is critical. Entry and exit must align with the cycle, or the strategy risks prolonged drawdowns.

In theory, this distinction is well understood. In practice, many investors fail to adjust their expectations and holding behaviour.

Investor Behaviour is the Primary Source of Underperformance

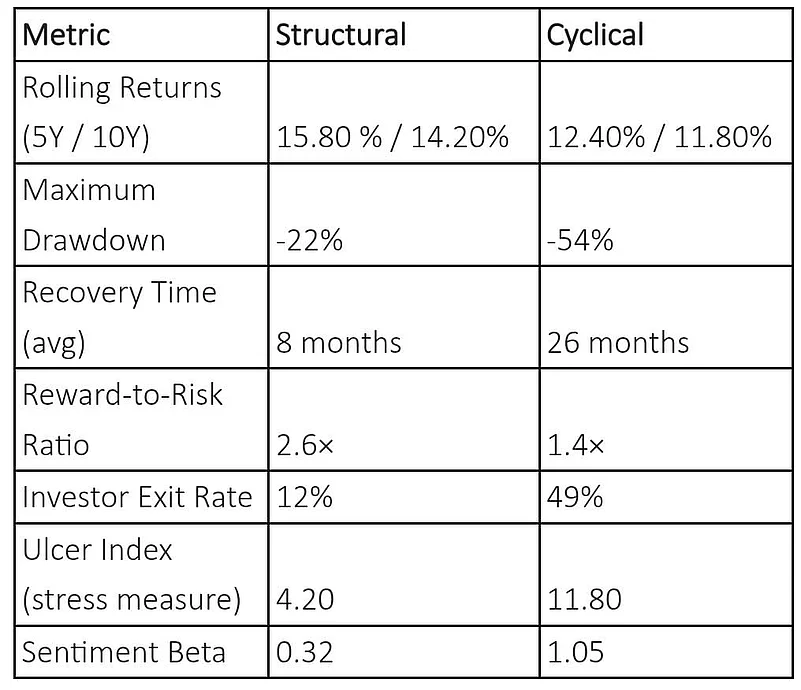

A long-term study of NSE India thematic indices between 2016 and 2026 reveals how behaviour, not selection, drives most thematic underperformance.

The takeaway is clear. Structural themes are less volatile, recover faster, and result in more stable investor holding behaviour. Cyclical themes, while potentially high-returning, generate higher levels of stress and attrition. Nearly half of investors in cyclical strategies exit during the ‘down cycle’ – often before any recovery begins.

These outcomes are not because themes are flawed. They happen because investors are not prepared for how the themes unfold over time.

The Real Challenge: Holding with Intent

Thematic investing is not passive. Each theme demands a different kind of engagement. Structural themes require patience. The rewards accrue over time, but they do not provide constant feedback. This makes it difficult for investors who seek visible progress or frequent performance triggers. The absence of movement is often misread as stagnation, leading to premature exits.

Cyclical themes, on the other hand, demand decisiveness. They reward early conviction, but punish delay. They also require clarity on exit points. Holding too long after a cyclical tailwind fades can reverse gains quickly. Investors often hold on to them under the assumption that structural change is underway when, in fact, the cycle has already played out.

In both cases, the same theme can deliver different results depending on how it is managed. The difference lies in the holding structure, not the investment thesis.

Aligning Theme and Temperament

Investors often focus on selecting themes based on return expectations. A more practical approach is to assess whether the operational tempo of the theme fits the investor’s temperament.

An investor with a long horizon and a low need for short-term validation is likely to do better with structural ideas. These strategies require fewer decisions, lower trading costs, and are more forgiving of inaction.

Conversely, an investor who follows markets actively and has a tighter feedback loop may be better suited to cyclical themes provided they have a clear process for monitoring macro conditions, sentiment indicators, and relative valuations. Problems occur when a structural theme is treated like a short-term trade, or when a cyclical idea is held as a passive allocation. This misalignment is one of the most common sources of thematic failure.

Key Questions to Ask Before Entering a Theme

To avoid behavioural mismatches, investors should assess the nature of the theme before allocating capital. A few key questions help clarify expectations:

What is the underlying driver of this theme – long-term reform or short-term rotation?

What does the return profile look like historically? Steady or episodic?

What level of monitoring does the theme require?

How much volatility can I tolerate without deviating from the plan?

Is there a pre-defined trigger for exit, or is the allocation open-ended?

These questions shift the focus from “What should I buy?” to “How should I hold it?” – which is more important for realised outcomes.

This makes time horizon, holding discipline, and behavioural alignment as important as the theme itself. When these are in sync, investors capture the full value of a theme. When they are not, even a correct call can lead to poor results.

Final Thought

Thematic investing is often framed as a way to express conviction in long-term structural or policy shifts. That framing is correct, but incomplete. Ideas alone do not deliver returns. Outcomes depend on whether the idea is held in a manner consistent with its nature.

The author is cofounder and executive director, Prime Wealth Finserv.

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)