Waheed Gokak (58) is a professor and father of two children. He was a little worried when he turned 50 as he had not planned for his retirement. Given the fact that he did not have much of a corpus to bank upon once he stops working in a decade’s time, he felt the urgent need to start his investments to secure his retirement.

Waheed was well aware about the menace of inflation and increasing life span. He knew that his savings would not be adequate enough and inflation-beating investments were a must for a secure future. As there were limited time available, suitable investment decisions were important. Thus, he was in search of a good financial planner who could facilitate his successful investment planning for retirement.

Meeting with Datta Kanbargi

Nearly 8 years ago, in the later part of 2015, Waheed met mutual fund distributor Datta Kanbargi. “I gave a patient hearing to Waheed to understand his situation, his thought processes and why he wanted to start investment,” says Datta. In the first meeting, Datta could figure out Waheed had a clear intent about why he wanted to invest.

After a few more meetings, the duo were ready to start their long-term association. Datta was happy to board him on the wealth creation journey and had explained the importance of patience, systematic investments and long-term compounding impact. Thus in December, 2015, the investment strategy was well placed and Waheed’s investment journey began.

Investment Strategy

After assessing Waheed’s cash flow and risk-appetite based on his assets & liabilities, Datta proposed a monthly investment of Rs 16,000/- through SIP mode with a top-up of 10% every year. He explained the concept of SIP as such a mode of investment helps in averaging out the investment costs across the market cycles. “Further, I highlighted the importance of increasing investment in a stipulated manner every year as income and salary go up simultaneously which calls for a rise in investment as well in the long-term,” narrates Datta. Waheed was educated about why time spent in the market was important instead of timing the market. He was also told that short-term volatility should not deter him. Waheed readily accepted this strategy and his investment journey began.

The First 5 Years of Waheed’s Mutual Fund Investments

As told and guided, Waheed kept his discipline intact and continued with SIPs. Intermittently, Datta also kept engaging with him with relevant educational communication. “Clear communication and continuous engagement with clients is one of my priorities. I am more like a service provider to my investors. I know it’s a business based on trust-based relationships which demands handholding of clients during their wealth creation journey,” explains Datta about his thought processes.

Since a major SIP contribution was going in schemes with value strategies, the first two years were quite good. Thereafter, during the next three years Value Strategy did not work. This got Waheed a bit nervous and worried. In fact, upon seeing 7% growth, he insisted on either reducing the SIP amount or stopping it.

Given Datta’s experience in dealing with clients’ investment psyche, he was not surprised with Waheed’s behaviour. He reminded him of the basics of investments and his goals. “I told him not to lose patience and let the SIP continue unabated,” says Datta. Waheed gave heed to him and acted as was told.

In 2020, during the pandemic, the market crashed nearly 35% in a short span of time. Already, Waheed’s portfolio was under pressure and the crash further impacted his investments. By December, 2020 as Waheed completed five years of investments, his portfolio merely 7% up on an annualised basis. Times were tough but the good part was Waheed continued with SIP, thanks to Datta’s handholding during the bad phase. By now his monthly investment was systematically increased to about Rs 25,000. This aided him to accumulate more units at lower rates during the long weakness in the market.

What We Did -- Successful Navigation and Strategic Approach

Datta, given his expertise, is well aware that his job significantly gained importance during weak market cycles. As this is the time when he needs to stand with his investors and instils confidence to be goal-focused without terminating investments. Though Waheed was impatient as markets cracked, Datta reminded him about his retirement goals. “We showed him the historical data and how schemes have performed post the crisis. We told him it was time to stay put and not take irrational measures of stopping investments,” notes Datta.

Further, Datta emphasized to Waheed that his goal was still five years ahead so there was no point in taking money out mid-way. The continuous engagement stoked confidence in Waheed and he agreed to continue. “At times we need to manage clients’ emotions and that’s exactly what we did with Waheed. We hand held him very strongly with conviction that he would be rewarded handsomely if he stayed invested,” pinpoints Datta. Once again, Waheed was convinced and continued on his wealth creation journey. As the markets bounced back in 2021 and scaled up much higher, Waheed could see exponential rise in his portfolio. As of January, 2024, his overall portfolio has appreciated a massive 22% on a CAGR basis.

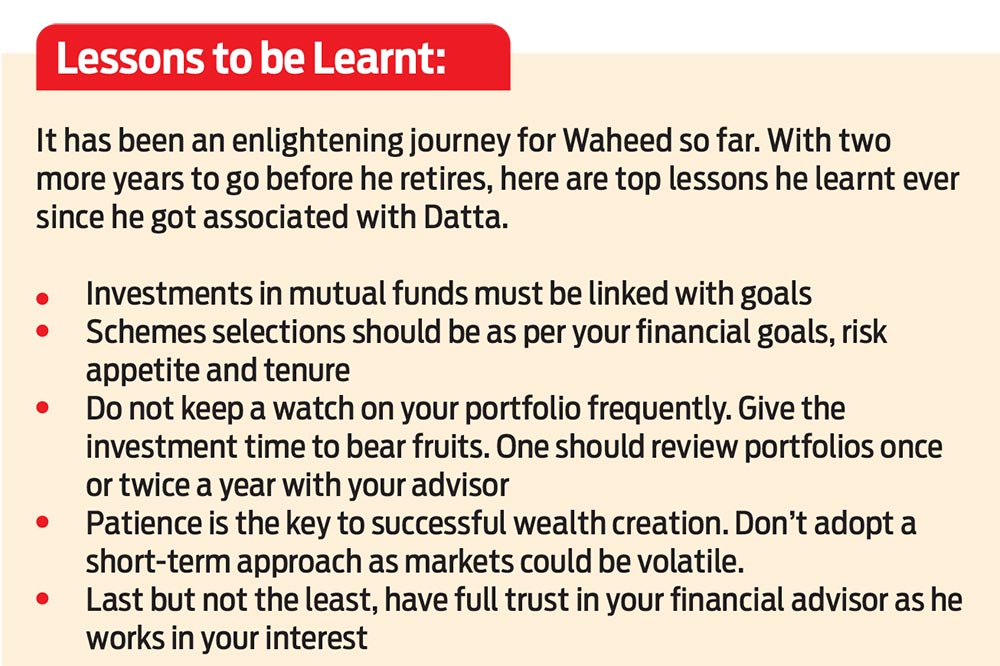

“I am very thankful to Mr. Datta Kanbargi for showing me the right path and keeping me goal-focused while my investment journey grew stronger,” obliges Waheed for the contribution Datta made. Mr. Waheed repeatedly says, “I must have started investing in Mutual funds much earlier”. Understanding the delay; he has made his children start investing early. He has made charts to show the children “cost of delayed investment” and so insists on investing early.

Anita Kanbargi & Datta Kanbargi Datta Anita Financial Services

Disclaimer

The opinions and insights shared in this article are those of Datta Prabhakar Kanbargi and Anita Datta Kanbargi from Anita Datta Financial Services and do not necessarily reflect the views of Outlook Money. The case study mentioned involves their personal experience with a client, Waheed Ahmed Gokak, and the financial outcomes discussed are specific to his situation, which may not be applicable to everyone.

This article’s content should not be seen as exhaustive or as an offer to invest, but rather as general information. It is not intended as financial advice. We recommend seeking advice from a qualified financial advisor to address your unique financial situation and make informed decisions.