Planning for early retirement is one of the best ways to get freedom from your day job. However, to make this a reality you have to start early to build a big corpus. Often, investors think this is an unsurmountable task. But with guidance and the right mutual fund selection, this can become a reality.

Why Start Early?

The aim is to start early to accumulate a significant corpus for retirement. Financial planning for early retirement involves identifying ways to maximise your savings and investments and ensure that your money lasts long after the golden years. The earlier you start, the more time your money has to grow. Start with whatever you can afford now and increase it gradually. It is never too early to start saving for retirement.

In this journey, equity has an active role to play. This is because over the long term, equity is one asset class that can help generate exponential wealth. One of the easiest ways to take exposure to equity is through the mutual fund route. You can regularly invest in mutual funds through a Systematic Investment Plan (SIP) or make lump sum investments as and when possible. The minimum amount to invest in a mutual fund is Rs 100. Start with an amount you are comfortable with and gradually increase the amount as your earnings increase.

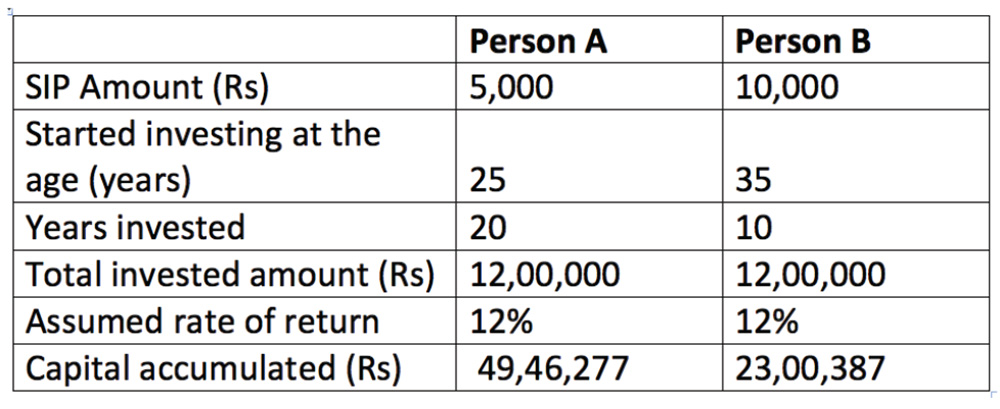

Let us understand the importance of starting an investment early with an example. Person A began to invest Rs 5,000 every month at the age of 25, while Person B started investing Rs 10,000 per month at the age of 35. They continued this investment till the age of 45. By that time, Person A had accumulated a corpus of Rs 49 lakh while Person B could only generate Rs 23 lakh. The only difference between A and B is the time they stayed invested and therein lies the power of compounding.

When you start investing early, the number of years for compounding to work in your favour increases. Compounding means that money earns interest not only on the initial investment but also on the interest earned. As a result, this is one of the easiest ways to maximise your wealth. This concept is often illustrated in the form of a snowball rolling down a hill. It starts small, but as it gains speed, the size increases as it rolls further.

Step Up The SIP Game

An SIP is an automatic way to invest a specific amount in a mutual fund of one’s choice at a predetermined frequency. You can schedule your SIP date at your convenience. For most investors, this is the end of the investing story. What they forget is that investments should rise in tandem with the one’s salary to make the dream of an early retirement a reality. By increasing the amount every year, you get to turbocharge your savings rate and potential reward over long term.

In the early years of one’s investment, the impact of these actions may not be visible. But, as one typically crosses the seven-year threshold, the numbers may surprise you positively. So, keep saving and step up the SIP amount at every instance possible.

To conclude, planning is of great essence when it comes to achieving early retirement. At the same time, it is no rocket science. Any and every individual should start investing from an early age to reap the benefits of compounding, at least when it comes to investing into equities. If required, seek guidance but above all save regularly and invest wisely.

By Vikram Lachhiramka, Director, Ayushmann Capital