One of the best ways to find out how well your mutual fund is performing is to look at its factsheet. However, that’s easier said than done. Navigating a mutual fund factsheet, which is full of data and charts, may not be that simple for everyone. Here’s how to read an MF factsheet and where you can find the relevant portions.

What Is An MF Factsheet?

The fact sheet contains vital information about the mutual fund schemes. It contains a plethora of information, such as the market outlook, scheme’s performance, comparison with benchmark, expenses, and portfolio composition.

Where Will I Find It?

Fact sheets for various schemes are readily available on the website of fund houses. Fund houses come up with updated factsheets every month.

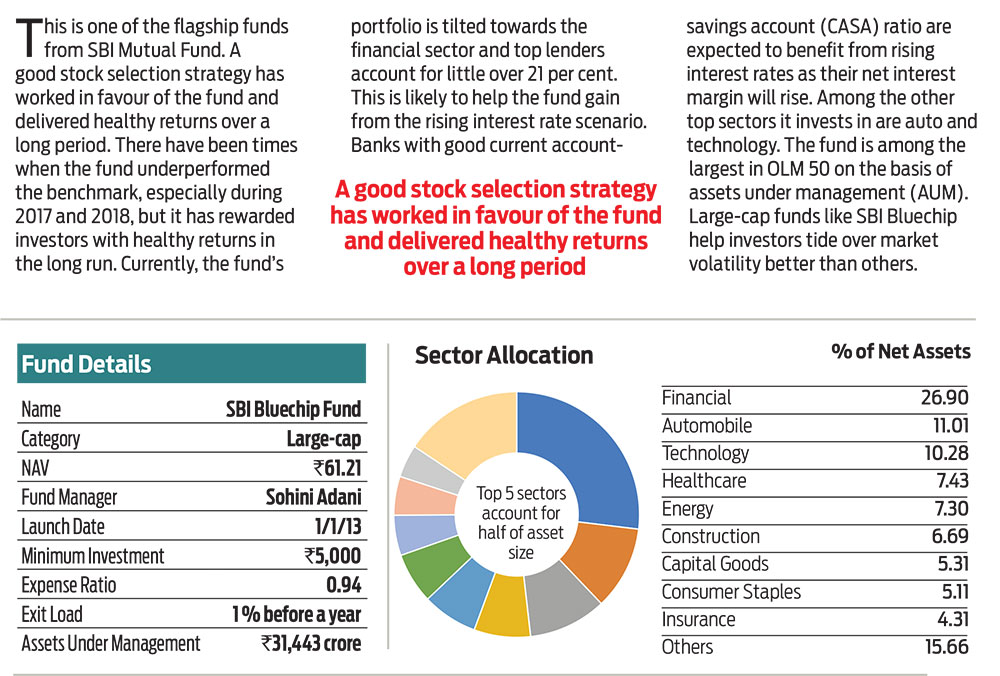

Where Is The Basic Fund Info?

The fund information section in the factsheet consists of crisp information about the scheme’s objectives and investment philosophy. This helps in evaluating the scheme’s compatibility with one’s financial goals.

Who Is The Fund Manager?

Finding about the fund manager, his educational qualifications, experience, and duration of management of the scheme can provide a sense of comfort. It is generally believed that the longer the fund manager spends managing a scheme, the better are its chances of delivering good returns.

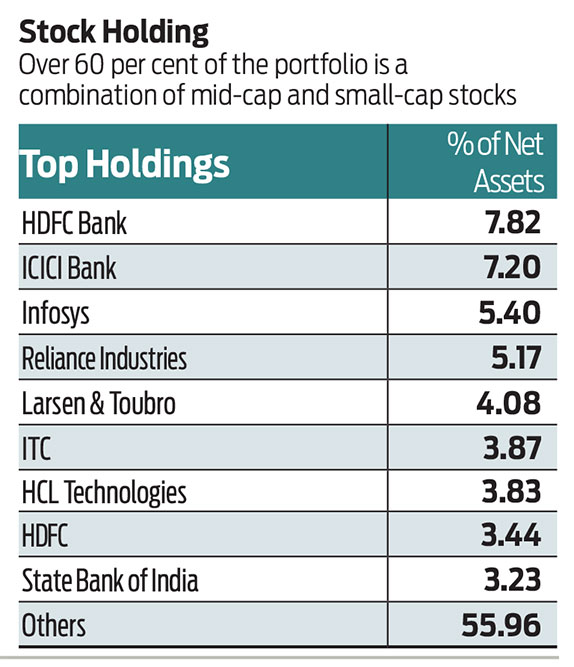

Where Is My Money Invested?

Check the portfolio section to find out which instruments the fund invests in. This section showcases the sector and stock composition for equity funds. For debt funds, it showcases the credit ratings of debt securities, which indicate its exposure to default risk, average maturity in the portfolio, and so on.

How Do I See How My Fund Is Doing?

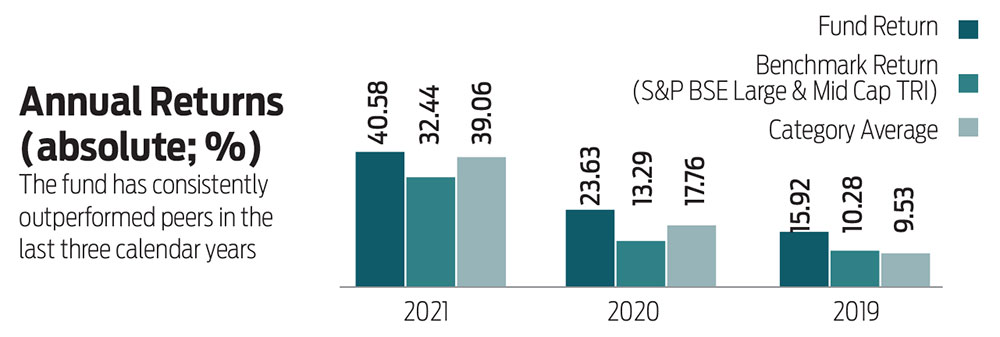

Fund performance is the heart of investing, because you invest to get better returns. In the fund’s factsheet, fund houses provide information on the scheme’s performance vis-a-vis their own benchmark, as well as the broader market index, such as CNX-Nifty or BSE Sensex, in case of equity funds. This helps in evaluating the performance of the scheme during various time periods. The timely evaluation of funds will help you stay on course in your investment journey.

Where Is My Money Invested?

Check the portfolio section to find out which instruments the fund invests in. This section showcases the sector and stock composition for equity funds. For debt funds, it showcases the credit ratings of debt securities, which indicate its exposure to default risk, average maturity in the portfolio, and so on.