Young India is willing to take moderate-to-high risk for better returns, unlike their conservative predecessors, according to the findings of the Outlook-Toluna Independence Day Youth Survey, carried out jointly by Outlook magazine and Toluna and released in July 2022.

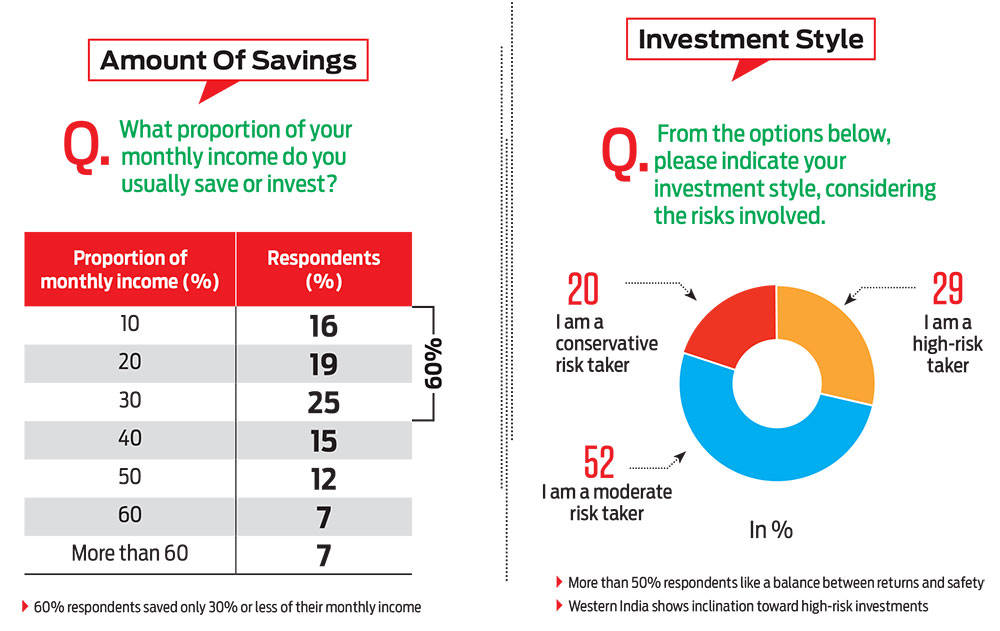

As many as 80 per cent of the respondents said they were willing to take moderate-to-high risk. Not surprisingly, the youth from the western part of the country showed higher inclination towards high-risk investments. Compared to the national average of 29 per cent, 36 per cent of respondents in the west zone were willing to take higher risk.

However, the quantum of savings among the youth is not that high, with 60 per cent of the respondents saving only 30 per cent or less of their monthly income. The survey also showed that women saved more than men—16 per cent of female respondents saved 50 per cent or more of their monthly income.

The survey was carried out among roughly 1,800 respondents across the country.

Investments

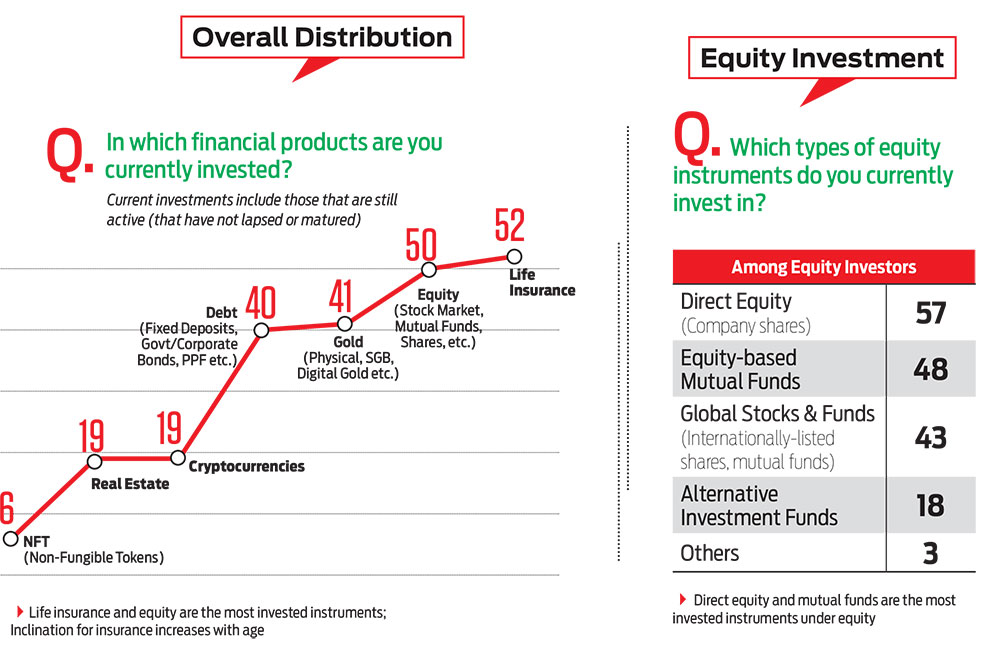

When it comes to investing, life insurance and equity are the two most popular instruments, with shares of 52 per cent and 50 per cent, respectively, followed by debt instruments and gold. This shows that even though life insurance is not always recommended for investment, it remains a preferred choice. Around 41 per cent people invest in debt instruments, such as fixed deposits, government bonds and Public Provident Fund (PPF), while 40 per cent prefer to invest in gold. Cryptocurrencies and real estate come next, with 19 per cent share each. However, if you take the quantum of investments in different assets, equity tops the list, followed by debt instruments, life insurance and gold.

Equity: A resilient economy and rising financial awareness are nurturing equity culture in India. When it comes to the maximum amount invested, equity stands out at 30 per cent. Within equity type, direct equity (company shares) is the most popular instrument (57 per cent), followed by equity mutual funds (48 per cent).

Debt: Among debt instruments, fixed deposits and recurring deposits together command the leading position, with 65 per cent share, followed by small savings schemes at 38 per cent.

Cryptocurrencies: These have found favour among young investors, with higher inclination from the age group of 18-21 years. Twenty per cent of respondents have invested in them.

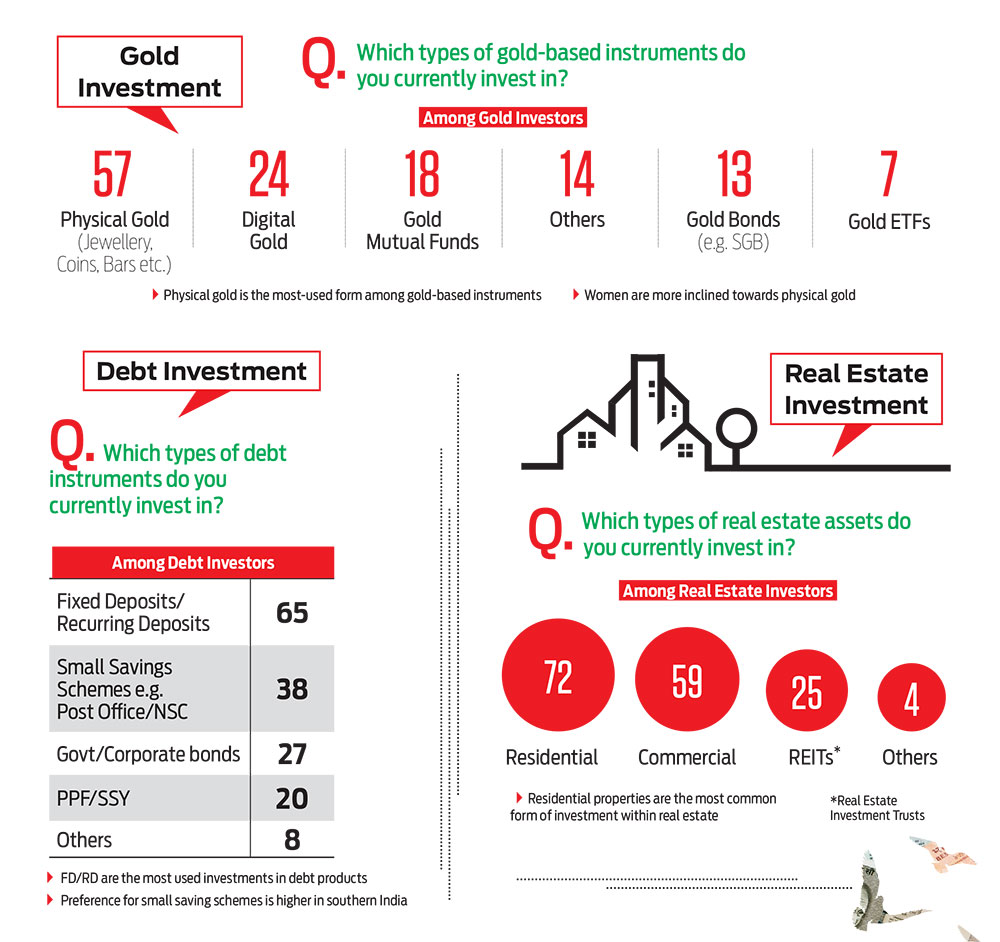

Gold: Traditionally, Indian women prefer to invest in gold, either in the form of jewellery or coins. The survey shows that 69 per cent women invest in gold compared to 46 per cent men. Overall, 57 per cent respondents prefer to invest in physical gold, followed by 24 per cent in digital gold. Merely 7 per cent respondents invest in gold exchange-traded funds (ETFs).

Real Estate: Residential properties are the most common form of investment, with 72 per cent investing in them, followed by commercial properties at 59 per cent.

Methodology

The Outlook-Toluna Independence Day Youth Survey interviewed 1,804 people between the age of 18 and 35 years. The investments part of the survey was conducted only among working professionals. The survey was conducted across 40 metros and non-metro cities, including Delhi, Mumbai, Chennai, Kolkata, Bengaluru, Hyderabad, Ahmedabad, Pune, Jaipur, Lucknow and Indore.

The respondents constituted 54 per cent men and 46 per cent women. Among age groups, 27 per cent each were 18-21 years and 22-25 years, 30 per cent were 26-30 years and 20 per cent were 31-35 years. Thirty per cent of the respondents were from the north, 27 per cent each from the south and west and 21 per cent from the east.

All interviews were conducted online using a standard, structured, self-filled questionnaire.

Protection

Post Covid, people have realised the importance of emergency savings and health insurance. Data from the survey proves that.

Emergency Funds: Overall, 89 per cent of the respondents said they keep an emergency fund for contingencies. Interestingly, women outshine men here too, with 92 per cent keeping emergency money aside. Savings bank accounts and FDs are the most preferred instruments for keeping emergency money.

Health Insurance: As far as health insurance is concerned, 77 per cent have a health policy, either funded by themselves or by their employers. But the quantum of cover is alarming. About 70 per cent of the respondents have a cover of less than `5 lakh, which may not be enough in certain cases, given rising medical inflation.

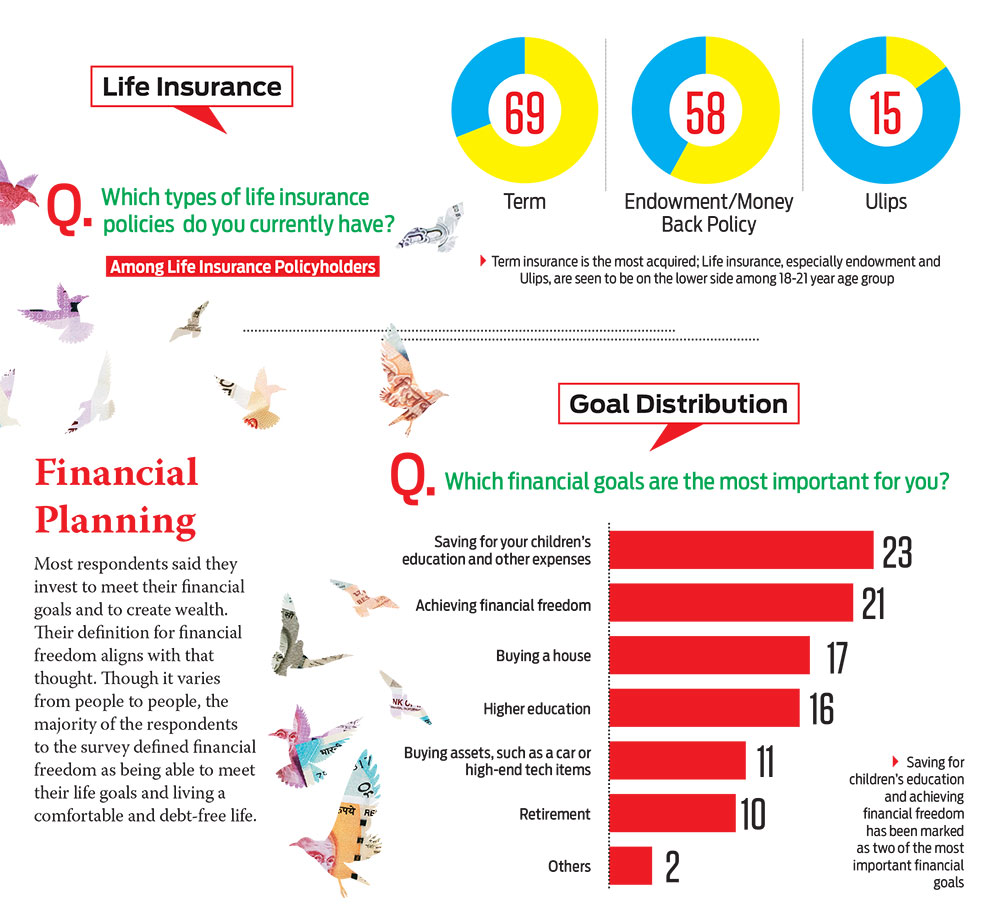

Life Insurance: Among life insurance products, term insurance takes the lead, with 69 per cent respondents buying it, followed by endowment plans (58 per cent). However, close to 50 per cent of the respondents have a sum assured equal or less than their annual income. Experts suggest taking a cover of at least 10 times one’s annual income, as a rule of thumb.