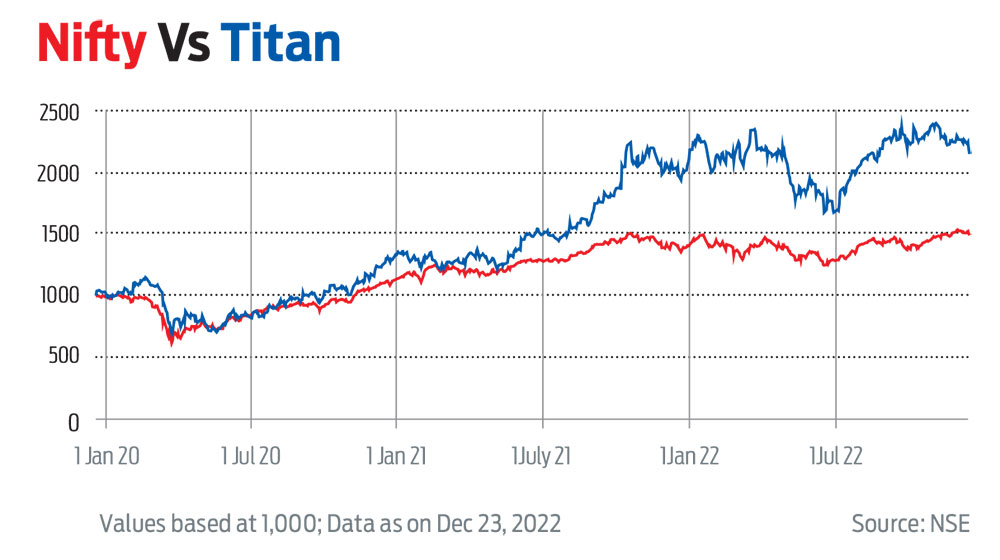

Company Name: Titan

CMP: Rs 2,483

Market cap: Rs 2,20,446 crore

Titan set up shop as a watchmaker in 1984, but has since then evolved itself as a lifestyle company. It has a strong presence in the jewellery segment through Tanishq, and has recently forayed into ethnic wear with Taneira, besides its eyewear, perfumes, and watches segments.

Jewellery is the leading vertical and contributes more than 85 per cent to the total revenues. The overall Indian jewellery market is pegged at about Rs 4 trillion, of which Tanishq’s penetration is around 6 per cent. This provides immense opportunity for growth.

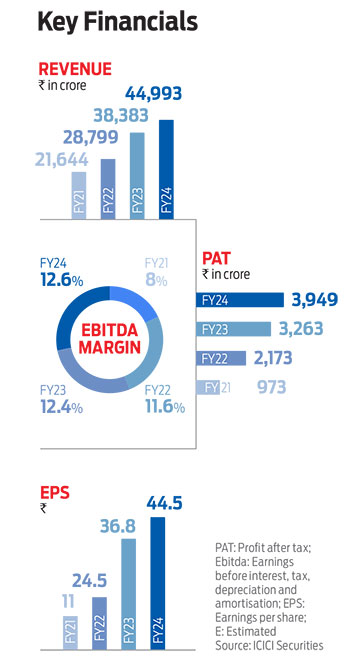

Regulatory changes such as gold hallmarking, goods and services tax (GST) and demonetisation have turned out to be favourable for it, and have led to market share gains. During FY18-22, the industry stagnated, but Tanishq reported a staggering compounded annual growth rate (CAGR) of 17 per cent.

Its regionalisation strategy in key markets is bearing fruit with gains in east and south. Tanishq has also enhanced its penetration in rural markets (with 50 per cent store presence). It intends to target new towns which have an existing gold jewellery market size of Rs 2,000 crore; and where the market share is less than Tanishq’s national average. The management has indicated plans to focus on middle India in 300-plus towns with emerging catchments (it is now present in 200-plus towns).

Tanishq’s sustained efforts towards getting a larger pie of the wedding jewellery space is proving to be fruitful; it is growing at a faster pace compared to non-bridal jewellery. Currently, it contributes 25 per cent to its overall jewellery revenue, while the segment contributes 60 per cent to India's jewellery market.

The management is upbeat about its foray into international jewellery retail. The company is targeting non-resident Indians (NRIs) and persons of Indian origin (PIOs). This provides it with a long-term opportunity. Titan is planning to open 30 stores at international locations and targeting a revenue of Rs 2,500 crore by FY27. The management remains buoyant on the long-term growth outlook with an aim to grow jewellery revenues 2.5 times by FY27 (with an implied CAGR of 20 per cent). Key growth pillars, which will drive aspirations include expansion of retail stores (40-plus annually), wedding jewellery (regionalisation) and high-value studded collection (formalisation).

In watches, Titan is targeting a revenue of Rs 10,000 crore by FY26 (for FY23, the estimate is Rs 3,100 crore). In the fast-growing wearables market, it plans to have products at varied price points under different brands and sub-brands, with focus on providing innovative and new features. Titan plans to launch 14 new products with incremental design and functional features each year. The wearable market in India has grown 57 per cent by volume and 70 per cent in value in the last three years.

Among emerging businesses, Taneira has huge opportunity. It aspires to increase the store count from the existing six to 125 by FY27 with a potential revenue target of Rs 1,000 crore (about 1.5 million pieces). Similarly, Titan is planning to ramp up its women’s bag business through a combination of multiple-channel growth strategy. It plans to sell 3.5 million bags by FY27 with a revenue potential of Rs 1,000 crore.

An enriched jewellery portfolio, with the launch of new collections and sustained investment in brand building, is enabling better-than-industry revenue growth. A capital efficient business model and industry leading profitability has led Titan to consistently generate more than 30 per cent return on capital employed (ROCE). Robust revenue growth and high ROCE makes it one of the best compounding stories.

***

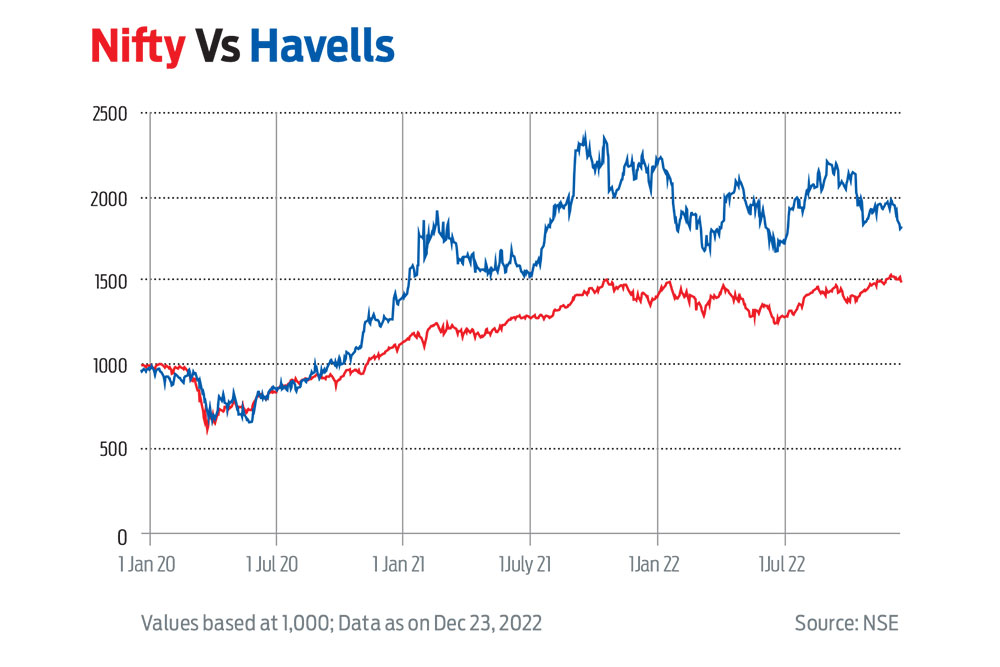

Electrifying Presence In Your Homes

Company Name: Havells

CMP: Rs 1,099

Market cap: Rs 68,909 crore

Havells India, which was incorporated in 1983, is one of India’s largest and fastest growing manufacturers of electrical components and systems. Its product line includes domestic and industrial switchgears, cables and wires, and consumer durables such as fans, LED lightings and fixtures. Havells entered the large appliances business (ACs and LED TVs) after acquiring Lloyd in February 2017. This gave it direct access to about 10,000 AC dealers and a market share of 12-14 per cent in the highly competitive room AC business.

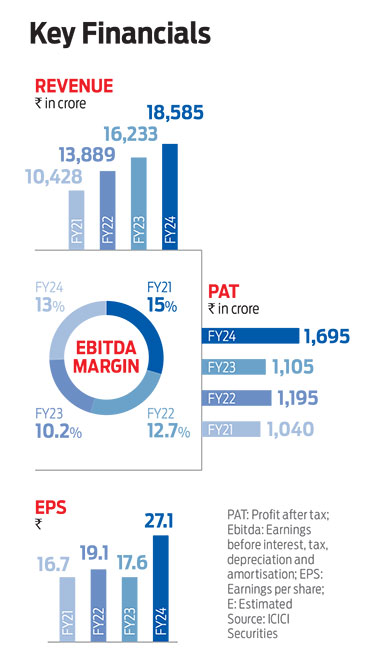

Over the last decade, Havells has transformed its business profile from being an industrial product-driven business to a consumer-focused business. The latter, which includes home appliances, has recorded a strong revenue CAGR of 21 per cent over FY12-22 led by new product launches and dealer expansions. After the Lloyd acquisition, contribution of consumer business in the topline has increased from 31 per cent in FY12 to 54 per cent by FY22. The industrial product segment, which includes wire, cables and switchgear categories, and contributes about 46 per cent to the overall topline, grew at 10 per cent over FY12-22.

Havells has a strong presence in the organised product category with market share in the range of 6-20 per cent. Though fans and switchgear are highly penetrated categories, Havells has the first-mover advantage in the premium fans and branded switches category. It is also focussing on new launches and increasing penetration in Tier II and Tier III cities. It plans to increase its touch points by 56 per cent to 2.6 lakh over the next five years to increase its presence in the rural markets. Havells spends 4-5 per cent on promotions to gain market share into new categories, such as refrigerators and washing machines. It has also laid down a capital expenditure plan of Rs 700-800 crore in FY23 to expand manufacturing capacities of ACs, washing machines, wire and cables.

Havells has reported strong revenue, earning a CAGR of 14-15 per cent over FY12-22, with double-digit Ebitda margin of 11-13 per cent. However, its recent performance in Q2FY23, was negatively impacted by high-cost inventory, leading to a fall in gross margin. In addition, advertisement expenses climbed back to pre-Covid levels that led to Ebitda margin falling to a multi-year low at 7.8 per cent.

The company is expected to see gradual recovery in gross margins from Q3FY23 onwards supported by softening raw material prices and improved product mix. The margin headwinds seem to be temporary concerns, while the structural growth remains intact.

Havells is likely to report strong revenue CAGR of 16 per cent over FY22-24 led by new product launches (in both small and large appliance segments) and dealer expansions. Softening of raw material prices and launch of premium products will result in strong Ebitda margin recovery from H2FY23 onwards (from its lowest Q2FY23 Ebitda margin of 7.8 per cent). As a result, profit after tax (PAT) will register a strong CAGR of 19 per cent over FY22-24. Strong brand, robust debt-free balance sheet (return on capital employed and return on equity at 24 per cent and 20 per cent, respectively) and focus on improving profitability of the Lloyd business makes Havells an attractive stock in the fast-moving electrical goods (FMEG) space.

That said, there are some important key risks. One, Lloyd is a loss-making business on the Ebit level mainly due to focus on market share gains. The delay in the turnaround of Lloyd may hit the overall profitability of Havells. Two, reversal of commodity prices from the current level and delay in price hikes due to rising competition may restrict Ebitda margin expansion going forward. Three, higher inflationary pressure, adverse monsoon condition may hit rural offtake of consumer durables.