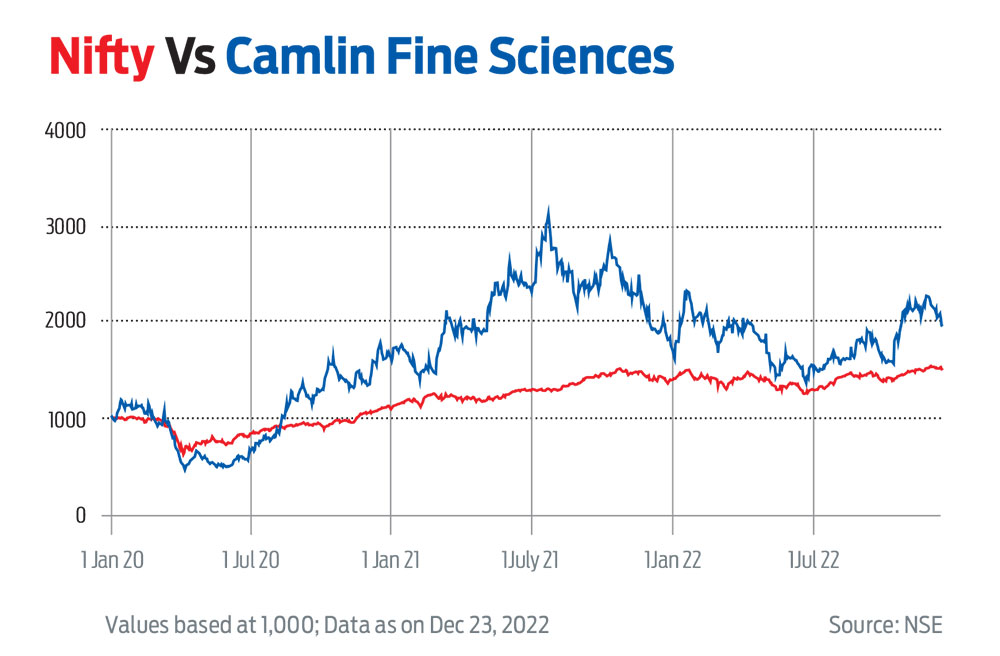

Company Name: CAMLINFINE

CMP: Rs 136

Market cap: Rs 2,140 crore

Camlin Fine Sciences (CFS) is a specialty chemicals company with operations in India, China, Mexico, Europe, North America and Brazil.

Its business comprises three segments—aroma products, shelf-life solutions and performance chemicals. Shelf-life solutions are essentially antioxidants used in food and beverages and animal feed. The products in this segment include ascorbyl palmitate, tertiary butylhydroquinone (TBHQ), butylated hydroxy anisole (BHA), and blends of chemicals. Performance chemicals are used in dyes, pigments, pharmaceuticals, and the agrochemical industries. These include, hydroquinone monomethyl ether (MEHQ), guaiacol, veratrole, among others. Aroma chemicals, such as vanillin, guethols, etc. are used in fragrances. As most of its products are items of daily consumption, their demand remains resilient.

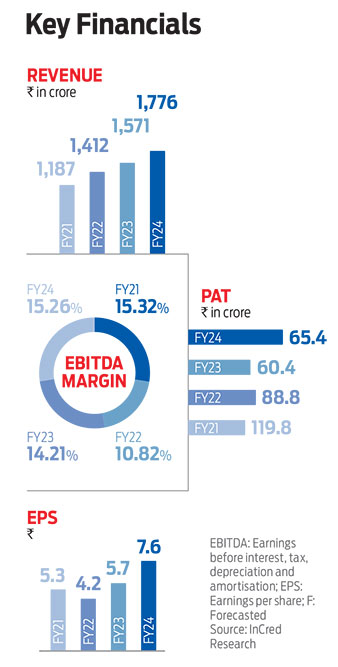

Its revenue was up 19.4 per cent compounded annual growth rate (CAGR) over FY16-21, and it is expected to deliver 12.6 per cent CAGR over FY21-24.

Until a few quarters ago, the company had to source raw materials, such as hydroquinone (HQ) and catechol. But with the commissioning of a 10,000-tonne diphenol (base chemical) plant in Dahej in 4QFY21, it has captive raw material, which will reduce input cost. Also, setting up a vanillin capacity will result in value addition in guaiacol and Ebitda accretion of Rs 330 million in FY24. Overall, backward integration and better product selection will expand the company’s earnings before interest taxes depreciation and ammortisation (Ebitda) margin by 360 basis points over FY21-24, driving earnings per share (EPS) CAGR of 21.56 per cent.

Profitability in HQ is good for CFS as traditional suppliers in Europe are struggling because of scarce power supply. Making MEHQ from HQ doesn’t make sense for CFS as selling MEHQ will not even recover the market price of HQ. Hence, it has taken the correct decision of manufacturing minimum quantity of MEHQ.

CFS has also commissioned a 6ktpa vanillin plant at Dahej by investing Rs 1.85 billion to produce guaiacol (key raw material for vanillin), ethyl vanillin, methyl vanillin and its derivatives. Vanillin is a high gross profit product and can add around Rs 1 billion in gross profit in the next five and a half months. HQ prices are also on the rise in Europe which shall benefit CFS Italian subsidiary. TBHQ prices and spreads are steady, which also bode well for profitability.

The European energy crisis is an opportunity for CFS as it is leading to higher prices for HQ. Some of the biggest producers of HQ globally (like Solvay) are in Europe and they are struggling on account of higher energy costs, which is leading to higher HQ prices. Rising prices of HQ has led to gross profit growth of around 70 per cent or Rs 300 per kg. The rational decision of making very small quantity of MEHQ in Q2FY23 will lead to better profitability in the coming quarters as well.

The company has also commissioned vanillin capacity at its SEZ facility and will ramp up production in the current month. Its total production capacity is around 6,000 tonnes and the FY23 production is forecasted to be around 1,800-2,000 tonnes.

CFS has disappointed in the recent past. But there are some positives. First, it is nimble footed when it comes to product portfolio selection (making MEHQ in limited quantity and instead selling HQ). Second, the commissioning of vanillin capacity will add Rs 2 billion in gross profit per annum, and lastly, the energy crisis in Europe is likely to increase HQ prices and, hence, profitability of its Indian HQ division.

***

Shaken, Not Stirred, Still Steady

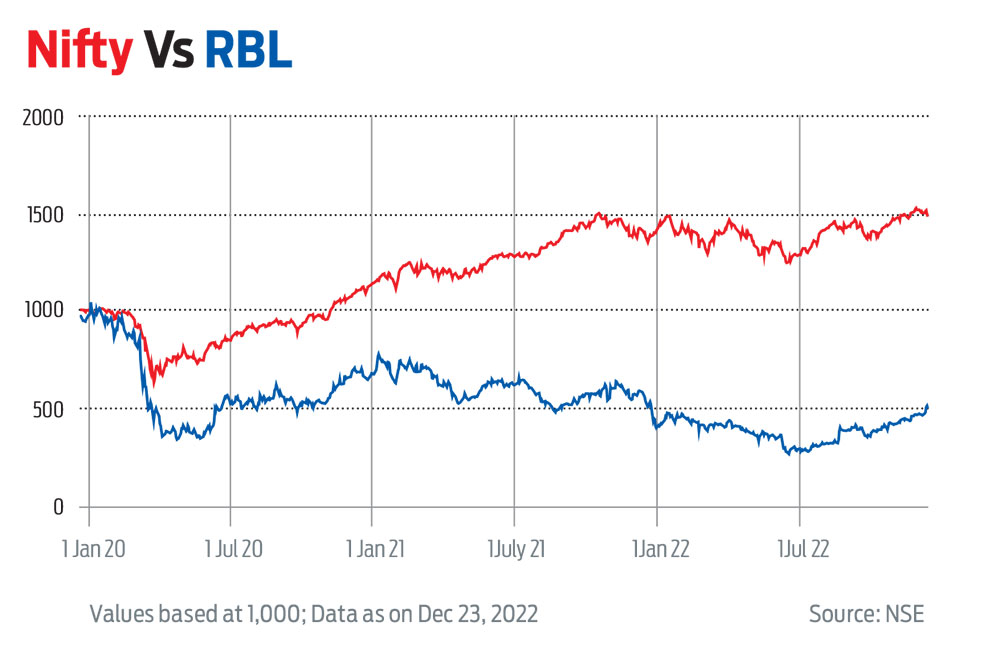

Company Name: RBL Bank

CMP: Rs 151.30

Market cap: Rs 9,070.81 crore

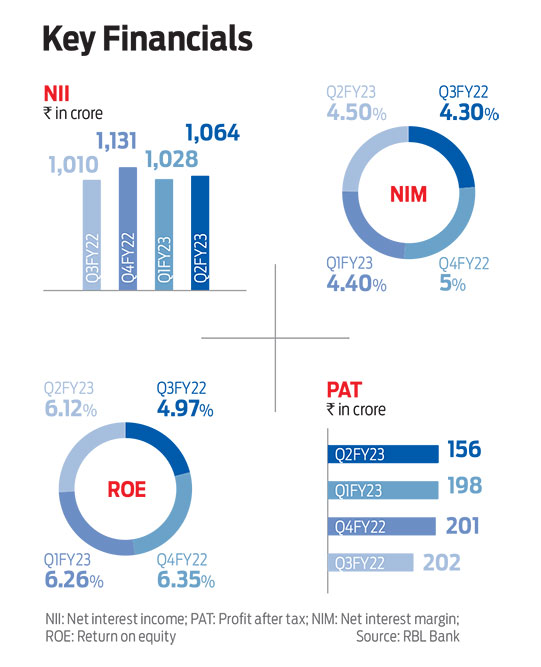

The worst seems to be factored in the current stock price and valuation of RBL Bank—given its history of high-risk loan strategy without much focus on the liability profile—which has resulted in bad asset quality and poor profitability. Also, friction with the Reserve Bank of India (RBI) on changes in the management leadership and rising losses in credit card business has led to a derating in the price multiple. The recent appointment of R. Subramaniakumar as the new CEO in June 2022, adequate provisioning on non-performing loans (NPLs) and the expected rise in the retail loan book from 52 per cent in Q2FY23 to 60-65 per cent by FY25F (forecasted, as per the management’s guidance) is likely to improve its margin profile in FY24F-25F. RBL Bank plans to add 80-100 branches every year.

In Q2FY23, RBL Bank witnessed strong loan growth of 12 per cent annually and 4 per cent quarterly on the back of growth in micro finance and credit card loans. It has maintained loan growth guidance of 15 per cent annually for FY23F. Deposit growth, however, remains muted at 5 per cent annually, and retail deposits stood at 40 per cent. Retail advances grew 6 per cent annually and 7 per cent quarterly. Wholesale advances grew 20 per cent annually and 2 per cent quarterly, while retail and wholesale loan mix stood at 52 per cent and 48 per cent, respectively. Within the retail segment, card business grew 17 per cent annually, while microfinance was down 8 per cent annually, but showed strong growth of 22 per cent quarterly. Home loans grew 123 per cent to Rs 34.5 billion, and tractor loans grew over 474 per cent to Rs 5.4 billion, annually. In credit card business, RBL Bank added 520,000 cards this quarter. Spending per card is also growing at 8 per cent annually. Total deposits grew 5 per cent annually and CASA deposits grew 7 per cent annually while retail and small business deposits rose 4 per cent annually and 5 per cent quarterly.

RBL is expected to follow its peers and increase deposit rates to support its loan growth, thus, leading to margin pressure in the near term. The bank posted return on assets (ROA) and return on equity (ROE) of 0.77 per cent and 7 per cent, respectively. However, given the expected margin pressure and elevated operating expenditure, RBL Bank is expected to continue to witness lower profitability in FY23F. The risk of higher slippage from the restructured pool also remains. At present, the stock is trading at an attractive valuation of 0.9-times trailing price-to-book value (PBV).

Card Issuance Remains Healthy

Credit card issuance in October 2022 grew 0.4 per cent on a monthly basis, which was up 19.6 per cent annually to 79 million, after witnessing the monthly decline following RBI's norms on discontinuing inactive cards. Note that SBI Cards remains the market leader in terms of new card issuance at 0.3 million, followed by Axis Bank.

Credit Card Business On Growth Path

Overall, credit card issuance and spending remains healthy, thanks to the festive season and the aggressiveness displayed by card issuers and preference for credit cards in Tier II and Tier III cities. With many non-banking financial companies wanting to apply for credit card licences, there is indication of strong competition going ahead, which will boost the market size and increase eligible customers for high-end credit cards. While tokenisation of credit cards could lead to temporary disruption, it will structurally improve data privacy and security for customers.

Also, there has been a systemic credit growth of about 18 per cent in Q2FY23 against 16.9 per cent in the year-ago period despite liquidity tightening and rise in policy rates.