Axis Banks, the nation’s third-largest private-sector bank has announced a new feature where a customer can open their fixed deposits (FDs) through its mobile app. An individual can utilise their funds from their non-Axis Bank accounts via Unified Payments Interface (UPI) and net banking. Usually, starting an FD requires shifting funds to an Axis Bank savings account first. However, with this new feature customer can invest directly from any bank account without needing to transfer their amount. This is an effort to streamline and save time as well as effort for the depositor.

How Does It Work?

Axis Bank has removed the requirement to pre-fund an Axis Bank savings account prior to opening an FD. Existing customers of Axis Bank with the authorised know-your-customer (KYC) process can now start FD bookings even if their primary funds are deposited in another bank.

FD accounts at Axis Bank will now be fully digital:

Funds can be directly moved from an external bank account to an Axis Banks account via UPI or Net banking.

Once the account holder completes the payment, the bank will also process the FD booking. It will automatically create without additional effort, there are no extra steps involved in booking FD.

Step-by-step guide on how to book an FD with Axis Bank using the UPI app

Step 1: Log in to the Axis Bank mobile banking app

Step 2: Click on the deposit option

Step 3: Choose ‘Book with UPI’ on the payments page

Step 4: Enter FD details

Step 5: Follow easy steps and transfer the FD amount via UPI using your preferred UPI app

Step 6: Pick from the given UPI payment options

Step 7: Put UPI ID, open the UPI app and process the payment

Step-by-step guide on how to book an FD with Axis Bank using net banking

Step 1: Log in to the Axis Bank mobile banking app

Step 2: Click on the deposit options

Step 3: Choose with net banking tab on the payments page

Step 4: Pick the linked account or any other bank account

Step 5: Pay via the net banking of the preferred bank account

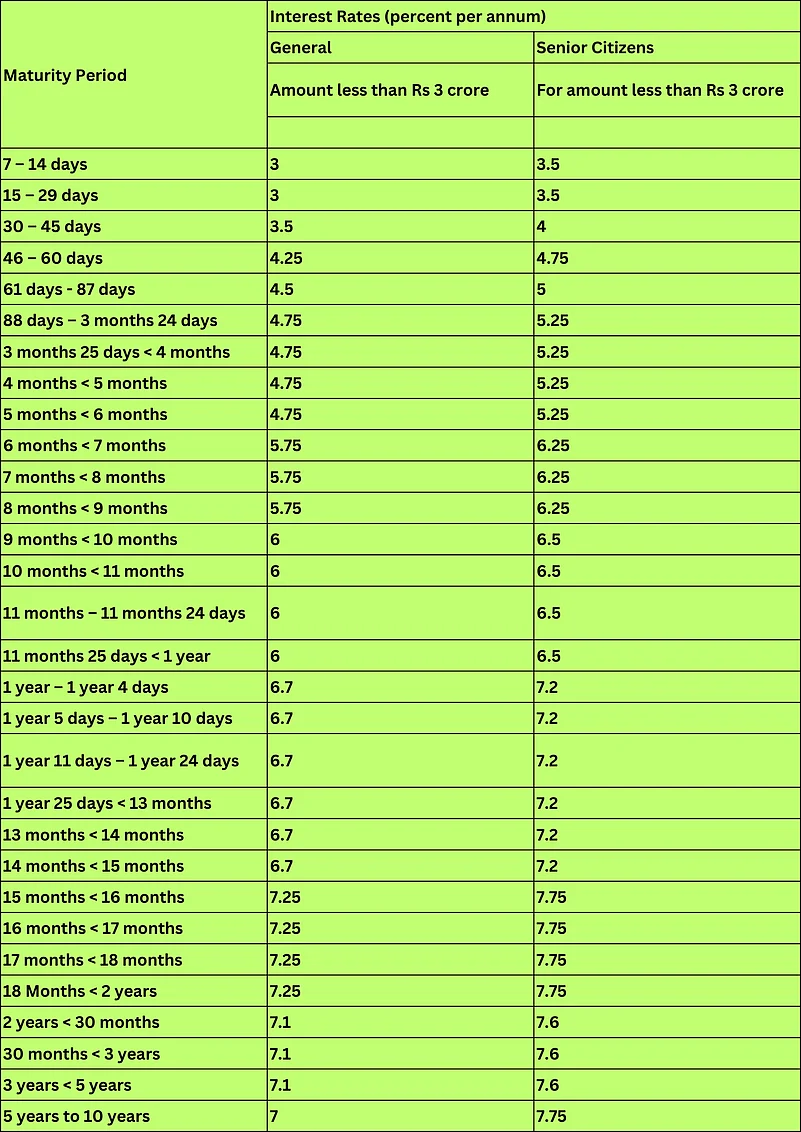

Axis Bank FD interest rate

Axis Bank gives an interest rate of 3 per cent to 7.25 per cent for tenure ranging from 7 days to 10 years usually in FD amounts under Rs 3 crore. For Senior citizens, Axis Bank gives FD an interest rate between 3.5 per cent and 7.75 per cent for amounts worth under Rs 3 crore.