Summary of this article

Rupee fell over 6 per cent in 2025, currently rebounded from record lows due to RBI's intervention

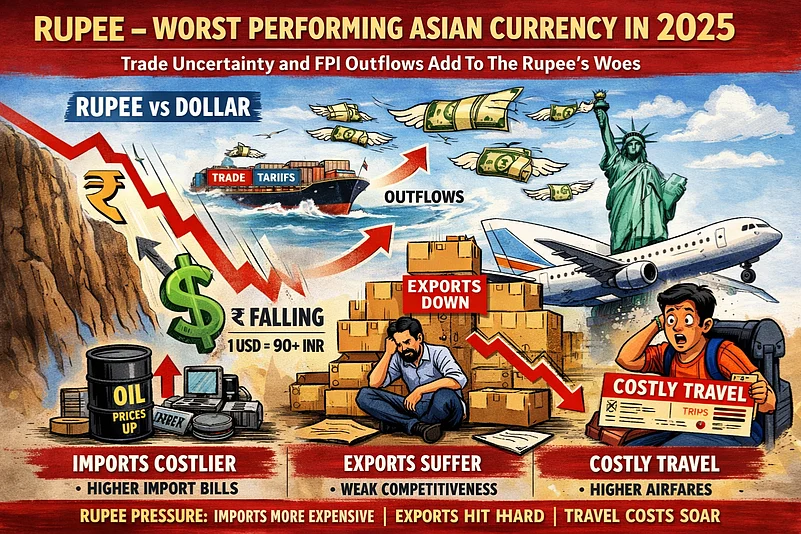

FPI outflows and global trade, tariffs uncertainty added to sharp depreciation in rupee

Rupee expected to fall more in 2026, but rate of fall seen limited

The rupee has fallen over 6 per cent in 2025, crossing over 91 to a dollar, with the recent rebound from lows bringing it to around a 5 per cent fall, trading at 89.85 against the US dollar today. The recent rebound in the rupee from record lows was mainly due to firm intervention by the Reserve Bank of India in the foreign exchange market. While the constant intervention of the RBI is expected to arrest the sharp fall and volatility in the currency, the downward pressure on the rupee remains.

Amid US President Donald Trump’s see-saw with trade and tariffs, which has cast a shadow over the global economy, India’s data has shown a strong resilience in growth and inflation parameters. The Reserve Bank of India, in its recent monetary policy meeting, also pointed out this resilience in the domestic economy, despite the 50 per cent tariff by the US. In August, Washington imposed a 25 per cent reciprocal tariff, followed by a punitive tariff of 25 per cent, pushing the total tariffs on India to one of the highest faced by an Asian economy.

The tariff worries have raised concerns over whether India’s economic growth could keep up its performance in the upcoming quarters amid a sharply depreciating domestic currency. With 50 per cent tariffs imposed by the US administration on Indian goods, regulators have also grown more and more worried about the fall in the rupee against other currencies. This year, the rupee has shown the steepest decline among Asian currencies and most other major global currencies.

The Dollar Has Also Fallen

Since Trump took office in January, the dollar has also fallen from record highs against its peers. The dollar index, which measures the strength of the dollar against a basket of six major currencies, is at 98.31. The index, despite hitting a 52-week high of 110.18 in January, has fallen 8.27 per cent in 2025.

The dollar-rupee movement, given the ongoing trade and tariffs uncertainty, has left a dent in foreign capital flow into India. However, due to the weakening rupee, India’s exports to the US have increased. Latest data from November shows that India’s trade deficit with the US reduced to a five-month low of $24.53 billion.

However, with India still being an import-driven country, the trade balance with other countries has seen a sharp drop. The continued fall in the rupee is also weighing on India’s import bill. Data from October shows that total imports of the country rose to $94.70 billion, against $82.44 billion in the previous year. Total exports of India, on the other hand, saw a slight decline to $72.89 billion in October from $73.39 billion a year ago. This brought down the trade deficit to $21.8 billion during the month, from $9.05 billion a year ago.

Meanwhile, the statistics of Indians travelling abroad for leisure, work, and studies also showed a change in trend during the year. A falling rupee, along with a change in visa rules, made Indians slightly hesitant to travel to other countries. According to data released by the Ministry of External Affairs, around 1.2 million Indian students enrolled for higher education in 2025, a drop of 5.7 per cent from the previous year. This was largely due to an increase in exchange rate costs. Indian students travelling to Germany and France to pursue higher studies rose, according to reports.

“In my case, I have a son who is studying in the US and still has one more year to complete his graduation. I had done some currency hedges to prepare for this, but it is getting more and more difficult due to the depreciation in the rupee and depleting a good amount of what I had saved up for his studies,” a fund manager at a mutual fund house said.

Indians travelling for leisure also searched for alternative destinations to reduce the pinch in their pockets due to the falling rupee. More and more Indians chose Asian and European countries closer home to combat the depreciating value of the currency.

How Will The Rupee Fare In 2026

Experts said that even if India finalises a deal with the US, the rupee is expected to continue to depreciate. This is because India still has a large forward book, out of which a major part is expected to be redeemed, which will put pressure on the rupee.

“We expect INR to be around 89.50 by March 2026. And then we expect it to go to 92 by December, because I'm not seeing capital flows improve a lot,” Gaura Sengupta, chief economist at IDFC First Bank, said, adding that (RBI’s) forward book is around $64 billion net dollar short, up to a year maturity is around $37 billion as of October. “The forward book has likely become more negative.”

Additionally, to offset the depleting foreign exchange reserves, the RBI is also expected to sell rupees when the rupee appreciates, limiting the rise in the domestic currency.

“We still expect mild appreciation pressure into FY27…but whatever improvement happens (in rupee) will not sustain, since there's a build up of buy-sell swaps. So, whenever there is an improvement in capital inflows, the RBI will absorb and add to the forex reserve. Currently, our forex reserve is 10 months. If you don't include the Forward book, it's 11 months,” Sengupta added.

However, the rate of fall and volatility in the rupee is expected to reduce if such a trade deal is reached. Most expect some semblance of a trade deal between the US and India sometime in 2026. Added to that, experts are expecting a pickup in nominal GDP growth, with around 10 per cent in FY26, and around 8 per cent in FY27. A pickup in growth, along with some recalibration of foreign flows, is expected to moderate foreign outflows, both short-term and long-term investments and thereby ease the pressure on the rupee.