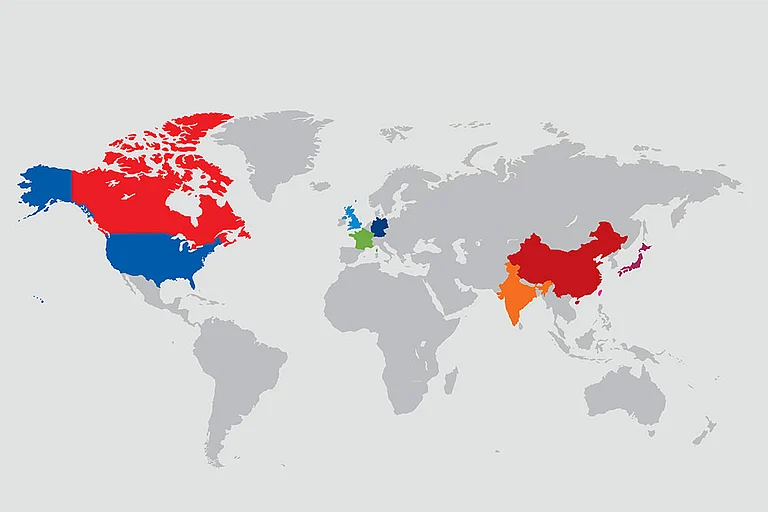

India is traditionally a cash-driven economy that only recently moved out of its comfort zone to adopt newer ways of transacting. With the announcement of Digital India in 2015, demonetisation of banknotes in 2016, and the pandemic of 2020, clubbed with evolving customer behaviour, e-commerce, and smartphone penetration, Indians have been encouraged to move from cash to cashless ways of financial services. As of 2021, fund transfer is the most basic service that customers can avail themselves of at their fingertips with the rise of FinTechs in the country.

With India’s government, Sebi, the Reserve Bank of India (RBI), and other regulators aggressively driving the ambition of making the Indian economy a cashless, digital one, Indians today have access to a plethora of financial services from the comfort of their home. These include services such as mobile wallets, insurance to even lending. That is still without accounting for a large section of our vast >1.3 billion population, who continue to live day to day without a formal bank account.

The unbanked and the credit-worthy

Traditionally, lenders adopted a ‘one-size-fits-all’ approach to lending, which meant they evaluated customers of all geographies and income brackets against one credit policy. As a result, a large population of the country remained excluded from access to credit. Financial inclusion, which is the cornerstone of a successful economy, remained elusive to a large, unbanked section of India’s population.

However, with FinTechs adopting and building models on AI, ML and analytics, NBFC lenders can adopt a personalised underwriting, and broaden their customer base, based on credit scores. For example, women, especially in rural areas, find it challenging to avail loans due to lack of necessary collateral, making accessibility to finance very limited to them. Traditional financial institutions have also declined credit to women borrowers in the past on grounds of lack of creditworthiness, forcing women to rely on savings or unauthorised money lenders. The power of FinTech thence has risen to be both a disruptor and saviour.

Loans that secure you, do not prey on you

A complete shift to digital means of availing financial services, especially loans, is inevitable. However, like any technology-driven boom, these services carry a risk that needs to be addressed by the organisations offering them and customers availing it.

Our journey to a digital, cashless economy has resulted in cyber-predators targeting vulnerable customers. The past year was filled with headlines on the increasing number of fraudulent instant loan apps. In an official statement, the RBI also cautioned customers against unauthorised lending platforms and mobile apps that promise quick loans. In such a scenario, it is therefore crucial for customers and industry players alike to weed out malicious scammers and fraudsters and protect the customer against such vulnerabilities.

Let’s take a look at how you can protect yourself from loan traps.

Government authorised and recognised

A borrower needs to ensure, before taking any loan-related conversation forward, whether the lender is a recognized entity by the RBI or regulated state governments. The RBI has mandated digital lending platforms to declare names and addresses of banks or NBFCs upfront.

Check for necessary compliance

As a borrower, one must be aware of the various compliances that any authorised lender must comply with. This means that it is important to only engage with lenders who are compliant with Foreign Direct Investment (FDI) laws and follow required legal protocols.

The key to trust is in utmost transparency

Before opting for a loan and sealing the deal, the vendor must let the customer know the terms and conditions of the relationship in a simple, straightforward manner. Similar to regulatory compliance, a lender must also follow a form of ‘fair practices code’ to make sure the customer does not have a stressed profile and can pay off his/her dues with ease.

Ethics and respect

Although the nature of the relationship between the lender and borrower is a professional one, it is still important to ensure collections practices such as late EMI payment, inability to repay dues, do not lead to personal harm, both physical and emotional. Any unsolicited calls, unethical access to the customer’s contacts, or any form of disrespectful behaviour is unlawful. Customers need to ensure that the lender follows a ‘zero-tolerance policy' for the violation of such ethical codes.

Protecting with a customer-first approach

Where there is finance, there is highly sensitive data to be protected at all costs. The 2020 pandemic has quickly bolstered customer dependency on non-traditional ways of availing financial services. While convenience, increased access to credit and financial inclusion are progressive goals - and worth pursuing us as a nation - more robust governance and scrutiny over malicious practices will continue to go through an evolution, as the crimes themselves increase in sophistication.

This is why only an empathy-driven ‘customer first’ approach, despite unprecedented times, will be key to ensure India never finds its economy in a debt trap.

The author is the CFO of True Balance

DISCLAIMER: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.