Summary of this article

The draft norms have been issued for public feedback, and the rules are slated to come into effect from July 1, 2026, once approved.

Banks are required to put in place a policy on recovery of loans, engagement of recovery agents for recovery of loan dues, and taking possession of security.

Where a grievance has been lodged by a borrower, the bank shall not forward the concerned recovery case to an employee or recovery agent till it finally disposes off the grievance.

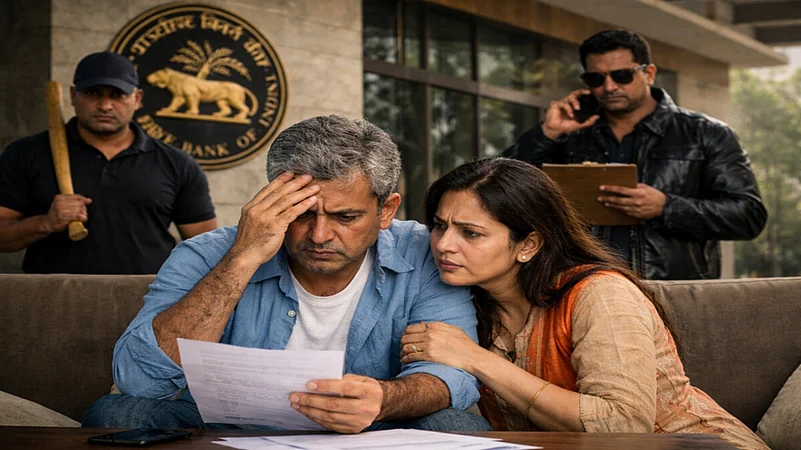

Good news for borrowers. Harassment by banks and loan recovery agents over missed payments or overdue amount may soon be a thing of the past. The Reserve Bank of India, in a bid to improve borrower protection and rein in harsh debt recovery, has issued detailed instructions on matters related to engagement of recovery agents to scheduled commercial banks (SCBs) and housing finance companies (HFCs).

The draft norms, called the Reserve Bank of India (Commercial Banks - Responsible Business Conduct) Second Amendment Directions, 2026, were also issued for public feedback on Thursday, and the rules are slated to come into effect from July 1, 2026, once approved.

As per the draft guidelines, banks are required to put in place a policy on recovery of loans, engagement of recovery agents for recovery of loan dues, and taking possession of security.

Banks employing the services of recovery agents are also required to put in place a due diligence process for their engagement, conforming to the instructions issued by the RBI. Recovery agencies engaged by banks should carry out verification of the antecedents of their representatives / employees at pre-engagement level and subsequently, on an ongoing basis at a pre-defined periodicity.

Banks are required to put in place a Code of Conduct for the recovery agents and their own employees engaged in activities related to recovery of loans. Moreover, while forwarding cases to any agent for recovery of default amount, the concerned bank is required to inform the details of the recovery agent to the borrower through a written notice to ensure due intimation and proper authorization. In case of change of recovery agent during an ongoing recovery process, the bank will immediately notify the borrower of the change.

Bank should put in place a mechanism for identification of the borrowers facing repayment-related difficulties, engagement with such borrowers and providing them necessary guidance about the recourse available.

Banks are required to ensure that the disclosure of borrower’s information to its employees / recovery agents is limited to the extent required to enable them to discharge their loan recovery related duties.

Where a grievance has been lodged by a borrower, the bank shall not forward the concerned recovery case to an employee / recovery agent till it finally disposes off the grievance. However, where the bank is convinced, with appropriate evidence, that the borrower is making frivolous / vexatious complaints to avoid recovery, it may continue with the recovery proceedings even if a grievance is pending with it.

In cases where the subject matter of the borrower’s loan dues is subjudice, banks are required to exercise utmost caution, as appropriate, in referring the matter to its employee or recovery agent.

Similar to these, many other directions have also been given to banks and HFCs to follow.

Commenting on the RBI norms, Siddartha Karnani, Partner, King Stubb & Kasiva, Advocates and Attorneys, says, “The RBI’s draft directions on responsible loan recovery signal a move from broad do’s and don’ts to a much more practical, rules-based framework. Practices that were always discouraged, like coercion or public shaming, are now backed by clear processes such as recorded calls, documented contact histories, and upfront disclosure of authorised recovery agents. This makes lenders directly accountable for the conduct of their recovery partners, turning what was often treated as a vendor issue into a core governance and compliance responsibility.”

Equally important is the focus on borrower dignity and privacy. Fixed calling hours, limits on third-party contact, and a pause on recovery during grievance redressal bring a degree of procedural fairness into the recovery process. For financial institutions, including banks, NBFCs and digital lenders, this means stricter supervision systems together with enhanced employee education, and a change in how they reward their recovery agents.

Although compliance costs will go up in the near term, it will also lead to better dispute resolution, improved audit documentation, and enhanced customer confidence with their lenders. Much will, however, depend on how consistently these RBI guidelines are enforced and how seriously financial institutions embed them into their day-to-day operations.