The Bank of Baroda (BOB) launched a new fixed deposit (FD) scheme for super senior citizens, offering them a 7.75 per cent interest rate. Super senior citizens are people who are 80 years and above. This new FD ‘BoB Square Drive Deposit Scheme’ is a special FD for ‘444 Days’. The special FD became available for investment on April 7, 2025, with no last date to invest in it.

When the market becomes volatile, investors tend to avoid investing in equities. Senior citizens typically prefer investing in guaranteed income and risk-free instruments.

Amid the fluctuating market, the monetary policy committee (MPC) meeting of the Reserve Bank of India (RBI), which decides the repo rate, will be concluded tomorrow, April 9, 2025. Experts anticipate a rate cut of at least 0.25 per cent this year, which may even occur in April.

In this scenario, this special FD offers a guaranteed income avenue for the short term.

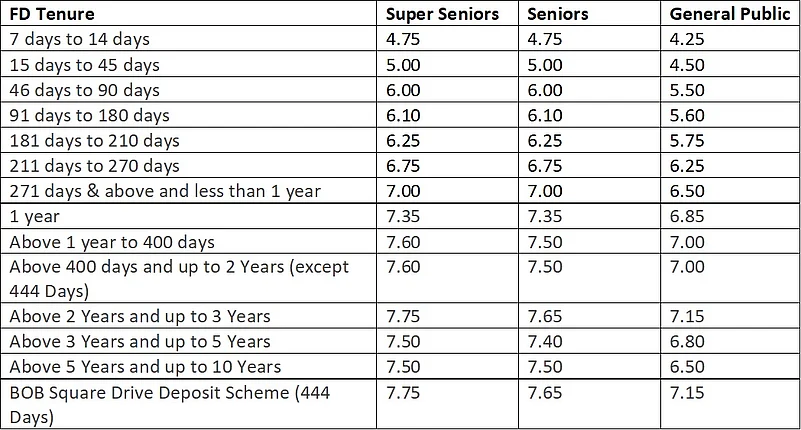

For callable FDs, this FD offers 7.75 per cent to super seniors, 7.65 per cent to senior citizens, and 7.15 per cent to the general public.

For non-callable FDs, the rates are a tad higher, offering super seniors, seniors, and the general public a 7.80 per cent, 7.70 per cent, and 7.20 per cent, respectively.

After the rate revision on April 7, 2025, the bank offers the following interest rates to the depositors.

FD Rates For Resident Indians:

Source: Bank of Baroda

(These rates are callable FDs up to Rs 3 crore.)

The bank has discontinued its other special tenure FD ‘BOB Utsav Deposit Scheme’, which was for ‘400 Days’ tenure, and offered seniors 7.80 per cent after a rate revision in October 2024. Now, with a 0.05 per cent rate cut, the new FD with a tenure of 444 days provides the highest interest rate among all the FDs currently offered by the bank.