Ujjivan Small Finance Bank (SFB) revised its fixed deposit interest rates on June 19, 2025. Fixed-interest or guaranteed-income instruments are typical components in senior citizens' portfolios. However, others also keep a portion of their money in FDs, particularly for liquidity and ease of use. After the Reserve Bank of India (RBI) reduced the repo rate this month, bringing it down to 5.50 per cent, banks are following suit and adjusting their lending and deposit rates. While many scheduled commercial banks' FD interest rates now range between 7-8 per cent, SFBs' interest rates are generally higher.

After Unity SFB changed its FD interest rates beginning this week, now Ujjivan SFB has also revised its deposit interest rates. Here are the rates for its callable FDs for senior and general citizens.

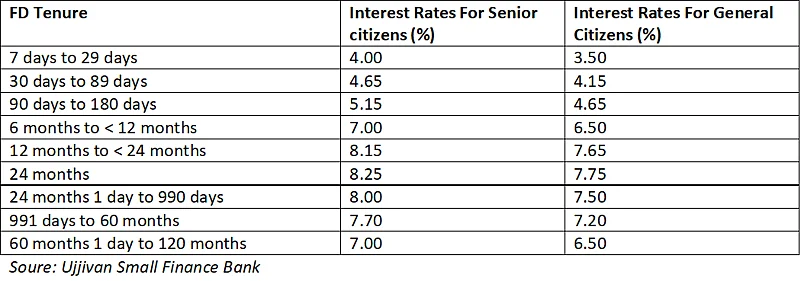

Callable FDs are those that an accountholder can break at any time before maturity and withdraw the amount either fully or partially. Though banks charge a penalty for premature withdrawal, it is permitted if one needs to withdraw money.

Non-callable FDs are those that are not permitted for permitted for withdrawal before maturity.

FD Interest Rates For Callable FDs (Sampoorna Nidhi) Of Less Than Rs 3 Crore

The bank offers 0.50 per cent additional interest rates to senior citizens on callable FDs.

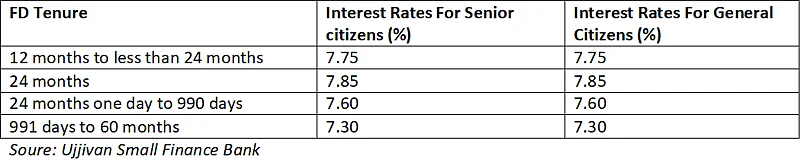

FD Interest Rates For Non-Callable (Platina Fixed Deposit) FDs

These FDs are not allowed for premature withdrawal or even renewal. The minimum amount for these FDs is more than Rs 1 crore to less than Rs 3 crore. The bank opens it for a minimum of 12 months and a maximum of 60 months. However, one can choose to get the interest on maturity or periodically on a monthly or quarterly basis.

Non-resident individuals can also open this FD. However, no additional interest rates are available for senior citizens. Here are the Ujjivan Bank FD rates:

Notably, deposits with SFBs are covered for up to Rs 5 lakh under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme.