Several banks have been revising their fixed deposit (FD) rates since the Reserve Bank of India (RBI) announced a 50-basis point (bps) cut in the repo rate, bringing it down to 5.50 per cent. Typically, the transmission of a repo rate cut takes a few months before banks can adjust their deposit rates. However, this time the adjustment occurring more rapidly possibly due to changes in the cash reserve ratio (CRR).

The CRR is the percentage of total time and deposit liabilities that banks must maintain to meet any financial emergencies. Most banks have already lowered their FD interest rates or discontinued their special fixed deposits, with current rates ranging from 7.00 per cent to 8.00 per cent.

However, Unity Small Finance Bank (SFB) is offering a higher rate of 9.1 per cent. This Bank revised its FD interest rates on June 16, 2025, providing a maximum interest rate of 8.60 per cent for the general public and 9.1 per cent for senior citizens aged 60 and above.

Unity Small Finance Bank

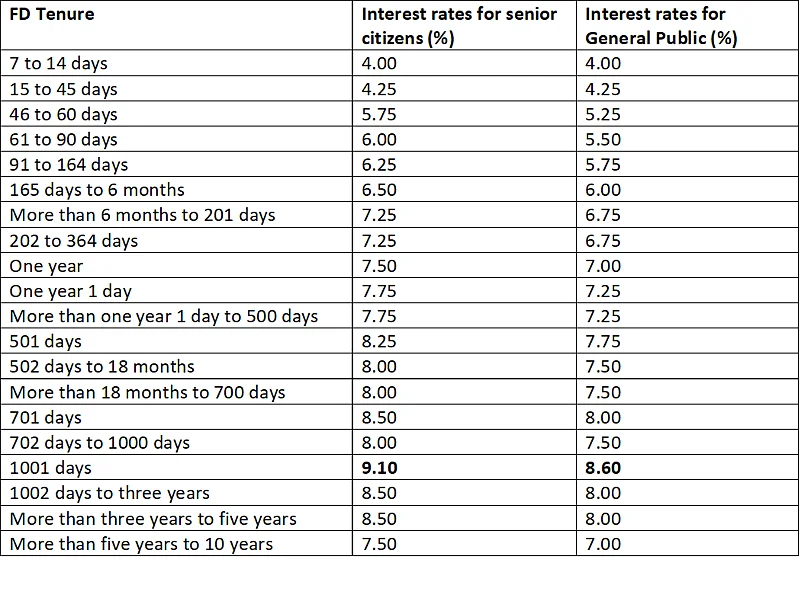

The Bank’s revised rates are applicable from June 16, 2025. Here are the details Unity small finance bank FD rates:

Source: Unity Small Finance Bank

The last time it revised FD rates was on February 12, 2025. At that time, the highest rate offered by the bank was 9.50 per cent for ‘1001’ days. The highest remains for the same tenure even after the rate revision on June 16, 2025.

Note that just like scheduled commercial banks, SFBs are also covered under the Deposit Insurance and Deposit Insurance and Credit Guarantee Corporation (DICGC) for up to Rs 5 lakh insurance in case a bank fails or becomes bankrupt.