Summary of this article

DoPPW issues notifications clarifying family pension rules.

Enhanced family pension applies for seven years post-retirement.

Legal consultation recommended for pension settlements involving two wives.

The Department of Pension & Pensioners’ Welfare (DoPPW) under the Ministry of Personnel, Public Grievances and Pensions issued two crucial clarifications regarding the Central Civil Services (Pension) Rules, 2021. In an office memorandum (OM) dated October 27, 2025, DoPPW clarified ambiguities that have led to several references and right to information (RTI) applications related to family pension. These are related to the enhanced rate of family pension after a pensioner’s death and the challenges in settling such pension cases among more than one wives. The DoPPW emphasised following the rules, especially when dealing with cases involving a higher retirement age or where more than two wives claim family pension.

Enhanced Rate For Family Pension

The OM stated that if a person dies after retirement. as per Rule 50(2)(a)(iii) of CCS (Pension) Rules, 2021, “In the event of death of a Government servant after retirement, the family pension shall be payable for a period of seven years, or for a period up to the date on which the retired deceased Government servant would have attained the age of sixty-seven years had he survived, whichever is less.”

However, for those whose superannuation exceeds 60 years, it clarified that the rule remains the same for all, whether the retirement age is 60 or above.

It states, “Where the age of retirement is more than 60 years, like the age of retirement of Central Health Service (CHS) doctors is 65 years, and the officer retires at the age of 65 and dies unfortunately before 67. It is clarified that the provisions of Rule 50 (2)(a)(iii) are applicable in all cases, i.e., whether the retirement age is 60 or 65 years. In all such cases, the enhanced family pension is payable for a period of seven years, or for a period up to the date on which the retired deceased Government servant would have attained the age of sixty-seven years had he survived, whichever is less.”

So, the universal rule for enhanced family pension is:

Seven years; or

Until the deceased would have reached the age of 67

Whichever is earlier.

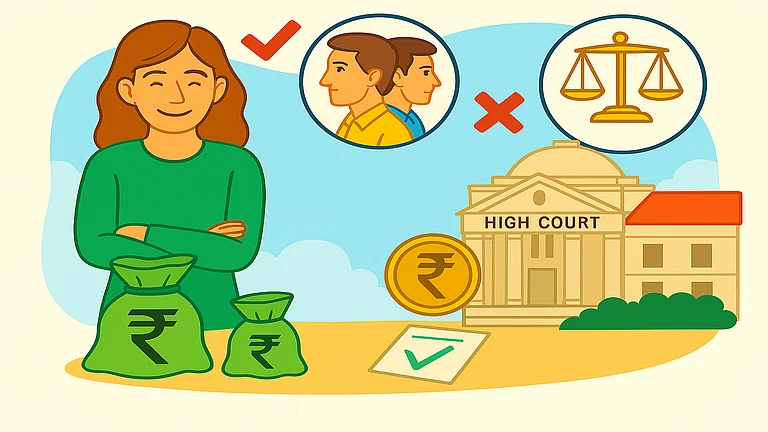

Family Pension Settlements Between Two Wives

The other OM, issued on the same day (October 27, 2025), addressed the order in which family pension is payable to the family members and if the settlement is between two wives of a deceased government employee or pensioner. As per Rule 50 (6) of the CCS (Pension) Rules, 2021, the family pension is payable first to the widow or widower (sub-rule 8), children including adopted children, step children and children born after retirement of the pensioner (sub-rule 9), dependent parents (sub-rule 10), and dependent siblings suffering from a mental or physical disability (sub-rule 11).

Widow or widower will mean spouse under the rule. It clarifies that where a deceased is survived by more than one widow, the family pension should be paid in equal shares to the widows. In case of an ineligible or deceased widow, her share becomes payable to her eligible child or children.

However, it pointed out that having a second wife while the first wife is alive is against the provisions of the Hindu Marriage Act, 1955, and contradictory to the provisions of CCS (Pension) Rules, 2021. Thus, to ensure accurate interpretation of the rules, it requested all ministries and departments to consult the Department of Legal Affairs before settling the family pension when two wives are involved.