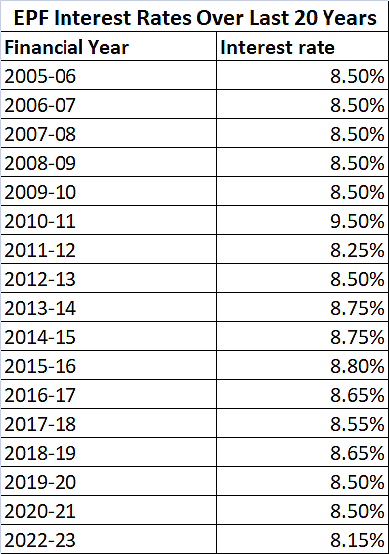

The Employees' Provident Fund Organisation (EPFO) offers a guaranteed interest to its members towards EPF contribution. For the financial year 2024-25, the recommended interest rate is 8.25 per cent. Note that it is the recommended rate, not the final rate. Changes could be made to the rates until it is approved by the government. Only when the central government approves it, the interest is calculated and credited to the members' accounts.

Let us understand how the EPF rate of interest is determined.

How Is EPF Interest Rate Determined?

In February every year, the central board of trustees (CBT) discusses several aspects, such as return from EPF investments, inflation, and other economic factors for determining the interest rate for EPF. CBT, which is headed by the Union Minister for Labour and Employment, then sends its interest rate recommendation to the Ministry of Finance.

The Finance Ministry then evaluates the recommendation, taking into account economic factors, budgets, etc., and may change the rates, raise questions, or approve it.

Once the approval comes from the Finance Ministry, the interest rates are considered approved for calculations. Only then EPFO credits the interest in EPF members' accounts for that financial year.

Source: EPFO

Delayed Credit Of EPF Interest:

Historically, approvals came late by at least 2-3 months or more. For instance, the EPFO notified the higher rates for FY2022-23 on July 24, 2023, For FY2021-22 on June 3, 2022, and for FY2020-21 on October 30, 2021.

This may raise questions regarding the loss of interest due to late credit. It becomes important because the interest is compounded annually in the scheme.

Does Year-End Credit Cost You Money?

EPFO has a set process for crediting the interest without impacting the interest benefits of EPF members. According to the Employees' Provident Funds Scheme, 1952, "Interest shall be credited to the member's account on monthly running balances basis with effect from the last day in each year."

It is important to note here that unlike bank fixed deposits, which credit interest on a monthly or quarterly basis, EPFO credits interest annually.

Now, crediting interest is different from accruing interest. While interest amount is calculated on a monthly basis both in FDs and EPF, it is transferred or credited to the account on a predetermined frequency, which could be monthly, quarterly, or annually.

So the interest accrues every month in EPFO, but only after the rates are approved, rate adjustments in calculations are done, and the amount is credited taking into account the running monthly balance. This ensures that every contribution made into EPF earns the compounding benefit even if the annual interest is credited late.

So, the interest credit may be delayed but the interest amount is not reduced, and annual compounding does not get affected.