Summary of this article

Atal Pension Yojana enrollments exceeded 80 million in 2025

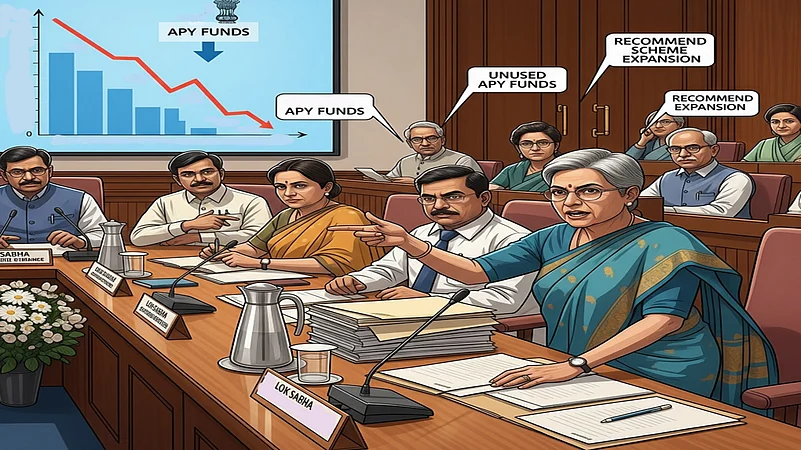

Standing Committee reported 29 per cent APY allocated fund utilisation in FY2024-25

Decrease in business correspondent outlets hampers scheme expansion. The committee recommends re-evaluation of business correspondent’s commission

Atal Pension Yojana (APY) enrollments crossed 80 million, and more than 3.9 million new subscribers have joined so far this year. But could it be more? The Standing Committee on Finance of the Lok Sabha recommends expanding the scheme. The scheme focuses on the unorganised sector workers to provide them with social security in old age. Launched in 2015, the scheme is a contributory in nature, similar to the National Pension System (NPS). However, unlike NPS, it offers a fixed pension in the buckets of Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000, and Rs 5,000 per month.

The standing committee expressed concerns about the under-utilisation of the funds (around 29 per cent) in the financial year 2024-25, according to a report by Hindustan. The committee also conveyed concerns about reducing number of business correspondent (BC) outlets in the villages. BCs could be individuals or the entities who act on behalf of banks to provide basic banking services in the remote, unbanked, and underbanked areas. Banks sometimes use the services of entities such as NGOs, civil society organisations, etc., to provide banking services through the business correspondence model.

While the gross enrollments under the scheme stood at 7.89 crore (78 million) as of June 30, 2025, per the government data, the standing committee sees lower BCs behind a slow expansion of the scheme.

The committee feels that more people can adopt the scheme if they are informed about it, and that the scheme can benefit people living in remote and rural areas.

Reportedly, in FY2023-24, 92.32 per cent of the allocated funds were used for spreading words about the scheme and increasing registrations under it, but in FY2024-25, only 29.19 per cent funds were utilised until February 2, 2025.

The committee is concerned about leaving the fund unutilised, whereas there are so many people who can benefit from APY but are not enrolled under it due to unawareness.

The lower utilisation (almost one-third) compared to the previous year raises questions about the reasons for not using the funds. It indirectly indicates the link between reducing the number of BCs and a timely distribution of funds to them. To monitor this and other aspects of the scheme’s implementation, the committee gave recommendations. A few of them are to initiate an investigation into the under-utilisation, how useful APY publicity is, getting feedback from beneficiaries/villagers, examining commission paid to the BCs, and whether it should be increased, among others.

Notably, there were 15.92 lakh BCs in the villages in December 2023, which reduced to 13.55 lakh in December 2024. BCs work in the remote areas where the bank branches don’t exist. They are the links to provide banking services to the unbanked villagers and include them in the banking system. Lower commission could be a major reason for the decline in the number of BCs, and the committee recommends a comprehensive evaluation of the scheme.