Summary of this article

Senior citizen in Kerala lost Rs 1.51 crore to fraudsters in a digital arrest scam

The victim was threatened with false allegations of facilitating illegal transactions and anti-national activities

Fraudsters gained trust by providing personal information such as Aadhaar and bank details before extracting money in two instalments

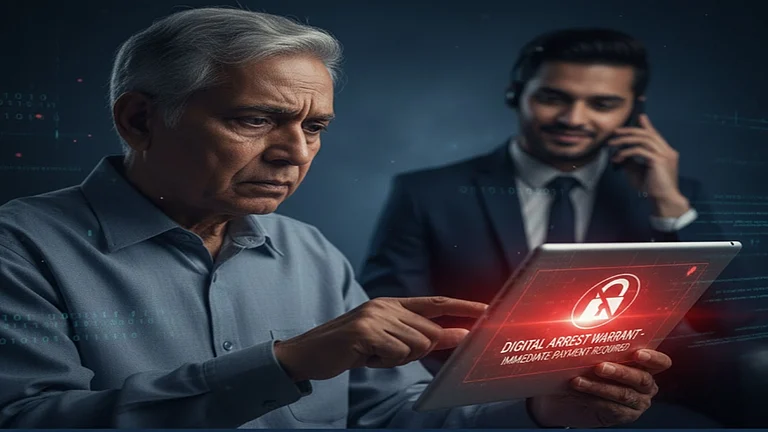

The digital arrest frauds are becoming more and more common among senior citizens. In a recent incident, a 68-year-old Man in Kerala fell prey to fraudsters’ impersonation tricks and lost Rs 1.51 crore in a digital arrest scam. The fraudsters impersonated the Enforcement Directorate (ED) officials. These frauds are serious, involving financial extortion ranging from lakhs to crores. The reason why seniors are the primary target could be that they are unsuspecting once they believe the person, and if they are retired from a decent job, they usually have decent savings, too.

In this recent case, the elderly person informed the cyber police on November 18, 2025, about the incident in which he transferred the money in two instalments to an anonymous account, per a report by The Hindu. He worked in Gulf countries before returning to India, and per the report, was threatened by the fraudsters for his involvement in facilitating illegal transactions. They set the trap up for the elderly by calling him on WhatsApp and charging him for facilitating bank account opening for banned political leaders, etc., which was against the national interest. They even told him that they were keeping a vigil on him for years for anti-national activities.

Once hooked to the call, one of the uniformed persons on the other side of the call acted as a senior ED official and asked him to transfer all his savings to an account which, they told him, was being monitored by the Reserve Bank of India (RBI).

Unfortunately, the elderly believed them and transferred the money to the account suggested by them, relying on their promise that it would be returned to them after completing the verification process.

The old man never suspected that it could be a fraud because the impersonating fraudsters told him his Aadhaar card number, bank account number, and other personal information. This made him convinced to transfer the money. He transferred the money in two instalments last month, but in November, he realised that he had been tricked.

The police are trying to track the bank account to which the man transferred the money. Reportedly, it would be seeking help from the banks to get the details. For this, a panel has been formed that has bankers and police personnel.

In another digital arrest fraud recently, a senior citizen couple in Haryana lost Rs 1.05 crore to fraudsters. The Supreme Court took suo motu cognisance of the matter and expressed its grave concerns as it involved fake judicial orders. The Court affirmed that digital frauds are a matter of serious concern and even proposed the involvement of the Central Bureau of Investigations (CBI) in such matters.

Ironically, this week is the International Fraud Awareness Week (November 16 to November 22, 2025), but not a single day is passing without a fraud case involving money in crores.

While campaigns are being run to spread awareness around digital fraud, individuals also need to keep themselves abreast of digital challenges and ways to tackle them.