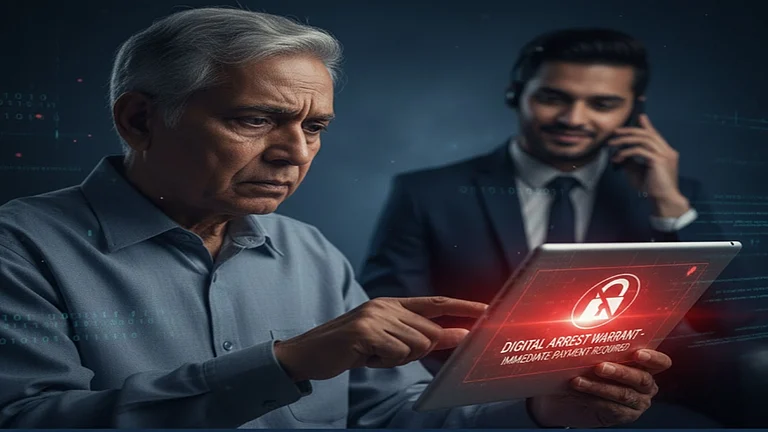

Digital arrest transactions are done with "Valid Consent" or under "Coercion"? This question came to the fore when three digital arrest victims separately filed their complaints to the National Consumer Disputes Redressal Commission (NCDRC) in January this year. The Commission, headed by Justice (retired) A.P. Sahi and Bharatkumar Pandya, accepted the complaints. It combined petitions from three victims, two from Gurugram (one lost Rs 10.3 crore and another Rs 5.85 crore). The third victim is from Mumbai (lost Rs 5.88 crore). The Commission noted the fraud as a 'deficiency in service by the banks' and directed banks to respond. In its order dated March 3, 2025, it said that "customer diligence was clearly compromised", and also that "RBI guidelines were blatantly violated", per media reports.

On July 7, 2025, representatives from seven banks (State Bank of India, UCO Bank, ICICI Bank, HDFC Bank, Yes Bank, Federal Bank, Kotak Mahindra Bank, and Shreenivasa Padmavati Bank) were present in the case hearing. Reportedly, ICICI gave its response in a 39-page document.

This is the first time that NCDRC has considered digital arrest as a deficiency in services by banks. Following the recent hearing on July 7, 2025, the Commission expressed that it would take support from government agencies, including the Indian Cyber Crime Coordination Centre (I4C) and the Financial Intelligence Unit (FIU), if needed. I4C is the nodal agency for protection against cybercrime, and FIU is the agency that monitors financial transactions to prevent money laundering.

Petitioners' Arguments:

The petitions allege that it is banks' responsibility to apply due diligence, monitor high-value transactions and unusual activity in bank accounts, and safeguard customers.

They argued that they had initiated the transaction under coercion, and thus, banks should not consider it as a valid consent. Instead, banks should implement more robust precautionary measures so that no account can be used for a fraudulent purpose.

Banks' Argument:

The banks' responses to the allegation were that if a customer executes a transaction, whether under coercion or not, the bank should not be held responsible for such transactions. The Reserve Bank of India (RBI) guidelines also define banks' liability for unauthorised transactions and not for transactions done under coercion.

Banks argued that there was no internal security system breach and no negligence on their part.

According to media reports, NCDRC noted the high-risk nature of accounts in which money was transferred. It also noted that banks issued no alerts to customers, and nothing was done to stop such transactions.

Now, the issue is whether the transaction should be considered as a consented transaction or not. Because if it is not a valid consent, then who would be responsible for the loss of money; the fraudsters or the banks with weak compliance and safety measures.

What Does NCDRC Do?

The NCDRC was established in 1988 under the Consumer Protection Act, 1986. It is a quasi-judicial body to resolve consumer grievances. A consumer can approach the Commission to make a complaint for any unfair trade practices, overpricing, deficient service, defective goods, among others. In case of services, the Consumer Protection Act 2019 defines the deficiency as:

As per Section 2(11) of the Act, "Deficiency means any fault, imperfection, shortcoming or inadequacy in the quality, nature, and manner of performance which is required to be maintained by or under any law for the time being in force or has been undertaken to be performed by a person in pursuance of a contract or otherwise in relation to any service and includes—

1. any act of negligence or omission or Commission by such person which causes loss or injury to the consumer; and

2. deliberate withholding of relevant information by such a person to the consumer".

So, depending on whether the Commission attributes digital arrest to a deficiency in banks' services, banks' responsibility would be defined.

The next date of hearing is on November 14, 2025.