Summary of this article

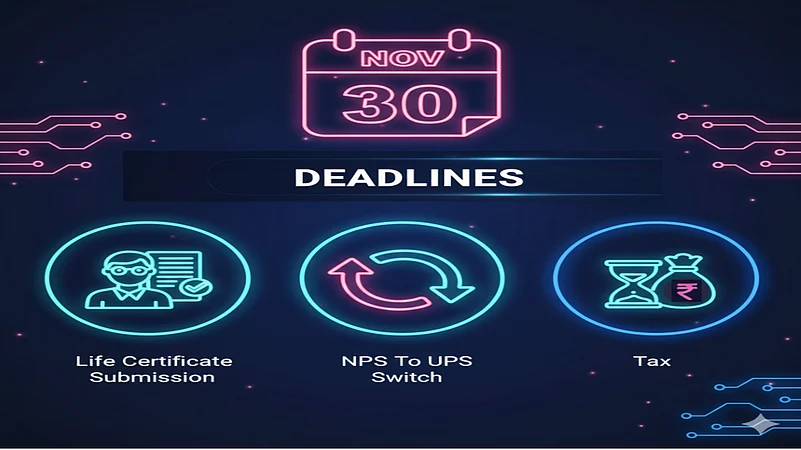

November 30, 2025, is a critical deadline to complete key financial tasks.

Pensioners must submit their life certificates by this date to avoid any disruption in pension payments.

Central government employees need to exercise their option to select NPS or UPS.

Timely compliance is essential to avoid pension disruption and other complications.

November 30, 2025, is the deadline for several important financial tasks. With just four days left, it is necessary to act before the deadline passes. Pensioners must submit their life certificate by this date to continue receiving their pension. Central government employees must choose between the National Pension System (NPS) and the Unified Pension Scheme (UPS). Besides them, certain individual taxpayers need to file their income tax returns before the deadline.

Life Certificate Submission

Life certificate submission is an annual exercise for pensioners, which starts on October 1 every year for super senior citizens (80 years and above), and on November 1 for senior citizens (60 years and above). If a pensioner submits a life certificate later than this date, the continuity of pension payment could stop. However, by submitting the life certificate by November 30, one can ensure an uninterrupted pension. If you haven’t done it already, there are still four days left to complete the process. The submission can be done both offline and online. To know the process, read here.

NPS To UPS Switch

The date is crucial for central government employees, for they can opt for their preferred pension scheme out of the NPS and UPS, only by November 30, 2025. Note that the UPS was implemented this year, effective April 1, 2025, for central government employees. They were given the option to choose between NPS and UPS, by September 30, 2025. But, later, this deadline has been extended to November 30, 2025, with some changes in the switching rules.

Until the implementation of the UPS, all central government employees were registered under NPS. Following the UPS’s launch, switching from NPS to UPS was offered as a one-time, irrevocable option. However, the rule was made a little flexible later by introducing a one-time switch-back option, most likely due to UPS’s weaker adoption among.

At present, if an employee doesn’t exercise the option by the deadline, NPS remains the default pension option.

Tax Filing

For taxpayers, the deadline to submit their challan-cum-statement for the tax deducted at source (TDS) in October 2025 to submit by November 30, 2025. It includes the TDS deduction on property, rent, etc., under Sections 194-IA, 194IB, 194M, and 194S. Further, the taxpayers who have been engaged in international transactions or specified domestic transactions during the financial year 2024-25 also need to submit the report under Section 92E and file their income tax return by the end of this month.