Summary of this article

Indians delay retirement planning, reducing compounding benefits

Lifestyle inflation, poor asset allocation hurt long-term retirement savings

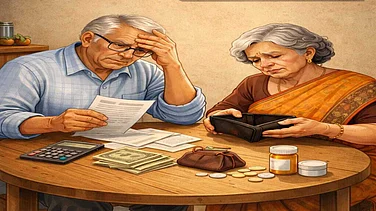

Healthcare costs, inadequate insurance threaten post-retirement security

Early, disciplined investing key to sustainable retirement income

Retirement planning in India often begins late, sometimes too late. While people in their 20s and 30s focus on career growth, lifestyle upgrades, and family responsibilities, serious financial preparation for retirement usually starts only around the 40s. By then, the window for compounding has already narrowed, and correcting earlier financial mistakes becomes tougher.

At Outlook Money 40After40 Retirement Expo in Mumbai, Sameer S Naik, head PR, media and training, Integrated Enterprises (India), said that as India ages, the challenge is becoming more pressing.

“Longer life expectancy, rising healthcare costs, and the gradual shift away from traditional family support systems mean individuals increasingly need to fund their own retirement. Yet several common financial mis-steps continue to derail retirement security for many Indians,” he said.

Delayed Planning, Lifestyle Inflation, And Poor Asset Allocation

He said one of the biggest mistakes Indians make is simply starting too late. Many assume retirement is a distant goal and postpone systematic savings. This delay reduces the power of compounding, forcing individuals to save much larger amounts later to achieve the same financial outcome.

Another major issue is lifestyle inflation. Income typically rises significantly in the 30s and 40s, but expenses often rise faster, such as larger homes, private schooling, expensive vacations, gadgets, and social obligations. While these choices improve current lifestyle, they frequently come at the cost of long-term savings, he added.

“Asset allocation also tends to be skewed. Indian households traditionally favour physical assets, such as real estate and gold. While these have cultural and emotional value, overconcentration in them can limit liquidity, diversification, and long-term returns. Equities, which historically have offered better inflation-beating returns over long horizons, still form a relatively small share of household financial assets,” said Naik.

Additionally, many investors either take excessive risk chasing quick gains or become overly conservative too early. Both approaches can hurt retirement outcomes, the former through potential capital erosion, and the latter through insufficient growth.

Ignoring Health Costs, Insurance And Retirement Income Planning

Healthcare inflation is another factor that is often underestimated. With longer lifespans, post-retirement medical expenses can become a significant financial burden. Yet health insurance coverage is frequently inadequate, or people rely on employer-provided insurance without building independent cover for retirement years.

“A related mistake is focusing only on wealth accumulation and ignoring income generation after retirement. Many people aim for a target corpus, but do not plan how that corpus will translate into a sustainable monthly income. Transitioning from accumulation to decumulation, managing withdrawals, taxes, and investment risks, requires careful planning that often begins too late,” Naik added.

He also spoke of behavioural dimension. Emotional biases, such as recency bias (investing based on recent market trends), herd mentality, and overconfidence can lead to poor financial decisions, he added.

He further said that lack of access to credible financial advice further compounds the problem, leaving investors dependent on informal tips, social media trends, or unregulated influencers.

“Ultimately, retirement readiness is less about chasing high returns and more about discipline, diversification, and consistency. Starting early helps, but even those in their 40s can still course-correct by increasing savings rates, rebalancing portfolios, strengthening insurance cover, and focusing on long-term financial stability,” Naik added.

The message was simple: retirement planning is no longer optional in India. With changing demographics, evolving social structures, and increasing longevity, financial independence in later years requires conscious and sustained effort, ideally well before the retirement years arrive.