Summary of this article

· Bank FDs offer safety with deposit insurance by DICGC up to Rs 5 lakh, covering principal and interest.

· Government-backed post office schemes provide attractive returns coupled with sovereign safety.

· RBI’s Floating Rate Savings Bonds (FRSB) offer floating interest rates linked to NSC rates, about 8.05 per cent currently.

One of the key features of the bank fixed deposits (FDs) is the insurance benefit by the Deposit Insurance and Credit Guarantee Corporation (DICGC) on a sum of up to Rs 5 lakh for deposits, including principal and interest. Such insurance covers all deposits, including the amount kept in the savings account, current account, and FDs. However, there are some highly secured investment instruments available in the market that are backed by the sovereign guarantee. Seniors may choose such instruments to diversify their investment portfolio. For example, there are multiple investment products in post office schemes that can offer very good returns, and they are backed by the Government of India. Another attractive product is the RBI’s floating rate savings bonds (FRSB), which are government-backed and offer a high return on investment.

Let’s check out some of these attractive investment options that are also suitable for seniors when compared to bank FDs.

Post Office Savings Schemes

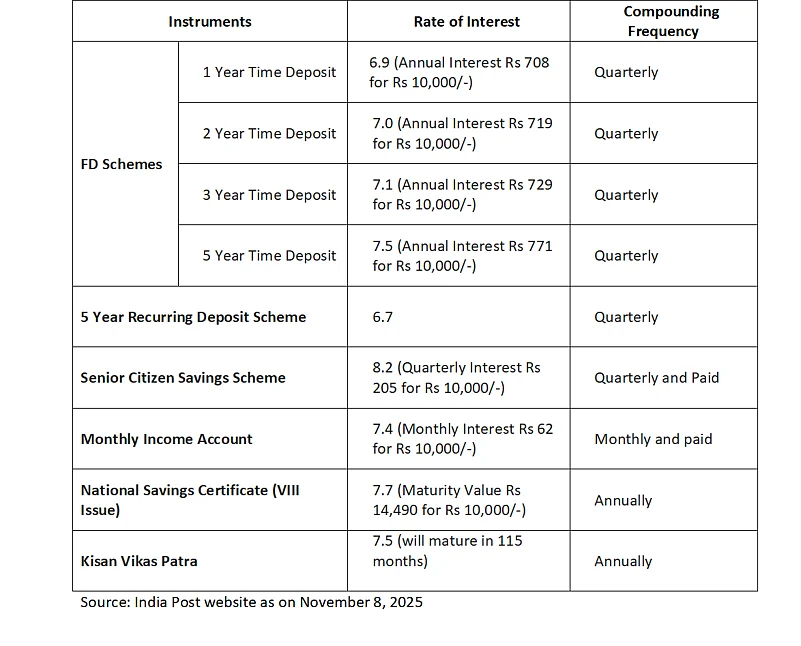

Under the post office investment schemes, you have several options to choose from, such as the Post Office Monthly Income Scheme (POMIS), the Senior Citizens Savings Scheme (SCSS), National Savings Time Deposits, etc. Interest on various schemes and their compounding frequency are mentioned in the table.

Interest on the post office investment schemes is highly attractive considering the level of safety they offer.

RBI Floating Rate Savings Bond, 2020 (FRSB)

FRSBs are issued by the government of India and operated by the RBI. Unlike other bonds that have a fixed coupon rate, the FRSB has a floating rate of interest that is paid on a semi-annual basis on January 1 and July 1 of every year. You can invest in the FRSB through the RBI’s Retail Direct Portal (RDG Portal). NRIs are not eligible to invest in the FRSB. Interest on FRSB is linked to the prevailing NSC rate plus 0.35 per cent, which currently is 7.70 per cent + 0.35 per cent = 8.05 per cent, and it is reset half-yearly in sync with the interest payment date. Maturity period on FRSB is 7 years from the date of issuance.

Why Should You Diversify FD Investment Into Other Low-Risk Instruments?

FDs are safe investments, but they are not the safest ones! So, if you are looking to build a secure investment portfolio for your retirement, then adding other safe investment instruments like Post Office schemes and FRSB can give your portfolio better safety and more flexibility for achieving your retirement goals.

The author is an independent financial journalist