The senior citizen population is on the rise in India. As life expectancy increases, so does the need for proper infrastructure and health plans to provide the silver generation with proper care, and give them a dignified life in their older years through medical and financial aids, and care.

As people age, so does the likelihood of diseases and illnesses, which also calls for expenditure on treatments. In an economy where medical inflation and expenses, such as hospitalisation, medication, major and minor treatments and even monthly check-ups are on the rise, and almost bleeding the senior citizens’ savings dry, mediclaim and medicaid offer a genuine helping hand.

But mediclaim and medicaid are vastly different. Mediclaim is a form of insurance, while medicaid comes in the form of a government scheme, which offers healthcare facilities to seniors living in the rural, sub-urban and even the not-so-affluent demography in the urban areas who may not have access to high-end medical care in the cities for lack of reach or monetary constraints.

What is Mediclaim?

Mediclaim in its traditional sense refers to medical or health Insurance. They are typically provided by the insurance companies.

These policies cover hospitalisation expenses, diagnostic expenses, surgeries, pre- and post-hospitalisation care, and ambulance services. There are many add-ons also, known as insurance riders that a person can add to his/her policy and make their coverage more customised. Some of these riders can also provide coverage for pre-existing diseases.

Cashless vs Reimbursement

It is always recommended to opt for cashless mode in payment rather than go for reimbursement. Cashless mode reduces your stress on handling payments. Reimbursement mode is one where the hospitalised policyholder or their family pays for the care and then are reimbursed by their insurance company after the submission of bills.

High Premiums

There is a limitation for seniors on the insurance coverage. In many cases, pre-existing diseases may not be covered.

What Is Medicaid? (Ayushman Bharat Yojana)

A medicaid is defined as medical aid where the government provides insurance to the citizens. The government has comprised a list in the SECC 2011 database (based on economic status) which basically takes a headcount for all the people falling below the poverty line (BPL).

Coverage

Under the scheme, those falling under BPL, have coverage of Rs. 5 lakh for the entire family, whereas a senior citizen is eligible for coverage of Rs. 5 lakh per head. In case a family has one senior citizen, the entire coverage is for Rs. 10 lakh, of which Rs 5 lakh is solely for the senior citizen and the rest Rs. 5 lakh for the rest of the family members. The scheme does not require citizens to pay any insurance premium as it is a medical aid provided by the government for the poor and vulnerable sections of the society.

Eligibility

Not all seniors can qualify for medicaid. Only those falling under BPL category are eligible. As such, the eligible individuals have to be listed in the official database.

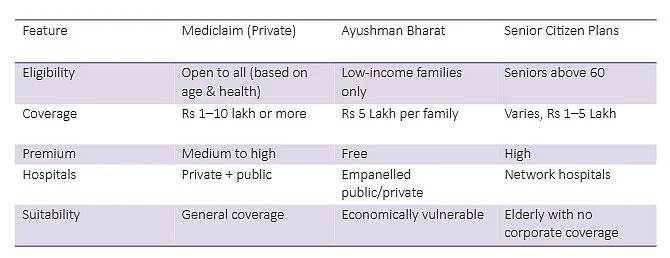

Here is the comparison between mediclaim and medicaid

Senior Citizen-Specific Health Insurance Plans

Private policies for senior citizens aged 60 and above offer higher entry age along with pre-existing disease coverage. However, they kick in after a waiting period, and offer lifetime renewability.

The policy allows coverage for treatment only within the hospital network mentioned that creates a problem for the policyholder. In an emergency, the hospital within the coverage network can be far which may cause inconvenience for the policyholder. This plan is usually bought by senior citizens like retired business owners or those who do not have any company coverage during their working career.

High Premium

The only problem with private insurance is that it comes with high premiums. These premiums gradually increase with age and frequent customisation as and when you get sick or contract more diseases whose care is evidently costly due to medical inflation.

Final Thoughts

Private senior citizen policies provide financial security for financially secure seniors, while medicaid like Ayushman Bharat is crucial for lower-income groups.

Understanding the difference between these schemes can help seniors make informed decisions about healthcare in old age. It is crucial to have medical coverage for smart spending if you do not want to dip it into your retirement accounts or emergency fund saved for any predicted financial crisis or have any fund with which you want to make a hefty purchase or investment in future.