Summary of this article

Rome was not built in a day, nor is wealth accumulated overnight. Savings and compounding require time to work their magic. Building wealth is a marathon, not a sprint. By consistently saving, living within your means, and investing your money wisely over a long period, you can harness the power of compounding to achieve your financial goals.

When it comes to building wealth, compounding and time are your best friends. On the other hand, inflation, taxes, and volatility are your worst enemies. While it is not difficult to build a sizeable retirement corpus, it requires four Ps:

Planning

Patience

Persistence

Prudence

Planning:

The desire to save and build sizeable wealth is not enough -- you need a well-structured long-term savings plan. Such a plan should account for both your current and future earnings, while carefully mapping expenses and leaving room for life events and expected scenarios.

Says Rohit Beri, CEO and CIO, ArthAlpha: “The other side of expenses is your savings plan — always prioritize savings over spending. First, decide how much you will save, then set aside a portion from the remainder for unexpected needs. Whatever is left should determine your spending."

Patience

Rome was not built in a day, and nor is wealth accumulated overnight. Savings and compounding require time to work their magic.

Building wealth is a marathon, not a sprint. By consistently saving, living within your means, and investing your money wisely over a long period, you can harness the power of compounding to achieve your financial goals.

Persistence

Sticking to the plan month after month and year after year is essential. ‘Get quick rich’ schemes will make you rich or wealthy. Only disciplined investing, spending within your means, and strict no to high-cost debt is the sure shot path to get there.

“Even an occasional miss of a systematic investment plan (SIP) during the early phase can make a huge difference in the final corpus you accumulate. And remember, markets are volatile, don’t let volatility scare you and move away from the plan,” says Beri.

Prudence

Avoid ‘get rich’ schemes like a plague; stay a mile away from leverage (only exception being affordable mortgages) and diversify your portfolio. Markets will be volatile, make sure you have an emergency fund which is separate from the savings pool. Dipping into a savings pool during market crashes will significantly impair your ability to recover.

The Plan To Build Retirement Corpus

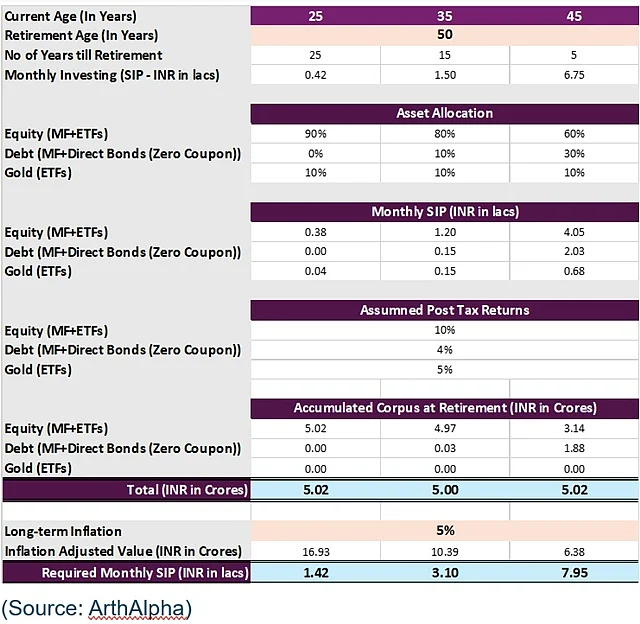

The plan to build a sizeable retirement corpus will vary based on your age, savings ability, income, risk appetite and planned retirement age. We will look at three examples; starting at age 25, age 35 and age 45. In all three cases, we assume that you want to retire at the age of 50 with the corpus of Rs 5 crore.

What we see is that for a 25-year-old, a monthly savings of Rs 42,000 is enough to reach a corpus of Rs 5 crore by age 50. Of course this depends on the assumptions we have taken, i.e., 10 per cent post-tax return from equities, 4 per cent post-tax return from debt, and 5 per cent post-tax return from gold. These are very reasonable assumptions, but we will need to reevaluate these every now and then.

For a 35-year old, we need a monthly savings of Rs 1.50 lakh; this amount can be lower if we increase our allocation to equity and will need a higher amount if we desire a safer portfolio. For a 45-year-old, the monthly savings required is Rs 6.75 lakh. As is evident, the savings required increase exponentially as we age; hence start as early as possible.

25-Year-Old

He invests majorly into equity – young age and long working life warrants this aggressiveness

Debt is tax inefficient and hence the safety portfolio is completely in gold exchange-traded funds (ETFs)

We have not taken into account future income increase which will ensure that portfolio grows to a much larger corpus

35-Year-Old

Still an equity heavy portfolio, but with meaningful allocation to debt

Debt is tax inefficient, so allocation is still restricted

Again, we have not taken into account future income increase which will ensure that portfolio grows to a much larger corpus

45-Year-Old

While the retirement is near, if the person has not built a sizeable portfolio, we will need a large allocation to equity to get to the Rs 5-crore mark

Debt is tax inefficient, which makes life difficult and allocation to debt is restricted keeping in mind the goal of Rs 5 crore

We have not taken into account future income reduction which may create challenges.

Inflation

The above plan doesn’t account for inflation. Ten years from now, Re. 1, will be a lot less valuable than what it is today. If we assume that inflation will average out to 5 per cent, we see that to save inflation-adjusted Rs 5 crore at the age of 50, the required monthly savings go up significantly:

25-year old: Rs 1.42 lakh

35-year old: Rs 3.10 lakh

45-year old: Rs 7.95 lakh

“For a 45-year-old, this may leave no room for error or push him towards riskier assets. For a 25-year-old, one can take into account the future increase in income and increasing savings as you move into the future, making it a lot easier to reach the goal despite inflation,” adds Beri.