Summary of this article

A regular cash flow after retirement is crucial to meet daily expenses.

Seniors need to understand ways to save taxes on their income to have more cash available to them.

One can ensure cash flow for different needs by creating an income ladder and utilising tax savings ways to minimise fund outgo.

By Bhuvanaa Shreeram

For retirees, there is a silent, nagging fear: “Will I have enough regular income to live comfortably without taxes quietly eating into it?” They are not wrong to worry. After years of accumulating a corpus through hard work and disciplined investing, the post-retirement years are about drawing down from that pool wisely. You need income, yes. But you also want peace of mind that you are not leaving too much on the table for the taxman.

So, here’s how you can consistent, tax-efficient income in retirement

Step 1: Know Your Tax Bracket

Before choosing where to withdraw, you must understand your tax identity. Are you a senior citizen? What tax regime do you choose, and what slabs are applicable to you?

Basic Tax Slabs (Financial Year 2025–26 / Assessment Year 2026–27)

New Tax Regime (Uniform for all ages):

Income Tax Slab

Up to Rs 4 lakh - 0%

Rs 4–8 lakh - 5%

Rs 8–12 lakh - 10%

Rs 12–16 lakh - 15%

Rs 16–20 lakh - 20%

Rs 20–24 lakh - 25%

Above Rs 24 lakh - 30%

In addition to this, there is standard deduction of Rs 75,000 (applicable to salaried and pension income under the new regime), rebate under Section 87A of the Income-tax Act, 1961, up to taxable income of Rs 12 lakh which can potentially reduce tax liability to nil for many retirees.

Under the new regime, age-based exemptions for seniors are not available.

Old Tax Regime (Age-based exemptions):

Age Income

Below 60 years - Rs 2.5 lakh

60-79 years (Senior Citizens) - Rs 3 lakh

80+ years (Super Senior Citizens) - Rs 5 lakh

Under the old regime, retirees can also continue to claim deductions, such as Section 80C (up to Rs 1.50 lakh), Section 80D, and Section 80TTB (interest deduction up to Rs 50,000 for those aged 60 and above).

If your taxable income is under Rs 12 lakh, particularly with pension and moderate returns, the new regime can result in nil net tax. But if you use deductions, such as 80C, 80D, and 80TTB, then the old regime could be more beneficial.

Step 2: Choose The Right Income Source

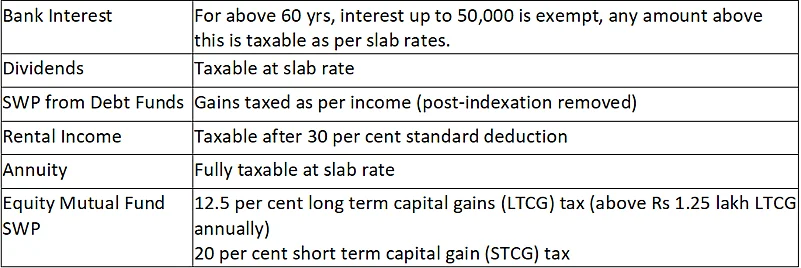

To minimise the tax outgo, look at where your income is coming from, and how much tax it attracts. Here is a list:

So, the income from capital gains, especially LTCG, is often taxed at a lower effective rate than interest income, thus creating planning opportunities.

Step 3: Withdraw Smartly - SWP Vs Dividend Vs Interest Vs Annuities

Let us take an example of a retiree who has a corpus of Rs 1 crore, and she wants Rs 60,000 per month (Rs 7.20 lakh per year). Here are a few scenarios.

A] Use Systematic Withdrawal Plan (SWP): If the fund is invested in equity mutual funds (MFs), a retiree can withdraw monthly through systematic withdrawal plan (SWP). The withdrawn amount includes both costs and gains and only the capital gains portion is taxed.

For equity funds, the first Rs 1.25 lakh of LTCG in a financial year is tax-exempt, and thereafter, 12.5 per cent tax applies on gains. On STCG, the tax rate is 20 per cent. It is important to note that equity net asset values (NAVs) fluctuate a lot, so withdrawal stability must be balanced with market conditions.

B] Take Dividends From MFs or Stocks: After 2020, dividends are taxable at slab rates. Although dividend provides regular income, it is less tax-efficient for higher net worth retirees.

C] Depend on Annuity or Bank Interest: Both annuity and bank interest provide a predictable cash flow. However, annuity payouts are fully taxable at the slab rate, whether from life insurance policies or the National Pension System (NPS). Also, interest income is fully taxable (except up to Rs 50,000 under Section 80TTB).

D] Use Tax Harvesting on Debt or Equity: One may consider selling earning assets strategically for this. They can realise gains up to the LTCG exemption and also reinvest the realised gains to reset the cost basis. This can reduce tax liability on future gains.

Step 4: Use Tax Slabs And Exemptions Smartly

Here are a few options one can use:

A] Section 80C: Invest up to Rs 1.50 lakh in eligible instruments, such as Public Provident Fund (PPF), Senior Citizens Saving Scheme (SCSS), equity-linked saving scheme (ELSS), under the old regime.

B] Section 80D: One can claim a deduction of up to Rs 50,000 per year on medical insurance premiums for self and spouse (higher if covering senior parents) and Rs 5,000 for preventive health check-ups.

C] Section 80TTB: Under the old regime, senior citizens can claim deductions on interest earned from deposits (fixed deposits, savings accounts, post office) for up to Rs 50,000.

D] LTCG Exemption: Use annual LTCG exemption for equity funds (up to Rs 1.25 lakh). To avail of this benefit, one can sell equity funds with Rs 1.25 lakh of gains and reinvest the amount without the need to pay tax on gains.

E] Rent, Interest and Advance Tax: Senior citizens with rental income or interest income need to estimate and pay advance tax to avoid interest and penalties. Further, they can submit Form 15H to their banks to avoid deduction of tax at source (TDS) on interest.

Step 5: Build An Income Ladder

Seniors can also establish income buckets for various needs that are easily accessible when needed.

These can be:

• MFs Or Cash - For immediate or short-term needs (low return and zero risk)

• Debt Funds or SCSS - For stability and fulfil medium-term needs

• Equity Funds (through SWP) - For tax-efficient income and long-term growth

• Annuities - If suitable, for guaranteed income after retirement

• Real Estate - If rental income is consistent and predictable

However, to suit one’s tax position, spending needs, and longevity assumptions, one must review and rebalance their ladder mix once a year.

Conclusion

Amid changing tax slabs, evolving exemption rules, and fluctuating market conditions, one’s income strategy should not be static. So, ideally, one should create a smart combination of cash flow planning along with tax efficiency that can help them live well and sleep peacefully.

Here’s a quote that seniors can think of while planning their taxes on retirement income: “Do not let the tax tail wag the retirement dog. But do not ignore the tail either.”

Smart retirees know how to walk the dog… gracefully.