In our culture, Diwali is considered the beginning of the new year, which makes it an apt time to make financial resolutions to strengthen the path to financial freedom. Experts who attended a webinar, organised by Aditya Birla Sun Life Mutual Fund in collaboration with Outlook Money, gave valuable insights on how to go about this task, which looks simple but needs careful considerations.

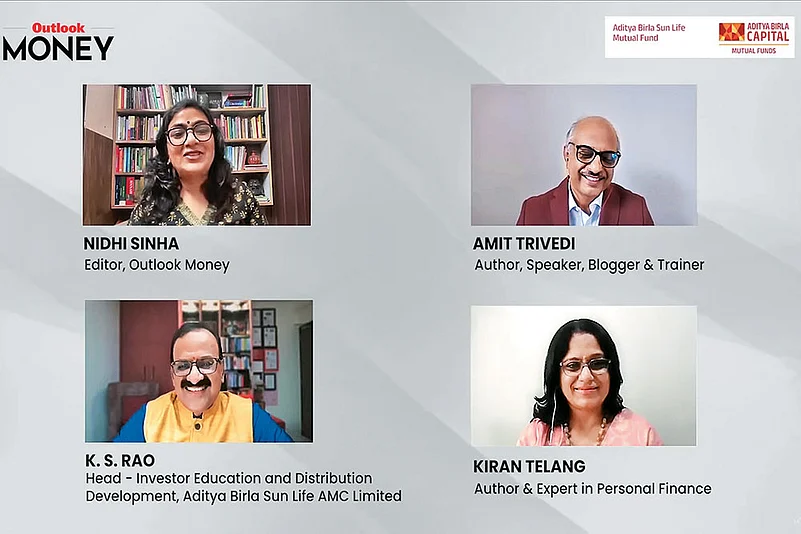

The experts at the webinar were K.S. Rao, Head of Investor Education and Distribution Development at Aditya Birla Sun Life AMC; Amit Trivedi, co-founder of OSAT Knowledge Private Limited and a renowned author; and Kiran Telang, a certified financial planner, a Sebi-registered investment advisor and an author. The webinar was moderated by Nidhi Sinha, Editor, Outlook Money.

Holistic Approach

Rao emphasised upon the symbolic lessons Diwali offers for financial planning. “Before you create wealth, clean the cobwebs,” he said, referring to the festival’s tradition of cleaning homes and settling debts.

He urged the importance of taking a holistic approach towards financial wellness, noting, “Your health is your primary wealth.” He linked the festival’s themes to the importance of health, education, and strategic planning in achieving financial success.

Rao recommended aligning financial resolutions with purposeful plans, much like the structured rituals of Diwali. He advocated for targeted investment portfolios (TIPs), supplemented by systematic investment plans (SIPs), for achieving long-term goals.

Overcoming Behavioural Barriers

Trivedi discussed behavioural challenges that often hinder following financial resolutions after making them. Quoting Benjamin Graham, he said, “The investor’s chief problem—and biggest enemy—is likely to be himself.” He suggested employing financial coaches to guide and motivate individuals, likening their role to that of a marathon coach who not only teaches how to run but ensures one stays on track.

Trivedi introduced innovative techniques for managing market volatility, emphasising mental preparation. For instance, simulating worst-case scenarios by marking down investments in a spreadsheet can help investors stay calm and avoid panic during market downturns.

The Magic of Baby Steps

Telang offered a fresh perspective, advocating simplicity in financial planning. “A journey of a thousand miles starts with a single step,” she said, urging individuals to break down financial goals into manageable tasks.

She shared an inspiring story of a client who transitioned from juggling multiple high-interest loans to purchasing a dream home, showcasing the power of systematic planning and discipline.

Telang emphasised the importance of mindset, borrowing the popular “all-is-well” mantra to illustrate how financial success starts with a positive attitude. “Find your motivation and name your fears,” she advised, highlighting the need for commitment to long-term goals despite short-term challenges.

Towards the end, Rao shared a concise mantra for financial resolutions: “Plan purposefully, prepare prayerfully, stay invested perpetually, pursue persistently, and proceed positively.”

The webinar reinforced the idea that making financial resolutions, much like lighting Diwali’s lights, can illuminate the path to a secure and prosperous future. Whether through innovative techniques, disciplined habits, or guidance from a coach, the journey to financial well-being is within everyone’s reach.

Disclaimer: This webinar is an investor education and awareness initiative by Aditya Birla Sun Life Mutual Fund in collaboration with Outlook Money.