When a child is born, we dream big for them. We imagine their first day at school, their college graduation, and the day they pursue a dream job or a higher degree overseas. But quietly, running parallel to these dreams, is a growing anxiety: How will we afford it all?

Today, sending your child to a college can easily cost between ₹10 lakh to ₹25 lakh or more. Now imagine this costs a few years down the line. With education inflation hovering around 11% annually, this number could double or triple by the time your child is ready.

That’s where the magic of Systematic Investment Plans (SIPs) comes in, not just as a tool for saving, but as a pathway to securing your child’s future.

Why SIPs Make Emotional and Financial Sense

SIPs are about more than just money. They are about discipline, consistency, and the peace of mind that you’re doing your best for your child’s dreams. They allow you to invest small amounts monthly, amounts that grow over time through the power of compounding.

But more importantly, SIPs allow you to stay ahead of inflation, especially when paired with the right financial advice. While long-term education inflation is about 11%, with a well-managed SIP earning around 12% annually, you’re not just keeping pace, you’re outpacing the rising costs.

Start Early, Invest Less

The best time to start investing was yesterday. The next best time is now.

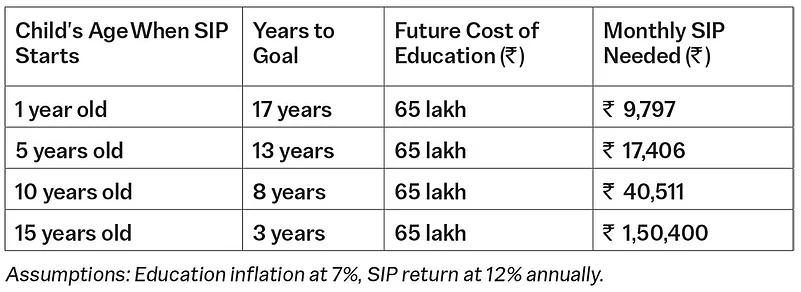

Suppose your goal is to accumulate ₹65 lakh by the time your child turns 18 (the inflated future cost of a ₹10 lakh education today, growing at 11% for 18 years).

A Delay Costs More Than Just Money

As the table shows, a five-year delay more than doubles your SIP requirement. Wait until your child is 15, and you’re almost forced to save the entire amount yourself. SIPs can no longer help you enough, no matter how good the return.

That’s because SIPs work best when they have time on their side. Time is the real wealth builder here. It gives compounding the runway it needs. By starting early, even small amounts grow significantly, and the burden on your monthly cash flow remains manageable.

The Role of a Good Advisor

You’re not alone on this journey. With a trusted financial advisor, you can choose the right funds, stay invested through ups and downs, and gradually increase your SIP as your income grows. Advisors can help you keep your portfolio aligned with your goals and maximise that extra 2% return, enough to make a meaningful difference over long horizons.

A Promise You Can Keep

In a world full of uncertainties, an SIP is a certainty you can create. It’s a monthly act of love and responsibility. The earlier you start, the easier it is to honour your promise.

Because one day, your child will walk into a college auditorium, wear that graduation cap, and hold a degree in hand. On that day, amidst the crowd and applause, you’ll know it wasn’t just their dream they were holding, it was yours too. And it all started with that small monthly investment.

Start now, because every dream deserves a financial plan.

Disclaimer: The Views are Personal and not a part of the Outlook Money Editorial Feature