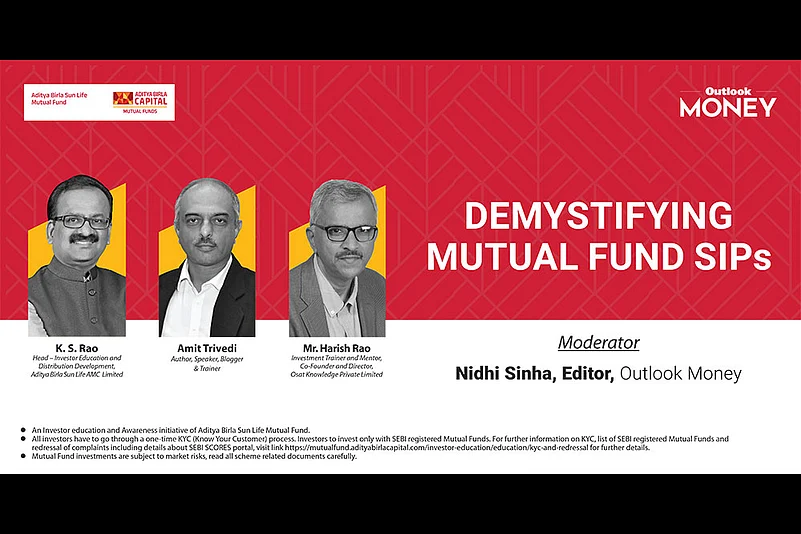

Systematic Investment Plans, or SIPs, are often celebrated as the backbone of disciplined investing in India. Yet, despite their widespread adoption, many misconceptions persist. To address these, Outlook Money, under the Investor Awareness Initiative of Aditya Birla Sun Life Mutual Fund (ABSL MF), hosted an insightful webinar. Moderated by Outlook Money Editor Nidhi Sinha, the session brought together financial experts to decode SIPs and their role in achieving long-term financial goals. The experts were K.S. Rao, Head of Investor Education and Distribution Development at ABSL MF; Amit Trivedi and Harish Rao, Co-founders of Osat Knowledge.

Setting the tone for the discussion, K.S. Rao said, “SIPs are more than just an investment method; they are a habit.” He highlighted how SIPs have become a household name, often misunderstood as standalone products. “People now say, ‘I’ve invested in an SIP,’ without realising it’s a method of investing in mutual funds. SIPs automate savings, ensure discipline, and eliminate emotional interference, making them indispensable for wealth creation,” he explained.

Trivedi elaborated on the technical aspects of SIPs, particularly rupee-cost averaging. “SIPs allow you to buy more units when prices are low and fewer when they’re high, turning market volatility to your advantage,” he noted. Trivedi emphasised that SIPs shield investors from the temptation to time the market, allowing the power of compounding to take over. “It’s a simple yet powerful approach to long-term investing,” he added.

Adding depth to the discussion, Harish Rao spoke about the versatility of SIPs. “From plain vanilla SIPs to step-up SIPs that grow with your income, there’s a solution for every type of investor,” he said. However, he advised against complex strategies like trigger-based SIPs, which rely on market timing. “Stick to simplicity and consistency—that’s the essence of successful investing,” he suggested.

One key takeaway from the session was the importance of investor awareness. Sinha highlighted how many investors confuse SIPs with other financial products, such as insurance premiums. Addressing this, Harish Rao stressed, “An SIP is a structured way to invest in mutual funds, not a product itself. Mis-selling often leads to such confusion. Investors must ensure they fully understand where their money is being invested and seek recourse if misled.”

The conversation turned to SIPs as a wealth creation tool, with K.S. Rao explaining their role in achieving financial goals. “Wealth creation is not about timing the market but staying in the market,” he said. Rao shared a compelling example: saving ₹500 daily through an SIP could grow to over ₹1 crore in 15 years at a 15% annual return. “That’s the power of compounding and discipline,” he remarked.

Wrapping up the session, Sinha summarised the webinar’s message. “SIPs are simple, flexible, and powerful. They allow investors to stay consistent, automate their savings, and work steadily towards their goals. For anyone seeking financial stability, SIPs are a must-have tool,” she said. She encouraged viewers to start small and remain consistent, stressing that the journey to wealth creation is best begun sooner rather than later.

To view the entire webinar, please visit: www.outlookmoney.com

Disclaimer: This webinar is an investor education and awareness initiative by Aditya Birla Sun Life Mutual Fund in collaboration with Outlook Money.