Summary of this article

Wages redefined: Basic pay must form at least 50 per cent of CTC, raising PF and gratuity-linked contributions.

Faster eligibility: Fixed-term employees become eligible for gratuity after just one year of service.

Higher payouts: Gratuity amounts may increase as calculations will be based on a higher basic-plus-DA.

Limited tax impact: Take-home pay may dip, but tax changes arise mainly if employer PF contributions cross Rs 7.5 lakh a year.

The government’s implementation of New Labour Codes aims to empower both workers and enterprises, paving the way for a more resilient, competitive, and self-reliant nation. However, these reforms will also bring significant changes to the calculation of wages, provident fund, gratuity, and other retirement benefits.

For instance, an employee’s take-home salary may decline as contributions toward retirement benefits rise, since the new wage code mandates that the basic salary must constitute at least 50 per cent of the total cost to company (CTC).

Here’s a closer look at some of these key changes:

How CTC Structures Will Be Reshaped

Under the New Labour Codes, statutory social security benefits such as provident fund, gratuity, ESI etc. will be calculated based on a uniform definition of ‘wages’.

“The new Labour Codes require that all forms of remuneration (whether in cash, kind, or allowances) be considered as ‘wages’, with only specific exclusions allowed. Further, these exclusions (other than exit-related payments like gratuity etc.) cannot exceed 50 per cent of total remuneration. Consequently, at least 50 per cent of an employee’s remuneration would amount to ‘wages’ for computing statutory benefits,” says Divya Baweja, Partner, Deloitte India.

This broader definition will lead to higher contributions by both employers and employees towards social security. This could mean a slight reduction for employees in their take-home pay if the overall CTC remains unchanged, as statutory deductions will likely increase under the New Labour Codes.

Also, “this change restricts employers from structuring salaries with very high allowances and a low basic component. While the measure is aimed at improving social security coverage, it also raises key questions on income tax outcomes for salaried individuals,” says Sandeep Jhunjhunwala, Partner, Nangia Group.

Impact On Gratuity Payment

Gratuity payment will now be covered under the Code on Social Security. Under the Code, fixed-term employees are treated differently from traditional permanent or “on-roll” employees for certain benefit eligibility criteria. One of the key changes introduced is that fixed-term employees become eligible for gratuity after completing one year of continuous service, instead of the five-year service requirement that applies to permanent employees.

“It is important to know that this one-year eligibility condition applies only to fixed-term employees. The standard gratuity qualification period for permanent or “on-roll” employees continues to remain five years of continuous service, as per the current legislative framework,” informs Preeti Sharma, Partner, Global Employer Services, Tax & Regulatory Services, BDO India.

The intent of this provision is to ensure parity in benefits for fixed-term employees who may otherwise not remain employed long enough to meet the five-year qualifying period, despite being treated at par with permanent staff in most other respects.

How Gratuity Will Be Calculated

Gratuity payouts are governed by the Payment of Gratuity Act, 1972. Under Section 4(2), the gratuity amount is calculated as:

Last-drawn monthly wage × 15/26 × completed years of service.

Since basic salary and dearness allowance (DA) are typically revised with each salary restructuring, the gratuity is computed on the latest basic pay plus DA. As employees move up the hierarchy and their compensation increases, the gratuity entitlement also rises accordingly.

For Example:

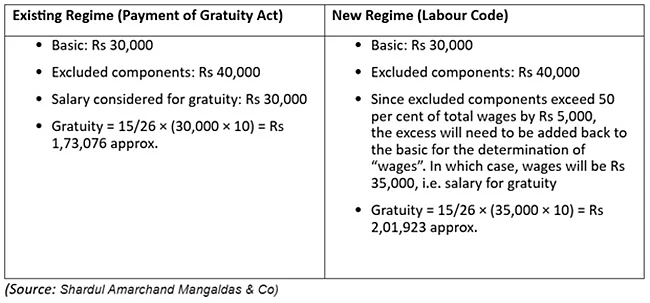

Assuming an employee has a total monthly remuneration of Rs 70,000 over 10 years of service, with a basic salary of Rs 30,000 and excluded components of Rs 40,000, roughly speaking, the gratuity calculation will be as follows:

Income Tax Implications On Salaried Individuals

The New Labour Code requires that basic salary and dearness allowance (DA) make up at least 50 per cent of the CTC, reducing the scope for higher allowances. Since most allowances are already taxable, this shift does not materially change the income tax liability for salaried individuals.

“The real impact is indirect, a higher basic salary increases PF contributions, gratuity and other wage-linked benefits, which may reduce the take-home pay, once the code is implemented post rules coming into effect. Only in cases where the employer's PF contribution exceeds the exemption limits of Rs 7.5 lakh, this restructuring triggers taxable allowance for the salaried employee,” says Jhunjhunwala.

Key Tax Implications Under Both Tax Regimes

Under the Old Income Tax regime, employees may benefit from higher PF contributions qualifying for deductions under Section 80C and potentially, larger HRA exemptions due to the rise in basic salary, both of which may reduce taxable income.

“Under the new income tax regime, where deductions such as Section 80C or HRA are not available, the restructuring of salary could have a minimal impact on the overall income tax liability. Income tax liability largely remains unchanged unless employer PF contributions exceed the Rs 7.5 lakh annual limit,” informs Jhunjhunwala.