Summary of this article

Harassment is illegal: Recovery calls outside reasonable hours, abusive language, threats, or public shaming violate RBI norms—regardless of the amount due.

Banks are responsible for agents: Lenders are legally accountable for the conduct of third-party recovery agents and can be penalised for misconduct.

You have escalation rights: Complaints can be raised with the lender’s grievance cell, the RBI’s Banking Ombudsman, or the police in serious cases.

An increase in missed loan repayments has become a common reality for many individuals in India due to job losses, medical emergencies, or other sudden financial shocks. What begins as a deeply personal financial setback often gets aggravated when lenders resort to relentless calls, threats, public shaming, or even intimidation of family members to recover dues. In many cases, borrowers suffer not because the law fails to protect them, but because they are unaware of the safeguards and remedies already built into India’s banking and regulatory framework.

The crisis has been acknowledged by regulators and the personal finance sector alike, bringing borrower protection issues into sharp focus. Over the years, the Reserve Bank of India (RBI) has issued comprehensive guidelines that draw clear “red lines” for lenders and their recovery agents.

“These provisions prohibit harassment - such as making calls at unreasonable hours, using abusive language, indulging in character assassination, or issuing physical threats - and place strict responsibility on banks and non-bank lenders for the conduct of their agents,” says Ashwini Kumar, advocate & founder of My Legal Expert (MLE).

Borrower experiences suggest that these protections are often not only hard to locate but are buried in circulars, notices, and website disclosures - far removed from the reality of a phone ringing at midnight.

Statistics underscore the scale of the problem. The RBI received nearly 13,000 complaints related to harassment by lending apps and recovery agents between April 2021 and November 2022—clear evidence that the issue is systemic rather than isolated. At the same time, delinquency rates in certain retail segments have edged up, placing additional pressure on lenders to recover dues and, in some cases, fostering a “by any means necessary” approach among third-party collectors. Borrowers caught in such situations often believe they have no option but to endure the mistreatment.

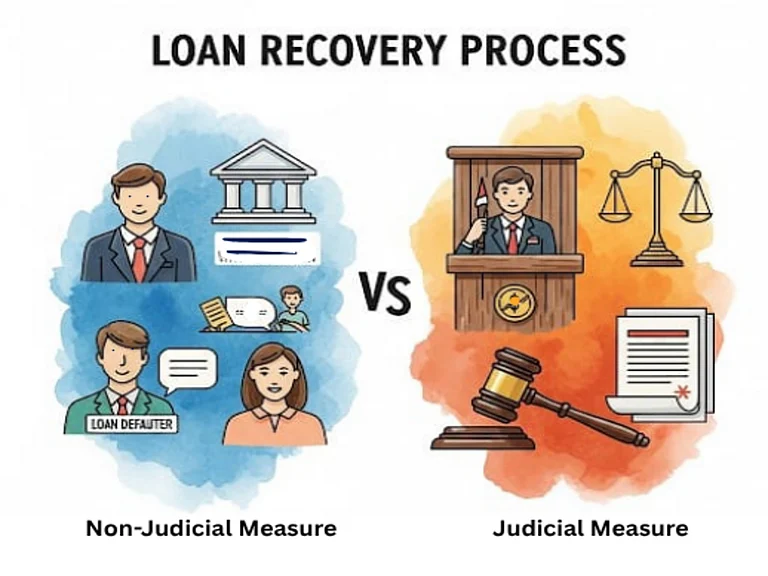

“The reality, however, is that borrowers are empowered—often without realising it. For instance, under RBI guidelines, recovery calls may be made only during reasonable hours. Recovery agents are strictly prohibited from harassing, intimidating, or mistreating borrowers or even individuals connected to them. Before declaring a loan in default or initiating recovery action, lenders are required to issue due notices in the prescribed manner, and they may be barred from engaging certain agents if misconduct is established. These regulations apply to all regulated banks and lenders, and violations can be reported to the lender’s internal grievance cell, the banking ombudsman, or, in serious cases, to the police,” informs Kumar.

Also, borrowers usually do not even consider the formal restructuring and settlement options available to them. Banks can, at times, be far more accommodating than borrowers assume. They may quietly offer revised repayment schedules, short-term moratoria, or even one-time settlement options - especially when a default arises from genuine hardship rather than wilful refusal to pay. The challenge is that frightened borrowers often engage only with field-level recovery agents instead of the bank’s authorised officers. When borrowers fail to reach out directly to the lender, they inadvertently reinforce a power imbalance in which the loudest voice prevails, not the law.

“Lenders have the right to remind borrowers of the distinction between the financial obligation and the illegal methods used to enforce it. A loan default does not mean that a person is stripped of their dignity or legal rights. Lenders still have their contractual remedies open to them, e.g., enforcing security, filing civil suits, or going through specific recovery laws; however, these have to be exercised within the framework of due process. The existence of a legitimate debt is never a reason for bullying. Teaching borrowers about this difference can give them a little confidence they might need when feeling trapped,” says Kumar.

Regulators are preparing for a tighter framework in the future. The new collection standards of the RBI give importance to empathy, accountability, and a constant review of the recovery policies aimed at preventing harassment and, at the same time, ensuring credit discipline. However, reading the regulatory text alone cannot change the reality on the ground. The borrowers' awareness, assertiveness, and documentation are essential to turning these protections into “real”.