The Reserve Bank of India (RBI) on April 9, 2024, reduced the repo rate – the rate at which it lends to banks – by 25 basis points (bps). It comes in the wake of the recent announcement by US President Donald Trump of 26 per cent tariffs on imports from India.

RBI Governor Sanjay Malhotra said the monetary policy committee (MPC) had agreed on a reduced repo rate. The repo rate is now 6 per cent from 6.25 per cent earlier. This is the second rate cut since February this year.

How It Will Affect Loans

For all existing borrowers, all home, car, personal, and education loans on floating rates will become cheaper. New borrowers will get loans at a lower rate as compared to last week. This is because a decrease in the cost of borrowing for banks leads to a proportionate fall in lending rates by banks.

“In the lending space, even a small rate cut can have a meaningful impact. Lower rates mean lower equated monthly instalments (EMIs), and that gives people confidence to borrow and spend, whether it’s a home loan, personal loan, or credit line,” says Kunal Varma, co-founder and CEO, Freo.

According to experts, the stance change also matters. It signals that the RBI is ready to be flexible and proactive, which is key to maintaining financial momentum. The real test now is how quickly banks transmit this cut, because only then will the real benefits be felt on the ground.

Home Loans And Fixed Deposits: Adhil Shetty, CEO, BankBazaar.com, said that Wednesday’s rate cut was on expected lines.

“Home loan rates are about to go sub-eight again with today’s 25 bps rate cut. The lowest rates we are currently seeing are between 8.10 and 8.35. However, the lowest rates are typically reserved for prime borrowers (credit score > 750) and refinance cases. Homeowners paying a substantially higher rate (50 bps or higher above prevalent rates) are advised to refinance their loans to avail lower rates,” he said.

He added that automatic, immediate, and full rate cuts are available only on repo-linked home loans offered by banks. “Despite six years of repo-linking, we see that only 50 per cent of floating rate loans with government banks are still linked to the marginal cost of funds-based lending rates (MCLR) and two per cent to base rate. Borrowers with these banks are advised to take stock of their older loan benchmark and consider refinancing to a repo-linked home loan if it helps them save interest outflows,” he added.

When it comes to fixed deposits (FDs), with large banks, FD rates are so far holding, with minor adjustments seen in some tenors.

“Depositors are advised to lock into the higher rates available now. Senior citizens can benefit from an additional benefit of 50 bps on most tenures. High net-worth (HNW) depositors can benefit from higher rates available on non-callable deposits,” adds Shetty.

Home Ownership To Become More Affordable

According to Raoul Kapoor, Co-CEO, Andromeda Sales and Distribution, the RBI rate cut could translate into cheaper home loans for borrowers.

“Lowering the repo rate effectively brings down the cost of capital for banks and housing finance companies, translating into cheaper home loans for borrowers. This makes home ownership more affordable, especially for first-time buyers and middle-class households,” he said.

He said that the RBI’s decision to cut the repo rate by 25 basis points for the second consecutive time—bringing the total cut to 50 bps—comes as a welcome move for borrowers and the real estate sector alike. This back-to-back reduction is not only a sign of improving macroeconomic stability but also a strategic push to boost consumption and home ownership.

Real Impact Of Rate Cut On Home Loans

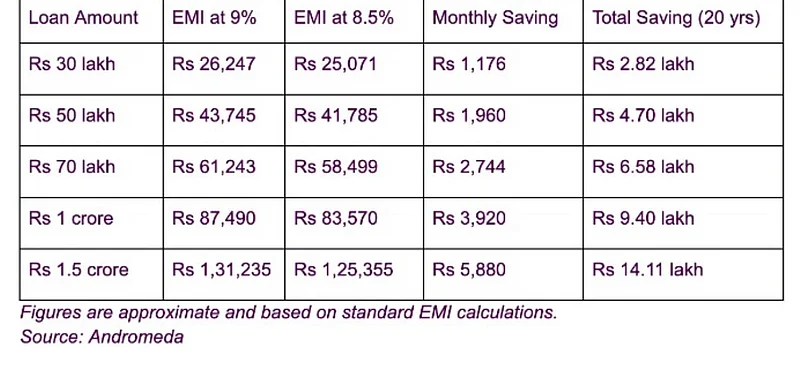

Kapoor also explained the real impact of this 50 bps rate cut with an example:

For a 20-year home loan, assuming the original interest rate was nine per cent, a 0.5 per cent (50 bps) reduction to 8.5 per cent will bring significant EMI savings:

He added that these savings are not just financial but psychological too—they increase loan eligibility and reduce the long-term cost of home ownership.

“As interest rates soften, we expect more fence-sitting homebuyers to move forward with purchase decisions, particularly in the mid and premium housing segments,” he added.