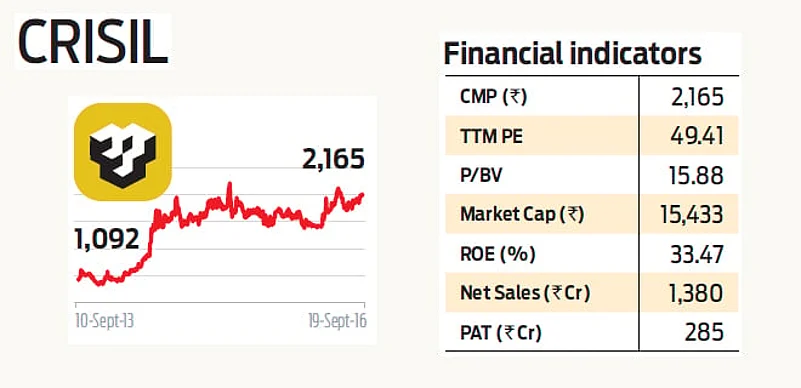

CRISIL is an analytical company and operates in three segments— Ratings, Research and Advisory. The consolidated revenue from operations grew 13.8 per cent to Rs.375.10 crore for Q1 FY17 against Rs.329.56 crore last year same quarter. For six months ended June 30,2016, consolidated income from operations increased 15.2per cent to touch Rs.733.77 crore.

Why: It is a zero debt company and its strategy for incurring capex through internal accruals has led to increase in margins.

What: The delay in the rollout of the new national small industries corporation subsidy scheme is expected to impact mandate for SME ratings.