The biggest takeaway from Budget 2025 was that there is no income tax till an income of Rs 12 lakh under the new tax regime. In fact, someone earning Rs 12 lakh would be saving Rs 80,000 in tax. This provision kicked in on April 1. When the announcement was made, there were speculations that those earning just above Rs 12 lakh would have to pay a much higher tax. However, that is not the case.

Under the simplified tax regime, there are no deductions or exemptions permissible other than the standard deduction and employer contributions to the national pension system (NPS). For a salaried taxpayer this would be provided by the employer itself.

Thus, if a taxpayer has a total taxable income of more than 12 lakh, under the new regime, he would need to pay taxes as per the income slabs. The income up to Rs 4 lakh is at a nil rate of tax. “The income slab from an income level of Rs 4 lakh to Rs 8 lakh is taxed at five per cent. The income between Rs 8 lakh to Rs 12 lakh is taxed at 10 per cent, while the income from Rs 12 lakh to Rs 16 lakh is taxed at 15 per cent. The income beyond Rs 16 lakh up to Rs 20 lakh is taxed at 20 per cent. The income between Rs 20 lakh to Rs 24 lakh is taxed at 25 per cent, and subsequently, beyond Rs 24 lakh income is taxed at 30 per cent,” says Aarti Raote, partner, Deloitte India.

“Further, the rebate under Section 87A for taxpayers filing tax returns under the New Tax Regime has been increased from Rs 25,000 to Rs 60,000. This means that individuals can now enjoy tax-free income of up to Rs 12 lakh under the new tax regime, with no tax liability for earnings up to this limit,” says Suresh Surana, a Mumbai-based chartered accountant.

What Happens If Your Salary Is Just More Than Rs 12 Lakh

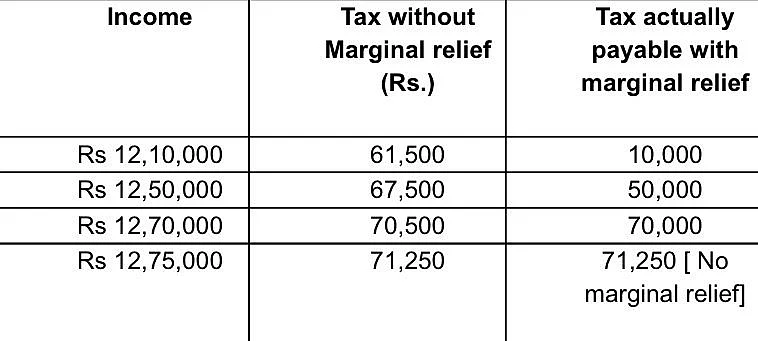

“Furthermore, marginal relief u/s 87A provides that individuals with incomes slightly exceeding Rs 12,00,000 do not face a disproportionately high tax burden. This means that even for an income up to Rs 12,75,000, no tax would be payable, as the additional tax does not exceed the incremental income. These changes make the new tax regime more attractive for middle-income earners,” says Surana. In other words, tax will be payable, but the net income will still stay Rs 12 lakh.

As aforementioned, the tax liability (considering the slab rates) on such a taxpayer having income of Rs 12 lakh would be Rs 61,500. However, a person having an income of Rs 12 lakh income pays nil tax by claiming the benefit u/s 87A. Further, by providing marginal relief, it has been ensured that the tax payable by a person having income marginally above Rs 12 lakhs is required to pay only a marginal amount of tax equal to the amount of income above Rs 12 lakh, so that their carry home income is also Rs 12 lakhs. In this case, he will be required to pay a tax of Rs 10,000.