Two days after the fatal crash of Air India Flight 171 in Ahmedabad, the country’s insurance regulator has stepped in with clear directions for insurers to respond quickly. The Insurance Regulatory and Development Authority of India (Irdai), in a formal advisory issued late Friday, has urged all insurers to process claims linked to the tragedy with “compassion, responsiveness, and the utmost efficiency.”

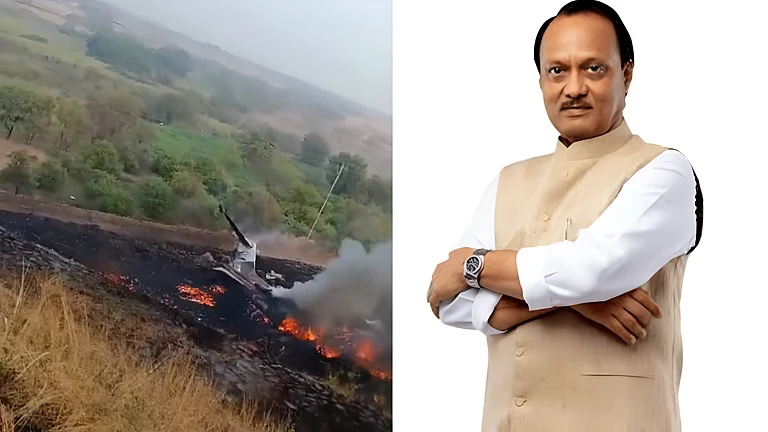

The June 12 Ahmedabad crash killed 265 people, including 242 onboard and many others on the ground when the London-bound Boeing 787 Dreamliner crashed into residential quarters at the BJ Medical College campus in Meghaninagar shortly after take-off.

Calling the incident “deeply painful,” Irdai said the insurance sector must play its role in easing the financial burden for the families involved. The regulator has asked all insurers, life, health, and general, to immediately identify policyholders among the deceased and begin settling claims, without unnecessary paperwork.

Key Directions By Irdai Are:

One of the most significant directions is that insurers must ‘waive standard requirements’ such as FIRs or post-mortem reports in cases where official confirmation of death is available.

“No claim should be denied or delayed on account of procedural formalities,” the advisory says. Insurers have also been told to directly release claim amounts to nominees named in the policies.

Since overseas medical insurance was mandatory for this international flight, insurers have been advised to check their records and identify policies linked to the crash. In addition to passengers, victims from the affected residential buildings must also be included in the fast-track process, the regulator stated.

For Families On The Ground

Since the Air India plane crashed onto the residential area of Ahmedabad, that too on a complex of a medical college, the Irdai has specifically directed some measures to ease the burden on these families as well.

For families that were affected on the ground, Irdai has instructed the Life Insurance Council and General Insurance Council to set up a joint help desk at the hospital where the injured are being treated.

This cell will coordinate directly with the insurers and help the survivors and family members in navigating the claim process.

As part of the directive, each insurance company is supposed to appoint a senior-level nodal officer who will be responsible for overseeing all claims related to this incident.

Additionally, the insurers have been asked to submit weekly reports to the regulator starting June 16, and both Councils will publicly share updates on the number of claims settled.

The move from Irdai follows growing concern from the public and media about how victims’ families will be supported in the aftermath of the crash, a tragedy that has left an entire city in mourning.