Summary of this article

Are Insurers Ignoring Irdai’s Guidelines on Health Insurance Sales?

A year after Irdai’s big reforms, one major rule is being overlooked, and policyholders are paying the price. Irdai’s Master Circular on Protection of Policyholders’ Interests, 2025 states:

“Premium is to be paid only after the insurer communicates acceptance of the proposal”

What is really happening on the ground? Insurers and online aggregators still collect premiums before underwriting. Some platforms move users from proposal to payment in under 5 minutes

Why does it matter to you? You may pay without knowing if your policy will be approved in case of PEDs. If the policy purchase falls, refunds can be delayed or reduced. This practice also opens doors to mis-selling, because money is already taken.

What Outlook Money Found

Tried buying a plan via an aggregator: Payment collected upfront, even when PED (pre-existing disease) flagged. However, direct insurer websites had stricter checks before policy issuance

Other Irdai guidelines that often get ignored

1-hour limit for cashless approvals

Discharge approval within 3 hours

No document collection from policyholder

30-day free-look period

Renewal must not be denied for prior claims (except fraud)

But most of this is still not standard practice

It has been over a year since the Insurance Regulatory Development Authority of India (Irdai), rolled out its Master Circular on Protection of Policyholders’ Interests, 2025, a sweeping reform meant to fix long-standing gaps in how policies are sold and serviced. But as more than half of 2025 has already passed, some parts of that circular seem to have barely made it past boardroom presentations, let alone into day-to-day practice.

Take this: as per the regulator’s instructions, insurers are not supposed to collect premiums before deciding whether they will accept a policy proposal. The idea is simple, first assess the risk, then ask for payment. Yet, in reality, most insurers and their agents are still collecting premiums right at the proposal stage. No underwriting done, no communication of acceptance, no transparency.

Health insurance and investment advisor Avigyan Mitra flagged this in a recent LinkedIn post, calling it what it is, a regulatory violation. What’s the point of Irdai tightening the rules if companies down the line continue business as usual?

“Insurance distribution companies and even the Standalone Insurer, are not following Irdai’s Master Circular, and nobody seems to care,” Mitra noted.

Summary of this article

What is really happening on the ground? Insurers and online aggregators still collect premiums before underwriting. Some platforms move users from proposal to payment in under 5 minutes

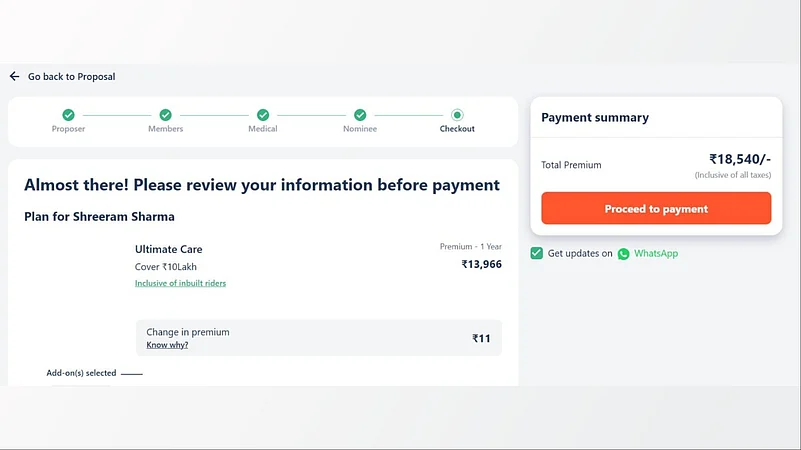

For instance, Outlook Money followed a process of buying an insurance policy through an online distribution channel. In less than 5 minutes, we proceeded from proposal details (after selecting and going over all options) and reached the payment page to lock-in the purchase. (See images below).

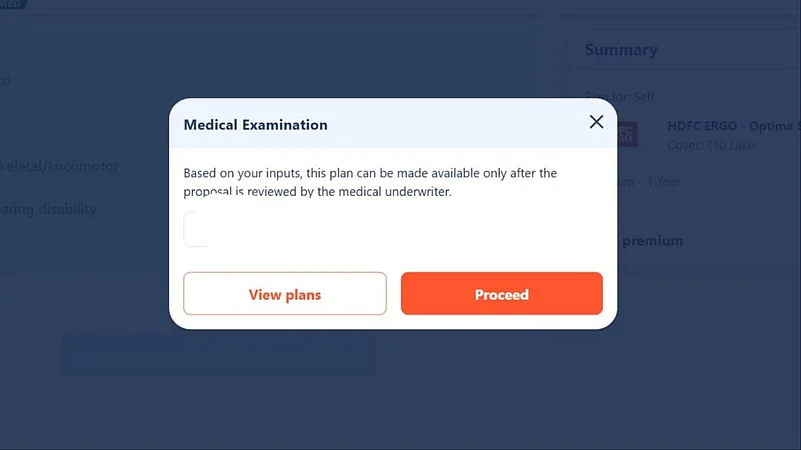

In case of pre-existing diseases, the aggregator website or insurer notifies that based on your inputs, the plan can be made available only after the proposal is reviewed by the medical underwriter. However, you'll still be asked to pay the premium and make the purchase, while the policy you have been assigned is still under review.

Mirta, in his post, noted that his on-ground investigation showed even the top-tier insurance distribution companies and health insurance executives had no clue if this circular even exists.

This shows that distribution channels do ask for premiums right at the proposal stage for both - plans that deem fit for a healthy individual or the ones that tick ‘PEDs’.

The same process, however, when followed directly on the website of an insurance company is stricter and requires more checks before a policy is issued in your name.

It is uncertain whether the insurers/aggregators collect premiums without full clarity on the buyer's medical condition when a plan is bought in the offline mode.

Why This Matters for Policyholders

For an average health insurance buyer, this sequence might seem like a minor matter of paperwork. But the implications can always be significant, for instance:

If your premium is collected before underwriting, you are essentially paying without knowing whether you will actually get (or buy) the policy, or on what terms.

If the proposal is declined or altered, refunds are either delayed or reduced, despite Irdai’s direction to return such amounts “immediately” unless specific deductions (like medical exam costs) are involved.

Sales agents may push policies aggressively to close deals, regardless of whether the client is eligible or the product suitable, because the premium acts as a commitment device.

The regulator’s circular clearly instructs that risk cover must begin only after premium receipt, after the insurer has accepted the proposal. In other words, underwriting first, payment next. But that’s not how it’s working on the ground.

However, this is not the only section of the Irdai Master Circular being brushed aside. The same circular introduced major reforms meant to improve transparency and service quality in health insurance such as:

A maximum 1-hour turnaround for cashless claim approval

Discharge approvals within 3 hours

Insurers/TPAs to collect documents directly from hospitals, not from the insured

Mandatory 30-day free-look period

Protection of ‘No Claim Bonus’ with either sum insured top-ups or premium discounts at renewal

No denial of renewal due to prior claims (unless fraud or misrepresentation is involved)

Yet, many of these consumer-centric provisions are still patchily implemented or ignored altogether, particularly for cashless authorisations and in cases of renewal practices for senior citizens.

What Can You Do?

If you are buying a health policy right now, it is worth pausing before you transfer any money and ask, why are you asking for the premium before confirming acceptance of my proposal? In theory, Irdai's 2024 circular is supposed to bring in better protection for the policyholders. But unless insurers and distribution channels make it a part of their operations it’s just another clause in the circular.