Summary of this article

Trust deficit persists due to mis-selling, hidden exclusions, and complex policy wording.

Rising grievances and claim denials highlight a structural failure in sales, service, and redressal systems.

Simple, transparent products and faster, fairer claims processing are essential to restore confidence.

Strengthening agent training, incentivising long-term service, and increasing awareness of Ombudsman mechanisms can ensure justice for all policyholders.

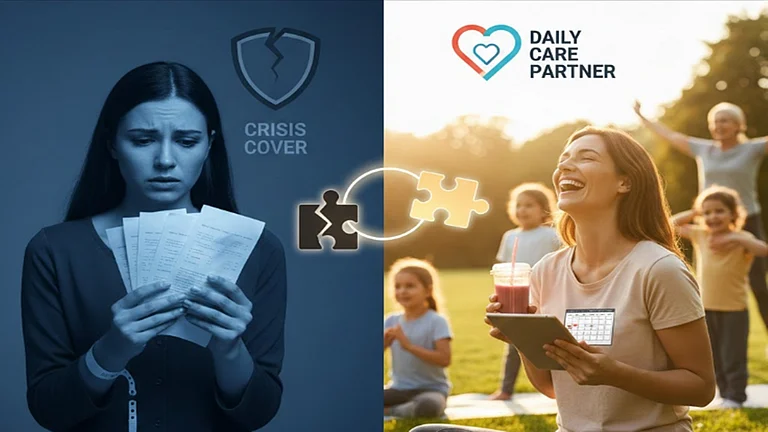

The goal of achieving ‘Insurance for All by 2047’ is a commendable step towards building a financially resilient India. The government and the insurance regulator, IRDAI, are right to prioritise this vision. However, public trust in the insurance sector remains low. Insurance is, at its core, a promise of support during a future crisis. When that promise is doubted, the motivation to purchase insurance naturally diminishes.

The vision for universal coverage cannot stand alone. To ensure the 2047 goal is successful, it must be paired with the commitment to ‘Justice for All Policyholders.’

Deepak Uniyal, CEO and Co-founder, Insurance Samadhan, says, “A policy that covers a person but then leads to the denial of a valid claim is harmful, as it wastes the customer's money and destroys their faith when they are most vulnerable. The widespread lack of confidence stems from issues across the entire insurance lifecycle.”

For the policyholder, the moment of truth - filing a claim or a formal complaint - is often impossible to navigate. Policyholders often lack the knowledge to correctly submit a claim or even to properly express their grievance using the required legal and technical language.

The structure of the sales environment is equally problematic. “As sellers and intermediaries typically have access to the marketplace easily and can easily leave it, they often concentrate on earning quick commissions instead of providing long-term customer service. This often leads to mis-selling and the omission or under-selling of important features such as complex rules and hidden exclusions. These details only become apparent when the family is urgently seeking claim settlement,” says Uniyal.

The growing number of complaints confirms the problem is structural. As the Mumbai Ombudsman, Sarojini Dikhale, pointed out, health insurance complaints have doubled in just six years. This is a clear indicator that the system is failing its primary users.

For the insurance sector to achieve significant growth, it must first establish trust. Trust is built through two essential elements: clarity and delivery.

First, products must be designed for simplicity. Policy documents should use plain language, and all major conditions, especially exclusions, must be easily visible and explained clearly. If a customer needs professional help to understand what their policy covers, the product is too complex.

Second, the process of paying claims must be fast and straightforward. Honouring a claim is the ultimate way to keep the promise. Claims should be settled quickly, without unnecessary administrative demands or deliberate stalling tactics. While companies often cite high claim ratios as a financial issue, this is often a direct result of poor initial sales practices that promised too much or sold the wrong product.

“In places like Uttarakhand, where there are many natural disasters like landslides and flash floods, we see that the basic home insurance policies are written more for urban areas than they should be for rural mountain regions. When a disaster occurs, families who want to rebuild their homes often have their insurance claims denied because of the wording in a standard home insurance policy that has the catch phrase "Act of God", which is usually used to describe an event that is unexpected and cannot be controlled,” informs Uniyal.

This wording does not consider the risk of the mountainous area known as the Himalayas, and therefore, the insurance industry's responsibility should be to ensure that the policy covers the specific risks of the area and that the policy does not deny a valid claim due to vague provisions.

Establishing a stable and trustworthy insurance sector requires cooperative effort from all parties involved:

Insurers should focus on providing comprehensive sales training to their agents and invest in developing technology to create a more user-friendly experience for their policyholders during the claims process.

Also, intermediaries should receive commissions and incentives for providing quality advice and retaining customers as opposed to simply signing new policies.

We have a well-established consumer redressal mechanism, such as the Ombudsman's office, but the awareness of such good mechanisms is low.

Since India is serious about achieving ‘Insurance for All,’ the entire system must guarantee that every promise made in a policy will be honoured. The pursuit of Justice for All Policyholders is not just a secondary objective; it is the fundamental necessity that will make the 2047 vision a reality.