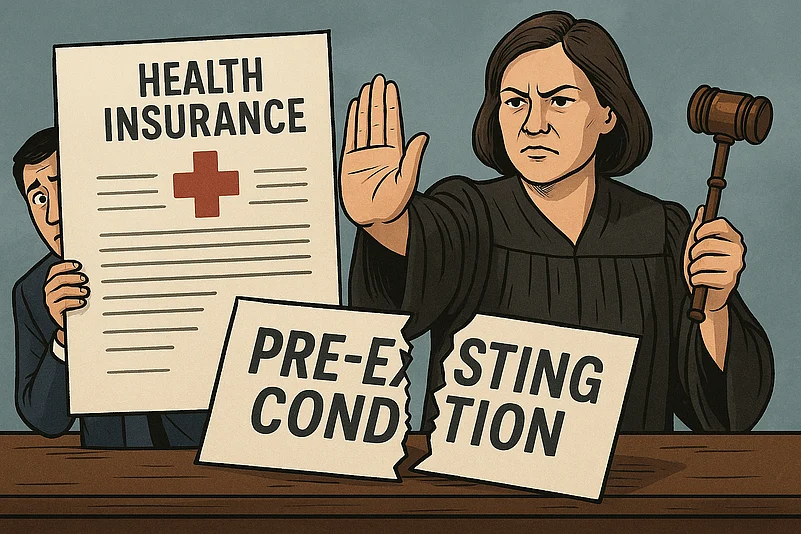

Health insurers cannot fall back on the excuse of a pre-existing ailment to refuse a claim unless they can clearly demonstrate that the customer intentionally kept crucial medical information from them, according to a recent news report by the Times of India.

A Family Left Searching For Answers

The case examined by the Noida consumer commission revolved around Rakesh Singh, who had been covered under a family health policy from HDFC Ergo for several years. In 2017, he was first treated for acute fever and vomiting. Not long after, he suffered a stroke. His family approached the insurer for cashless treatment and later for reimbursement, only to be turned away on both occasions.

The company argued that Singh had a history of rheumatic heart disease and had not revealed this at the time of taking the policy. What struck the commission, however, was the insurer’s silence during repeated renewals. The policy had been extended year after year without a single request for updated health information. The panel noted that this pattern of renewal was significant; it indicated that the insurer had accepted the customer’s risk profile without objection.

Scrutiny Cannot Start Only At Claim Time

In its order, the panel said that an insurer must show deliberate concealment if it wishes to reject a claim on grounds of a pre-existing illness. It is not enough to point to a condition in hindsight. For a repudiation to stand, the company must establish that the policy would not have been issued had the correct information been provided.

Since there was no evidence of intentional misrepresentation, the commission held the insurer accountable. It directed the company to pay Rs 2.4 lakh to Singh’s family, in addition to interest and litigation costs. The order also served as a reminder that insurers are expected to carry out their due diligence while renewing policies. If an insurer wants to reassess medical disclosures, renewal is the stage to do it, not after a claim lands on their desk.

What Consumers Should Take Away

For policyholders, the ruling comes as reassurance in an area often clouded by uncertainty. Many customers fear that insurers may invalidate claims by retroactively invoking old or undiagnosed conditions. The commission’s stance reinforces the idea that long-term renewals and uninterrupted premiums strengthen a consumer’s protections.

The decision also points to a broader expectation of fairness. Customers should not be burdened with surprise interpretations of their medical history, especially during emergencies. Health insurance, the order implies, is meant to be a safety net, not a technical maze that becomes harder to navigate when families are already under stress.