Consumer commission ordered full reimbursement after insurer wrongly denied an emergency claim.

Road-accident treatment outside network hospital still qualifies for medical-emergency coverage.

Oriental Insurance must repay Rs 94,276 with nine per cent interest and compensation.

Verdict reinforces consumer rights against unfair insurance claim rejection practices.

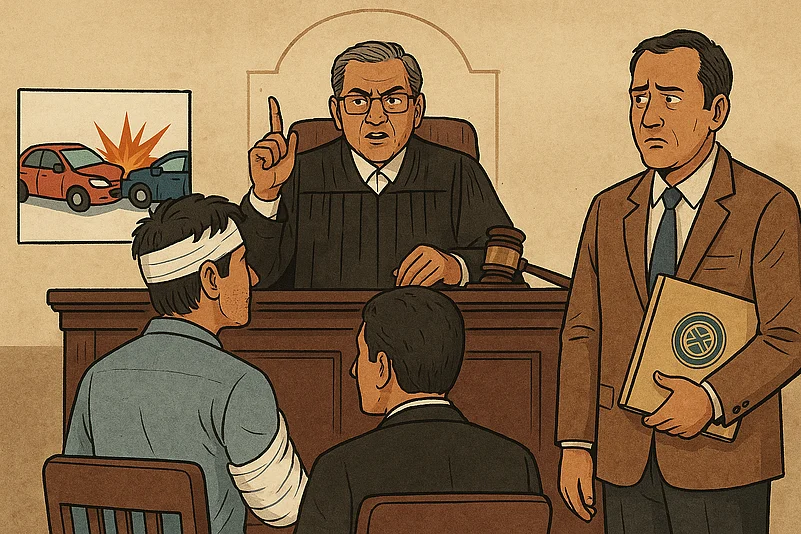

The Ernakulam District Consumer Disputes Redressal Commission has come down firmly on Oriental Insurance Company and its third-party administrator Medisep, directing them to pay a policyholder whose medical claim had been turned away. The order follows a road accident case in which the insurer refused reimbursement, according to a recent report by the Times of India.

Commission Rejects Insurer’s Stand

The matter traces back to January 2023, when K. M. Muhiyudheen, a resident of Ernakulam, met with a road accident that left his left leg badly injured. With no time to spare, he was taken to the nearest hospital for treatment, a practical decision made in the urgency of the moment rather than with any consideration of the insurer’s network list. Since the hospital was not on Oriental’s empanelled list, he applied for reimbursement of the expenses, which came to slightly over Rs 94,000.

The insurer rejected his claim on two grounds: that treatment outside the network hospital system would be reimbursed only if the situation qualified as an emergency under their interpretation, and that the policyholder had not first approached Medisep’s internal grievance mechanism. Feeling unfairly treated, the policyholder took the matter to the consumer forum.

Upon reviewing the evidence, the commission determined that a road accident clearly constitutes a medical emergency. It also pointed to the insurer’s own agreement with the state finance department, which allows emergency treatment at any hospital, regardless of empanelment status. The forum further cited the legal principle that any uncertainty in insurance policy wording must favour the insured party.

By relying on procedural objections instead of acknowledging the urgency of the situation, the insurer was found to have engaged in a deficient and unfair practice.

Order For Full Reimbursement And Compensation

In its ruling, the commission instructed Oriental Insurance and Medisep to return the full amount of Rs 94,276 to the policyholder, along with nine per cent interest calculated from the day he first filed his claim.

Recognising the mental distress caused by the wrongful rejection, the forum also directed the insurer to pay Rs 20,000 as compensation and an additional Rs 5,000 towards legal expenses. The parties have been asked to comply within 45 days of the ruling.

Why This Verdict Matters

What the order ultimately underlines is something very basic: in a medical emergency, people go where they can be treated quickest, not where an insurer’s network list points them. When a person is hurt in an accident, the first priority is getting care without delay, and the commission made it clear that an insurer cannot use technicalities later to turn down a genuine claim.

The ruling also stresses the responsibility insurers have to uphold fair practices and interpret policy terms reasonably. For policyholders, it is a reminder that consumer forums remain an effective avenue for challenging unfair claim denials.