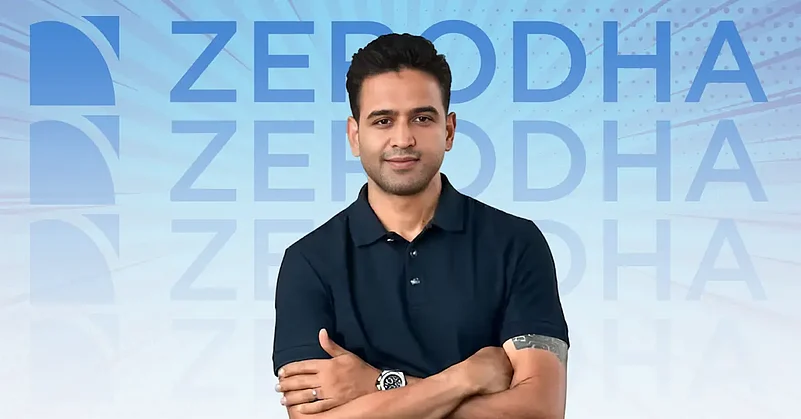

Many of us may think that personal finance is all about investing but it starts with protecting oneself through insurance. Zerodha co-founder Nithin Kamath has advised that everyone starting their personal finance journey should ensure that they have sufficient life and health insurance.

His post on X read, “The first thing you should do when you are starting your personal finance journey is to ensure you have sufficient life and health insurance. If you have dependents, not having life insurance is a bad idea.

Based on my interactions with folks, perhaps the biggest reason why they don't have life insurance is because the policies are a nightmare to understand with all sorts of jargon and hidden clauses.

Then there's the fact that insurers keep changing things. For example, I didn't know underwriting rules had become much tougher and rejections had gone up.”

Health and life insurance are thus crucial aspects of financial planning. Since medical inflation is 14 per cent, medical procedures and treatment are expensive. Not having sufficient health insurance can mean huge out-of-pocket expenses.

Life insurance is required when one has dependents. So, if you are earning and you have dependents like spouses, children or parents, life insurance is a must. But as Kamath has pointed out, life insurance comes with jargon and hidden clauses, so it is difficult to understand. Also, underwriting rules have become more stringent and hence rejections have gone up. As a result, many are left without coverage.

In a post last year on X, Kamath said that insurance is the biggest aspect of personal finance that the vast majority of Indians struggle with. One big reason is a lack of awareness about insurance, rampant mis-selling, complexity, spam, etc.

He said that health insurance and life insurance (term insurance) are the only two products most people need. But the products that are sold the most are ULIPs and other traditional products that promise both insurance and investments but offer the worst of both worlds, not to mention the ridiculous commissions. Hence, experts suggest that one should always keep insurance and investment separate and stay away from such sales pitches.