Despite global uncertainties, the domestic stock market had a strong recovery in April as the headline index Nifty 50 surged over 3.4 per cent. Most of the buying momentum came in the last three weeks, during which the Nifty 50 surged around 2,600 points, or 11.9 per cent, from its low on April 7.

Vinod Nair, head of research, Geojit Investments, said that the broader market saw strong performance during the month, helped by easing tariff concerns, hopes of a US-India trade deal, and steady foreign investor inflows. However, he noted that the momentum is being limited by growing tensions between India and Pakistan and lacklustre Q4 earnings.

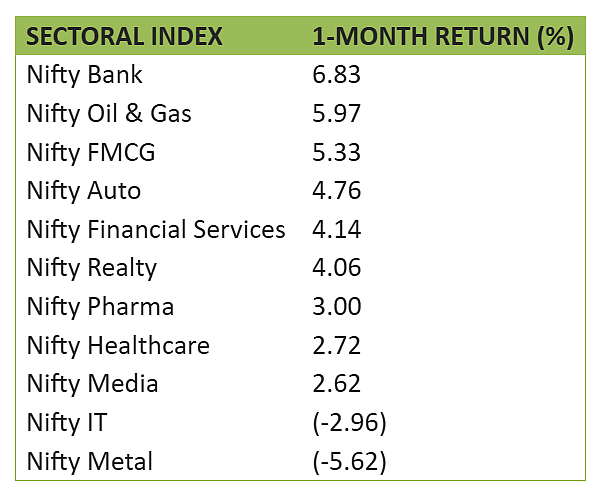

Amid this rally, several sectoral indices managed to beat the benchmark Nifty 50’s returns, while others lagged, with some even giving negative returns. Outlook Money looked into the returns each sectoral index yielded during April. Let’s take a look at what the data says.

Banks Lead, Metals Melt

The Nifty Bank index emerged as the top gainer in April, rallying 6.83 per cent, closely followed by Nifty Oil & Gas, which surged 5.97 per cent in the month. Nifty Auto, Nifty Financial Services, and Nifty Realty yielded 4.76 per cent, 4.14 per cent, and 4.06 per cent, respectively. Nifty Pharma came in next, with a three per cent surge, followed by Nifty Healthcare, which gained 2.72 per cent, and Nifty Media, which rose 2.62 per cent during the month.

However, Nifty Metal and Nifty IT were the laggards this month, correcting 5.62 per cent and 2.96 per cent, respectively.

Why Bank Stocks Are Gaining

Shrikant Chouhan, head of equity research, Kotak Securities, had earlier this week told Outlook Money that asset quality at major banks has improved, the Reserve Bank of India (RBI) is keeping liquidity supportive, and Indian banks’ focus on domestic lending is helping them stay resilient despite global uncertainties.

He further added that the valuations of banking stocks are still attractive, which is drawing in more investors. With stress in the microfinance segment easing and foreign investment flowing back in, top banks that were under pressure earlier are now seeing renewed support, adding fuel to the sector’s rally, he had said.

Further, several top banks, including HDFC Bank and ICICI Bank, reported estimate-beating March 2025 quarter earnings during the month, which also boosted investor confidence in banking stocks.

Why Metal Stocks Are Falling

Metal stocks came under pressure after US President Donald Trump, on April 2, which he dubbed as Liberation Day, announced reciprocal tariffs on its trading partner countries, including India and China.

Although these tariffs do not directly affect India’s metal industry, there was a growing concern that a trade war between the US and China, which make up nearly half of the global economy, could slow down global economic growth and push metal prices higher.

However, later in the month, Trump announced a 90-day tariff pause, which eased some concerns of trade wars.