Around the start of the fourth quarter of calendar year 2024 (around September-October), there was plenty of money to be made in the Indian stock market, irrespective of whether you were a savvy investor or not. The choice of stocks and the skill to time the market didn’t matter so much.

A simple back-of-the-envelope calculation shows that nearly 80 per cent of the BSE 500 stocks delivered positive returns in one year as on September 30, 2024. Essentially, if you had randomly chosen 10 stocks, eight of them were likely to have been profitable. The markets had entered the Goldilocks phase at the time; there was low volatility, and returns were high. Besides, mid-cap and small-cap indices saw significant gains.

The party lasted till it did. The following period was not that exciting for investors. A series of events, both on the global and domestic fronts, such as economic slowdown, trade tariff speculation and foreign institutional investors (FIIs) sell off, coupled with already inflated company valuations, led the stock market into a more volatile and uncertain territory.

“India has seen strong foreign portfolio investor (FPI) outflows on the back of fragile sentiment of overwhelming growth coupled with elevated valuation,” says market expert Ajay Bagga.

Since October 2024, the markets have seemingly entered choppy waters, leaving investors who came in late in the market looking at their portfolio values turning into red.

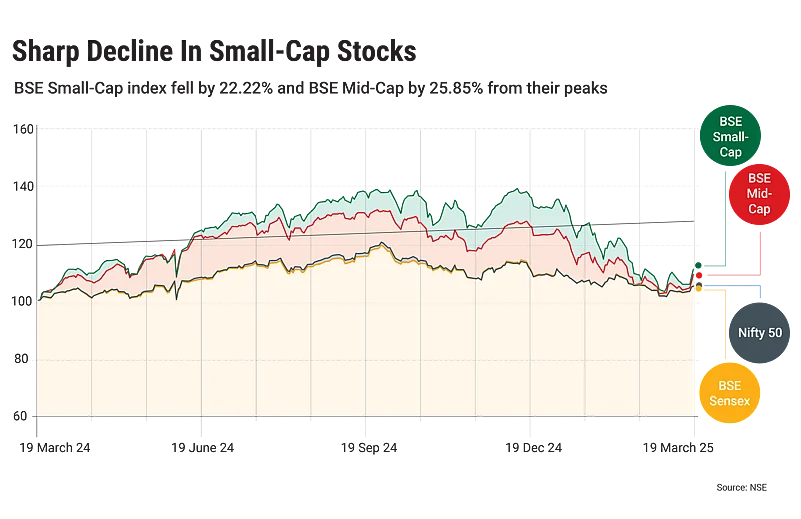

The major benchmark indices, the BSE Sensex and the Nifty 50, have tumbled nearly 16 per cent from their September 2024 peak, marking the sixth-largest drawdown since the 2008-09 financial crisis and the second-largest since the Covid-led crash in March 2020.

Mid- and small-cap indices, such as the BSE Mid-Cap and the BSE Small-Cap faced the maximum heat during this time and skid 22.22 per cent and 25.85 per cent, respectively.

The Valuation Gap

Higher valuation of the Indian market is one of the major culprits for FII outflows and market volatility. The recent correction has pulled down the Nifty price-to-earnings (P-E) ratio from 24.38 on September 26, 2024, when the Nifty was soaring at 26,216, to 20.61 now. This is closer to the 10-year average multiple, which is at 19.91, making the market attractive for investors. “On the valuation front, Indian indices have fallen to historical average levels which provides further comfort to investors,” says Bagga

However, India is still commanding a higher premium compared to major markets, such as China, Canada, France, and other major markets (see Pricey Equities for India’s position in terms of P-E). Experts argue that Indian markets were historically at a premium due to a higher growth rate compared to other countries.

Says Mohit Nigam, fund manager, Hem Securities: “We are the world’s fastest growing emerging markets and it is likely that we will continue to command a premium due to this differentiated positioning in future. The gap between the valuations of Indian and global markets may vary from time to time, but there are high chances that Indian markets will continue to command higher premium till the time we are growing higher than the world.”

The Investor’s Dilemma

The current market downturn is being defined differently by various investors. Newbie investors refer to it as a crash. Aditya Prakash, 25, a software engineer based in Pune, calls it a market crash, as he has not witnessed any major market corrections in his few-years-old investing life. He has been investing in the stock market since 2022.

However, when you ask experts or seasoned investors, they refer to it as a correction, as they have experienced similar volatility in past market cycles.

Whether you call it a correction or a crash, there are a few common questions that are on the minds of investors. Has the market become riskier, or has the correction brought stocks down to more comfortable valuation levels?

In this scenario, people often feel tempted to buy more stocks at lower prices. That’s because at the broader index level, the 15-20 per cent fall over the last 5-6 months may not seem substantial given the high returns delivered by the market in the last few years.

However, if you look at individual stocks, the situation is scarier. Some of the large-cap index stocks have fallen as much as 50-55 per cent. In the case of small-cap index stocks, the fall is much sharper, going up to 86 per cent. For instance, the BSE Small Cap Index, which has 200 stocks as its constituents, shows that half of the stocks are trading more than 50 per cent lower from their peaks. The bottom 25 stocks in the small-cap index are trading 65-83 per cent lower. For instance, Kamdhenu Ventures, which was trading at `58.60 on September 26, 2024, closed at `10.30 on March 20, 2024, a decline of 82.42 per cent from its peak. Similarly, Gensol Engineering and Jai Corp are down by 78.81 per cent and 77.89 per cent, respectively.

To assess the performance of large-cap stocks, we looked at the BSE 100 index, the benchmark index for many large-cap-oriented funds. Out of 100 stocks, 25 or one-fourth of the companies, are down by more than 30 per cent, with some falling as much as 58 per cent from their 52-week high. Adani Green Energy and IndusInd Bank are at the bottom, with the highest falls of 57.53 per cent and 56.60 per cent, respectively. Here, the big question arises: should you buy them, as conventional wisdom suggests—buy low and sell high? To answer that question, we’ll have to tackle another one first.

Has The stock Market Bottomed Out?

The dilemma to buy or not also depends on the question: whether the market has bottomed out, and recovery is on the cards.

In the last few trading sessions till the filing of this report, some recovery was seen in the market. This reversal may be seen as the market recovering from the bottom, and might tempt you to take the plunge, but you need to be cautious. While a bounce-back from recent lows may appear promising, short-term rallies don’t always signal the end of a downtrend.

To a question on whether the market has bottomed out, Shrikant Chouhan–head, equity research, Kotak Securities, says: “Not yet. This is a pullback or relief rally following the continuous decline we experienced since the announcement of the Union Budget 2025. We can say we were closer to decent support levels when the market (Nifty 50) was around 22,000-22,200.”

The correction may also signal positivity, according to some experts. Says Bagga: “The correction in the leading indices and the 20 per cent-plus fall in the broader indices is nearing an end. Domestically, the macro situation is improving, with the economy having made a bottom in the September 2024 quarter and corporate earnings probably having made a bottom in the December 2024 quarter. On government expenditure, the December capex was up 91 per cent year-on-year (y-o-y) and the January capex was up 51 per cent y-o-y. The tax revenues are pointing to a recovery in the broader economy.”

Further, aggregate demand will benefit from the triple action by the Reserve Bank of India (RBI) in terms of the rate cut, macro prudential credit easing and liquidity injection on a massive scale, he adds.

The brokerage consensus for earnings growth is in the range of 13-15 per cent for FY26 and FY27.

What Should You Do?

If you have ever been tempted to buy a stock that has dipped sharply, think again. Sure, there are many stocks where investors press the panic-sell button because of some negative news. As a result, some may even fall to levels that may look extremely cheap. But remember that there’s still a lot of volatility left in the market, and sometimes volatility in negative news-driven stocks can continue for a longer period.

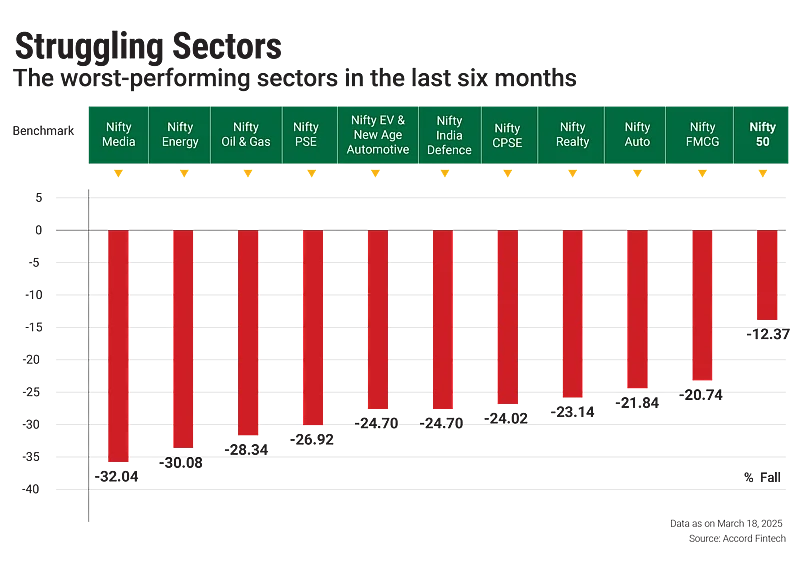

Also, the mid- and small-cap space was significantly impacted during the recent correction.

So, does this present a potential investment opportunity? To ascertain that, experts say, investors will need to dig deeper and find stocks that have still some value left, especially in the mid- and small-cap categories. “Invest a small portion in mid- and small-cap stocks, but invest with a long-term perspective. Also, invest only in well-researched stocks after taking the advice of experts,” says Chauhan.

He adds that long-term investors should focus more on identifying quality stocks available at extremely attractive valuations rather than spending sleepless nights wondering if the bottom has been reached.

“A meaningful correction in the market always presents an opportunity to buy your dream companies or management at attractive valuations,” says Chauhan.

Bagga suggests that investors should focus on companies with robust cash flow, strong management, and no leverage, ideally from index constituents, as they tend to have a higher probability of bouncing back.

The returning tide of liquidity from FIIs and domestic investors is not going to lift all boats, which means not all stocks will appreciate. You need to be sharp and vigilant about stock selection at this point.

kundan@outlookindia.com