Summary of this article

The Securities and Exchange Board of India overhauled market regulations to enhance transparency and simplify compliance for intermediaries.

Key changes include the introduction of a Base Expense Ratio for mutual funds and reduced brokerage caps for various transactions.

The regulator also introduced a standardized Draft Abridged Prospectus for IPOs and special incentives for retail investors in debt markets.

The Indian securities market has witnessed significant growth in recent years, with mutual fund participation reaching record highs, the number of demat accounts surging and the primary market witnessing strong participation from investors.

Amid this growth, the Securities and Exchange Board of India (Sebi) has overhauled major regulations which govern several facets of the securities market.

On December 17, Sebi announced several reforms which seek to change the way the mutual fund space and the primary market are governed. The newly announced reforms seek to bolster investment and increase transparency in the investment process along with the streamlining of compliance and due-diligence for market intermediaries. Here are some of the key reforms announced by the market regulator post its board meeting:

Overhaul of Mutual Fund Regulations

The market watchdog has replaced the Mutual Fund Regulations 1996 with the Sebi (Mutual Funds) Regulations, 2026. Here are the key changes announced as a part of this reform:

Base Expense Ratio (BER)

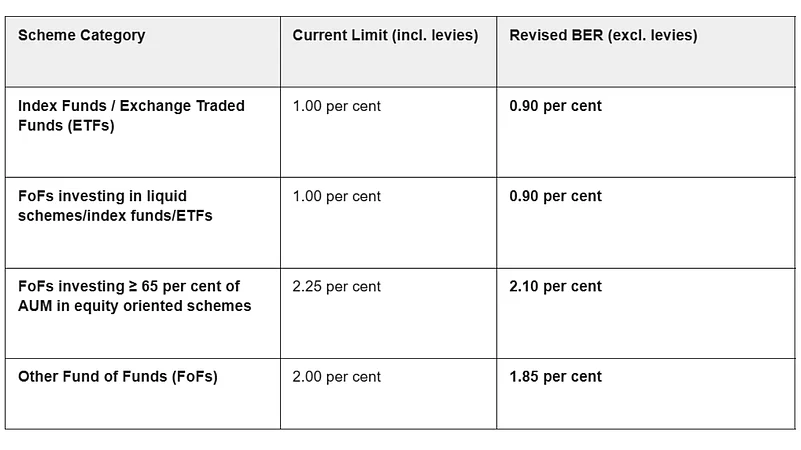

Sebi has amended the Expense Ratio framework, one of the major changes includes the introduction of the Base Expense Ratio (BER). The BER does not include statutory and regulatory levies such as Goods and Services Tax (GST), Stamp Duty, and Securities Transaction Tax (STT). These levies will now be charged on the actual trade over and above the brokerage costs. This reform is aimed at helping investors see exactly what they are paying for. The Total Expense Ratio charged to investors for mutual fund investments will be calculated as the sum of BER, brokerage, regulatory levies and statutory levies.

Lower Caps for Investors

The market regulator has also introduced changes to make investment in mutual funds more affordable. Sebi has revised the maximum limit of the expenses charged to investors. For index funds and ETFs and Fund of Funds investing in liquid schemes, the limit has been reduced by 10 basis points (bps). On the other hand the limit has been reduced by 15 bps for FoFs investing more than 65 per cent of their AUM in equity oriented schemes and other FoF schemes. The market regulator has mandated that the BER for open-ended schemes will be determined on the basis of the scheme's Assets Under Management for equity oriented and other open ended schemes.

Potentially Reduced Transaction Costs

Sebi has also slashed the brokerage caps for fund houses as a part of the reforms. The brokerage caps which dictate the maximum percentage which can be charged as brokerage to the investor has been reduced. Prior to the reforms the brokerage limit for cash market transactions was 8.59 bps (exclusive of statutory and regulatory levies), the Sebi has reduced the cap to 6 bps. On the other hand, the brokerage cap for derivative transactions has been reduced to 2 bps (exclusive of levies) from 3.89 bps net of levies prior to the reforms.

New Rules for Stockbrokers

The market regulator has also made changes to the 1992 Stock Broker Regulations and replaced them with the Sebi (Stock Brokers) Regulations, 2025. Notably, the new rules seek to simplify the norms and remove obsolete regulations which in turn has reduced the word count of the norms to 9,073 words from 18,846 in the previous document as per Sebi. Here are some of the key changes introduced as part of Sebi (Stock Brokers) Regulations, 2025:

Enhanced Supervision and Ease

Sebi has allowed stock-brokers to maintain books of accounts in electronic form. The market regulator expects the shift to benefit both regulatory bodies and market intermediaries by increasing the ease of doing business and allowing for greater security and supervision. Additionally the criteria for "Qualified Stock Brokers" has been rationalised to ensure firms with large client bases or high trading volumes face stricter oversight.

Measures for Deepening Debt Market Participation

The market regulator has relaxed the Sebi (Issue and Listing of Non-Convertible Securities) Regulations, 2021 to boost investor participation in the corporate bond market. As a part of the relaxation bond-issuers will be allowed to offer some incentives to select categories of investors, debt issuers will be allowed to offer additional interest or discounts on the issue price to senior citizens, women, armed forces personnel, and retail individual investors. However, these benefits will be only provided to initial allottees and will not be transferred upon the sale of the debt-based security.

Ease of Doing Business for IPO-Bound Firms

The market regulator has amended the Sebi (Issue and Listing of Non-Convertible Securities) Regulations, 2021 to add ease in the initial public offering (IPO) process for companies and investors.

Lock-in for Pledged Shares

The market regulator has amended the norms to allow pledged shares held by non-promoters to be marked as "non-transferable" securities by depositories. This change ensures that companies comply with the mandatory six-month lock-in period post the listing of the scrip even if the pledge is later invoked or released.

Draft Abridged Prospectus

The market regulator has sought to boost primary market participation and allow investors to make more informed investment decisions by introducing a concise, standardized "Draft Abridged Prospectus" for IPO-bound firms. The prospectus will be accessible via the Sebi website at the early DRHP stage instead of the final RHP stage.

Other Key Reforms

Other key reforms introduced by Sebi include reducing the timeline for crediting securities to an investor’s demat account (following service requests like transmissions or duplicate certificates) from 150 days to 30 days. Sebi has also allowed for a special window to be opened for investors who purchased physical shares before April 2019 but have not been able to register them in their name.

Other key reforms include allowing Credit Rating Agencies to rate a wider set of financial instruments. However, CRAs will be allowed to do so if they clearly label Sebi-regulated and non-Sebi-regulated products separately to prevent investor confusion. The board also acknowledged the report of the High-Level Committee on conflict of interest for Sebi officials. However the market watchdog noted the need for further detailed discussion in future meetings.