Summary of this article

SIP inflows have been rising steadily over the years.

SIPs don’t protect you from market ups and downs..

Boost SIP Returns with an easy strategy.

A systematic investment plan (SIP) is undoubtedly the most convenient way to invest in mutual funds. You simply instruct your bank to automatically deduct a pre-decided amount and invest it in a specific mutual fund scheme. Without fail, this amount gets invested every month into the scheme of your choice. The best part is, you can start small; even with Rs 500 or Rs 1,000 a month.

Thanks to this convenience, SIP inflows have been rising steadily over the years. In fact, SIP inflows for September 2025 were 20 per cent higher than those in the same month last year. The inflows through the SIP route have grown five times since September 2020 — from Rs 7,788 crore to Rs 29,361 crore in September 2025.

So, whether you are someone who has just started to explore mutual funds or who has been investing for years, you must know these seven facts about investing through SIP that can help you maximise your gains in mutual funds.

1. SIP Is A Mode To Invest In Mutual Funds, Not A Type Of Fund

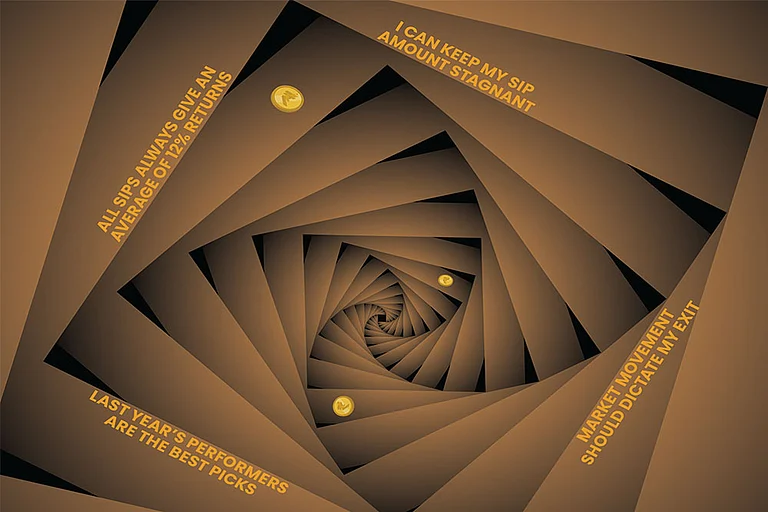

Many novice investors believe that SIP is a mutual fund. They think that they are investing ‘in’ SIP, which is not true! Actually, SIP is simply a method that helps investors invest in mutual funds on a regular basis, in a disciplined manner, through an automated set up between your bank and the mutual fund company.

2. SIPs Don’t Guarantee Safety

SIPs don’t protect you from market ups and downs. When you invest by way of an SIP, you are investing in a mutual fund which in turn invests in stocks or bonds. Your returns and the level of risk depends on how these instruments perform. For instance, if you are investing in a small-cap mutual fund, which invests in small-cap stocks, your investments will have the underlying risk of investing in small-sized companies of the country.

The advantage of investing through SIP than a one-time lump sum is that they help smoothen out volatility over time.

So, the key lies in picking the right funds that suit your risk tolerance, following suitable asset allocation as per your goals, and sticking with them through market cycles.

3. Flexible And Easy To Manage

One of the biggest reasons SIPs are so popular is their simplicity. You can start with as little as Rs 500 per month. In fact, there is a concept called ‘Choti SIP’ where certain funds allow you to invest Rs 250 and Rs 100 as well.

And in case you ever face financial crunch, you can pause or stop your SIP at the click of a button or by filling a simple form, without any penalty.

4. Time Makes All the Difference

If you are investing via SIPs, you don’t need to time the market. That's because your investment happens automatically every month. As such. you don’t have to worry about market highs and lows.

At first it may seem to be slow, but over time, the results can be surprising. That’s because the real magic of SIPs lies in compounding. Compounding means the way your earnings start generating more earnings over time.

For instance, investing Rs 2,000 per month for 10 years at a 12 per cent return per annum, can grow into about Rs 4.50 lakh from a total investment of Rs 2.40 lakh. Stretch that to 20 years, and the same monthly investment of Rs 2,000 can grow to nearly Rs 18.40 lakh.

So, instead of waiting for the right time, stay invested and let time do its work. The longer you stay invested, the greater the effect of compounding.

5. Consistency Builds Wealth

SIPs may look like a slow process at the beginning. But it's important to remember they are not about quick gains, but steady growth over time. Consistency is what matters while investing in mutual funds through SIP. For instance, if you have been investing Rs 15,000 every month for 20 years at a 12 per cent return, your corpus could grow to around Rs 1.50 crore. But if you skip just one SIP every year, the accumulated corpus could fall by Rs 40 lakh to about Rs 1.10 crore.

So, missing even a few installments can be harmful for the overall growth of your investment.

6. Rupee Cost Averaging Works Silently in Your Favour

A major advantage of investing through SIP is ‘Rupee Cost Averaging.’ Understand it like this. Suppose you go to the market to buy some apples for Rs 500. Apples cost Rs 100 per kg, so you would get 5 kg of apples. After a week, you head to the market for apple shopping again. This time apples have become slightly costly and now they cost Rs 120 per kg. So, this time with the same amount of Rs 500, you would be able to purchase 4.20 kg of apples.

Similarly, when markets fall, your fixed SIP amount buys more units of the mutual fund, and when markets rise, your fixed SIP amount buys fewer units for that month.

Now over time, your average cost price of mutual funds comes down since you invested regularly without timing the market. This can be called an effortless way of making volatility work for you instead of against you.

7. Boost Returns with the SIP Step-Up Option

If you can, try increasing your SIP amount slightly every year, say, by 10 per cent or higher. This small increment can make a huge difference.

Let’s understand with an example.

Two friends, Aanaya and Arvind started to invest Rs 5,000 per month in a mutual fund scheme. They decided to continue for 20 years, with a minor difference. While Aananya chose to invest the same Rs 5,000 every month, Arvind decided to top up or increase his monthly investment amount every year by 10 per cent.

Their mutual fund earned them 12 per cent returns. But the difference in their final accumulated corpus at the end of 20 years was amazing. While Aananya made a healthy corpus of Rs 46 lakh, Arvind’s step-up SIP helped him build a corpus of over Rs 93 lakh — more than double the wealth achieved by Aananya.

That’s the power of small, consistent upgrades.

In short, SIPs work best when you stay patient, disciplined, and consistent. They are not about chasing the market, but about building wealth gradually and steadily.