Post-Covid, fund houses have been on a new fund offer (NFO) launch spree in the name of innovation. Sample this: between 2021 and 2024, around 750 NFOs were launched. In 2024 alone, the mutual fund (MF) industry made history by launching 248 NFOs in a single year, the highest ever in its history, according to data from the Association of Mutual Funds in India (Amfi).

A quick back-of-the-envelope calculation shows that this amounts to more than one NFO every working day in 2024. Let’s break it down: There were 366 days in 2024, a leap year, which included 104 non-working days (Saturdays and Sundays) and 16 market holidays. This left 246 working days, and saw 248 NFO launches within those says.

In 2025, the pace is only slightly slower—33 NFOs have been launched till February 20—but we are only in the second month of the year so far. Many others are either in the approval stage or are about to be launched.

Interestingly, the markets reached a new high in 2024, along with the record number of NFOs. Historically, when markets start moving up, more and more NFOs come in. Barring the recent correction, the stock market has been continuously rising for the last four years, with some volatility in the interim.

Investors usually run towards the markets when they are at higher levels. The NFO launch spree essentially caters to that rising demand, and data proves that. The NFO subscription amount went up to Rs 1.27 lakh crore over a one-year period.

Wave Of Passive, Thematic, Sectoral Funds

Interestingly, fund houses are focusing on launching NFOs of either index funds or exchange-traded funds (ETFs), pegged to different thematic and sectoral indices. Among the 33 NFOs launched in just about one-and-a-half-months, 11 are passively-managed index funds and seven are either sectoral or thematic funds.

As on February 20, 2025, there are seven ongoing NFOs, out of which three are index funds, fund-of-funds, or ETFs. Similarly, in 2024, a little less than half of the NFOs—120 out of 248—were passive funds (46 ETFs and 74 index funds). These included thematic and sector-based index funds.

There’s no denying that index funds and ETFs create competitive and cost-effective options that benefit the investors. What raises concern, however, are the narrowly mandated sectoral and thematic options in the passive funds space.

Investors tend to invest in markets when they are at higher levels. The NFO launch spree caters to that demand and data also proves that

Apart from the index-based thematic and sector funds, 54 pure-play thematic (35), and sector (19)funds were launched. Sector and thematic funds also have a narrower mandate than diversified funds.

This trend is not limited to India alone. Thematic funds are on the rise even in other major markets, including the US and some European countries. According to Morningstar Global Thematic Funds Landscape 2024 released in October 2024, in the trailing five years to the end of June 2024, worldwide assets in thematic funds almost doubled to $562 billion from $269 billion. The report also highlights that Europe is the largest market for thematic funds, accounting for half of the global thematic fund assets, while the US represents 22 per cent.

One key regional difference is the preference for actively-managed versus indexed strategies. In Europe, 86 per cent of thematic fund assets are in actively managed funds. In contrast, 81 per cent of US thematic fund assets are in indexed strategies. India also replicates the US strategies where most of thematic funds are in indexed strategies.

The Lurking Risk

At the beginning of 2021, fund houses started introducing broad-based thematic funds, such as manufacturing funds, innovation funds, and business cycle funds.

Gradually, they moved to other indices and the mandate started getting narrower. For instance, the Nifty Tourism Index comprises 15 stocks from the tourism sector. Similarly, the Nifty India Railway PSU Index consists of 14 stocks.

These narrower mandate indices rely heavily on just 2-3 stocks, which account for 50-60 per cent of the index weight. For instance, in the Nifty Tourism Index, the top three stocks contribute around 60 per cent of the weight.

This increases the chances for volatility. If the prices of these key stocks fall, the entire fund’s performance can be badly affected.

As a result, investors in such funds may face higher risk compared to those in more diversified funds, where the impact of a few underperforming stocks is lower on the overall portfolio.

Swarup Anand Mohanty, vice chairman and CEO, Mirae Asset Investment Managers India, cautions investors about the risks associated with these funds. “Investors should understand the difference between thematic and sector-based mutual fund schemes and not treat them the same. Sectors can be cyclical in nature, and while opportunities may be lucrative, they are often short-term,” he says.

So, why are fund houses launching such high-risk NFOs? One of the reasons may be linked to the 2017 recategorisation ruling by the capital market regulator, the Securities and Exchange Board of India (Sebi), which mandated fund houses to keep just one scheme per category. Index funds, ETFs and thematic and sectoral funds were kept out of the recategorisation exercise.

Kaustubh Belapurkar, director-manager research, Morningstar, poses a critical question: “Some fund houses are not adequately invested in certain themes within their diversified funds, yet they launch thematic funds from that theme. This is a bit unusual—if an emerging theme has potential, why shouldn’t the investors in diversified funds also benefit from it?”

The fund houses give another rationale for the preference for thematic and sector funds.

Says Mohanty: “The surge in thematic and sector-focused NFOs reflects a noticeable shift in investor behaviour. As we’ve seen over the past few years, there’s a growing interest in moving beyond core portfolio allocations to tactical or satellite investments, particularly in emerging sectors, such as manufacturing, technology, and green energy.”

Also, the fact that it is a global trend may be another reason. “It is not a local phenomenon; it is global, and India is following suit,” says Belapurkar.

Don’t Chase Recent Returns: Investors, typically, get tempted by recent returns. When a sector is in favour, sector funds may deliver high returns, which attract investors to make quick gains.

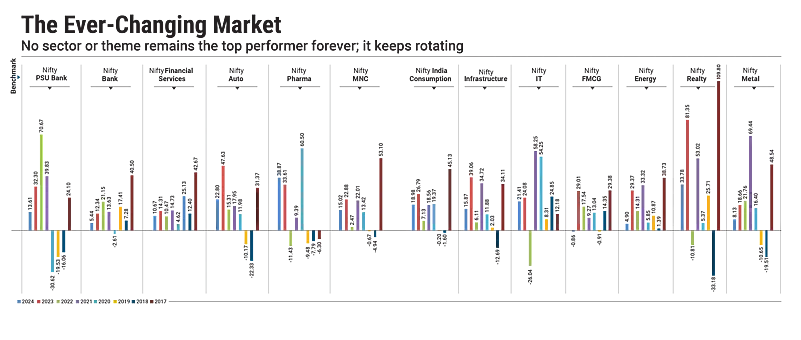

However, this is where most investors get trapped. Typically, they invest in a sector at its peak, driven by short-term performance, without considering the cyclical nature of sectors (see The Ever-Changing Market). Once the sector loses favour, they may make losses.

Timing the entry and exit is crucial in thematic and sector funds. If your timing is off, you may end up on the losing side. For instance, in 2021, when technology stocks were the talk of the town, many investors poured money into technology funds. However, in 2022, many of them faced huge losses.

Says Belapurkar: “Thematic and sector funds are cyclical in nature, making the timing of entry and exit crucial. These funds are suited for investors who actively do research and manage their investments, not for the average, passive investor.”

Look For Gaps: Whether you should invest in an NFO or not will depend on your overall investment portfolio. If the NFO offers a product that your portfolio lacks, you may certainly consider it.

Says Mohanty: “We believe thematic funds can offer significant long-term value, but they require a balanced and strategic approach. These funds should complement a core portfolio, ensuring diversification and resilience to market cycles. By maintaining a disciplined allocation, conducting regular portfolio reviews, and aligning investments with long-term goals, investors can effectively navigate the inherent opportunities and risks.”

Evaluate The NFO: If you are considering a thematic or sector fund, evaluate the track record of the fund house as well as the fund manager under whom the NFO is released. Take your time to do your research because even after the NFO period gets over, the schemes are available to regular investors. Plus, you could look at existing schemes from the same sector or theme.

The Final Take

Mutual fund industry officials argue that by launching NFOs, they are offering multiple options to investors, but perhaps putting in a risk-mitigation mechanism in place will bode well, such as, a sector or thematic fund with a trigger option on entering at lows and exiting at highs. This approach would serve both stakeholders.

kundan@outlookindia.com