Mutual Fund Mis-Selling Disclosures: Investing in mutual funds is a popular way of growing wealth. However, as the asset class gains popularity, some investors are falling prey to malpractices such as mis-selling. Mis-selling refers to the practice of misleading investors about the financial products they wish to invest in. Investors often report instances in which intermediaries such as mutual fund distributors engage in mis-selling.

To curb instances of such mis-selling, the Sebi (Securities Exchange Board of India) has mandated asset management companies to disclose such cases on a quarterly basis on their websites and the Amfi (Association of Mutual Funds In India) website. According to the disclosures accessed by Outlook Money, four out of the top 20 AMCs in India in terms of AuM (Assets under Management) have reported six cases of mis-selling in their disclosures. As many as five of the six cases which have been reported involve unauthorised switch transactions. However, exact details of all the complaints were not disclosed in the quarterly reports available on the websites of the AMCs.

What Are Unauthorised Switch Transactions

Unauthorised switch transactions refer to the switching of funds from a scheme in which an investor has invested money to another scheme without the consent of the investor.

For the investor this can potentially lead to a higher capital gains tax, as switching from one scheme to another counts as redemption, thus lowering the net returns the investor would make from the scheme. Apart from the financial consequences of such malpractices, investors can also experience a breach of trust after falling prey to such malpractices.

Why Do Some Distributors Make Unauthorised Switch Transactions

Since mutual fund distributors earn money in the form of a commission when an investor invests in a scheme, they might undertake such unauthorised transfers to increase their earnings if the scheme the funds are being switched to gives them a higher commission.

To curb such instances of mis-selling, especially with regard to New Fund Offers (NFOs), the Sebi mandated that from April 1 onwards, the mutual fund distributors would receive the lower of the two commissions if an investor switched from their existing scheme to an NFO. However, this rule applies only to switches from an existing scheme to an NFO; instances of mis-selling in existing schemes continue as the distributor gets the higher of the two commissions when such switches are made.

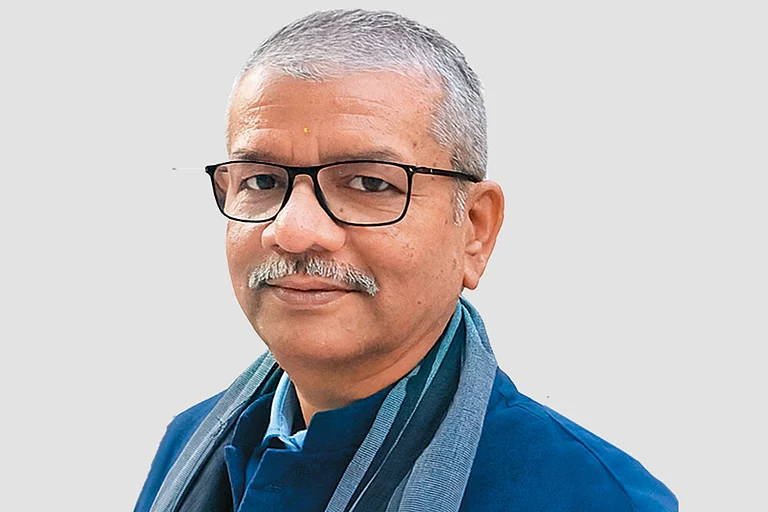

Rajani Tandale, Senior Vice President at Mutual Fund at 1 Finance a Sebi RIA told Outlook Money that MFDs earn commissions from AMCs for mobilising assets. Tandale added that unlike Sebi registered RIAs, MFDs are not mandated to document the advice or rationale for switching schemes which in turn makes unauthorized switches easier for them.

“MFDs earn commissions (often called trail commission) from AMCs based on the assets they mobilize. Switching clients’ investments to schemes with higher commission payouts increases their income. Some schemes offer higher initial commissions, incentivizing distributors to move clients’ funds from existing schemes. Unlike Registered Investment Advisers (RIAs), MFDs are not required to document advice rationale or seek prior client approval systematically, making unauthorized switches easier,” Tandale said.

According to the Amfi’s fraud awareness booklet, distributors might also make unauthorised switches to debt schemes from equity or international schemes to reduce payout time. Some of the common ways in which mutual fund distributors can make unauthorised switches involve using signed transaction slips taken on a trust basis, forging the investor’s signature and fraudulently logging in to the online portal to make the switch.

In the disclosure for the March quarter of FY 2024-25 made by Nippon India Mutual Fund, accessed by Outlook Money, the mutual fund distributor was found to have made 10 unauthorised transactions totalling nearly Rs 12 lakh.

Notably the investor’s and the investor’s wife’s funds were switched without their written consent from Nippon India Largecap Fund to Nippon India Innovation Fund. Notably the Total Expense Ratio (TER) for Nippon India Largecap Fund is 1.39 per cent, and the TER for Nippon India Innovation Fund is 1.84 per cent as of May 27 as per the Amfi website. The commission paid to the distributor is a part of the TER charged to the investor by the mutual fund house.

How Can Investors Protect Themselves From Unauthorised Switches?

According to Amfi’s Fraud Awareness booklet, investors can protect themselves from unauthorised switch transactions by doing the following:

1) Sign transaction slips only when required and never without checking the details of the transaction.

2) Do not leave blank signed slips with intermediaries like mutual fund distributors.

3) Investors should focus on filling all the forms themselves and sign them, while making sure to strike off blank portions.

4) Mutual fund investors should also consistently monitor their investments and check their account statements before and after investing money.

5) Never share login credentials or OTP with an intermediary

Manasvi Garg, a Sebi Registered Investment Advisor, told Outlook Money that investors can protect themselves by reporting suspicious transactions and investing only with AMFI-registered Mutual Fund Distributors.

“Investors can protect themselves from unauthorised switch transactions by keeping an eye on the email and SMS alerts sent by AMCs and RTAs. Unusual activity should be investigated immediately. Investors should prefer AMFI-registered Mutual Fund Distributors (MFDs) and SEBI-registered Investment Advisors (RIAs),” Garg said.

What Can Victims Of Mis-Selling Do?

Notably all six complaints found in the disclosures by the AMCs were made by the investors themselves. Complaints against a fund house or other intermediaries registered with Sebi can be made through Sebi’s SCORES portal.