Amid the current volatility in the equity market, there is a notable demand for large-cap funds. Large-cap stocks are considered a safe haven during volatile times due to their size. Typically, when the market turns volatile, investors tend to opt for safer options. Blue chip stocks are considered less volatile than other stocks across market capitalisation. They tend to handle the fall better and recover sooner than others. If you are looking for a reliable large-cap fund, your search ends with Canara Robeco Large Cap Fund. It has proven its mettle with consistent performance across market cycles.

Portfolio

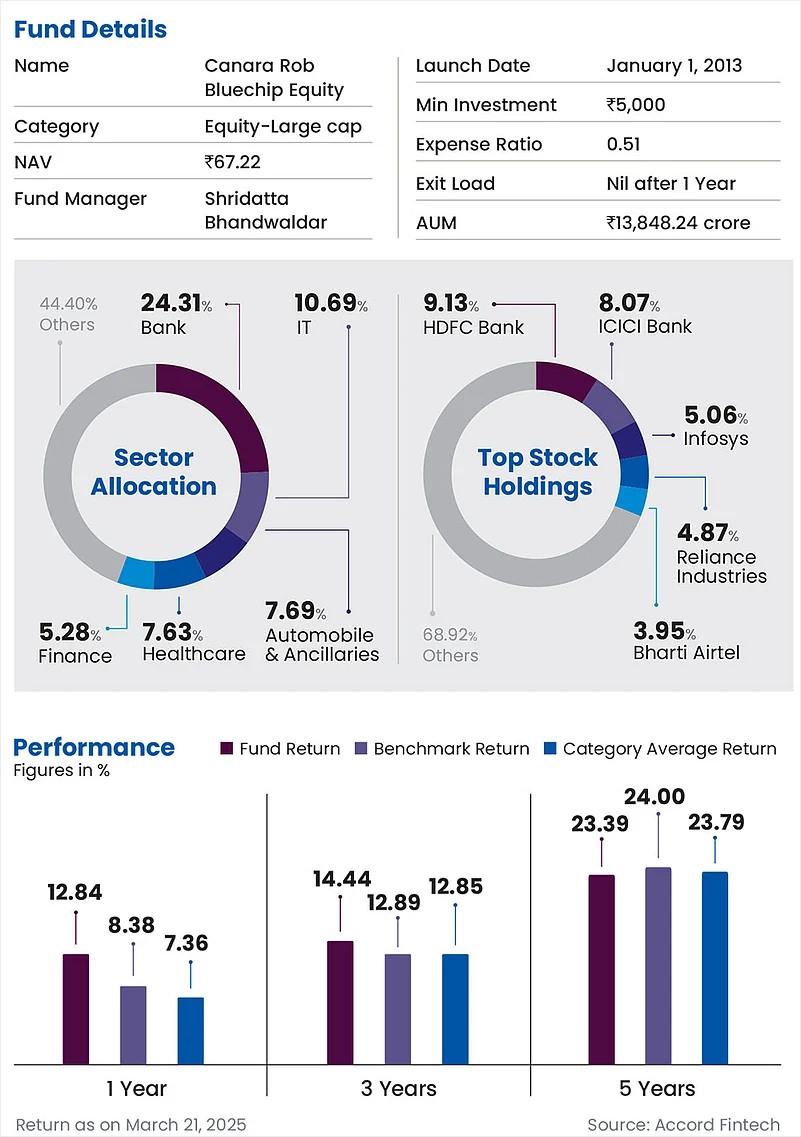

The fund’s investment strategy revolves around core and satellite portfolios. It invests 65-70 per cent of its portfolio in top-quality companies with strong moats and quality management. The rest 30 per cent is allocated to companies that are likely to benefit from emerging trends in economic activities. The core portfolio provides stability, while the satellite portfolio allows the fund manager to deliver alpha.

In terms of the number of stocks, typically, it holds 40-45 stocks in its portfolio. As far as stock selection strategy goes, it invests in companies and sectors that are expected to perform better than the general market. “We look for companies and sectors that are expected to perform better than the general market”, says Shridatta Bhandwaldar, fund manager of the scheme.

The fund also uses a proprietary quant model to identify winning stocks. The fund manager’s ability to astutely pick stocks has been the key behind its consistent performance.

Performance

The fund has a long track record of consistent performance and proven ability to protect downside better than its peers, especially during market volatility. It has outperformed respective benchmark every year in the last five years. It has delivered steady returns, if not the best, since its inception.

OLM Take

Its consistency makes it suitable for an investor’s core portfolio. The fund’s focused exposure to large-cap stocks makes it suitable for all market conditions.

kundan@outlookindia.com