Asset allocation has long been considered a fundamental principle of smart investing. A multi-asset allocation fund provides a one-stop solution for all your investment needs. These are diversified mutual fund schemes that invest in at least three asset classes—typically equity, debt, and gold or other commodities.

A multi-asset strategy provides flexibility to the fund managers to change asset allocations based on market conditions, and manage risk while capturing opportunities.

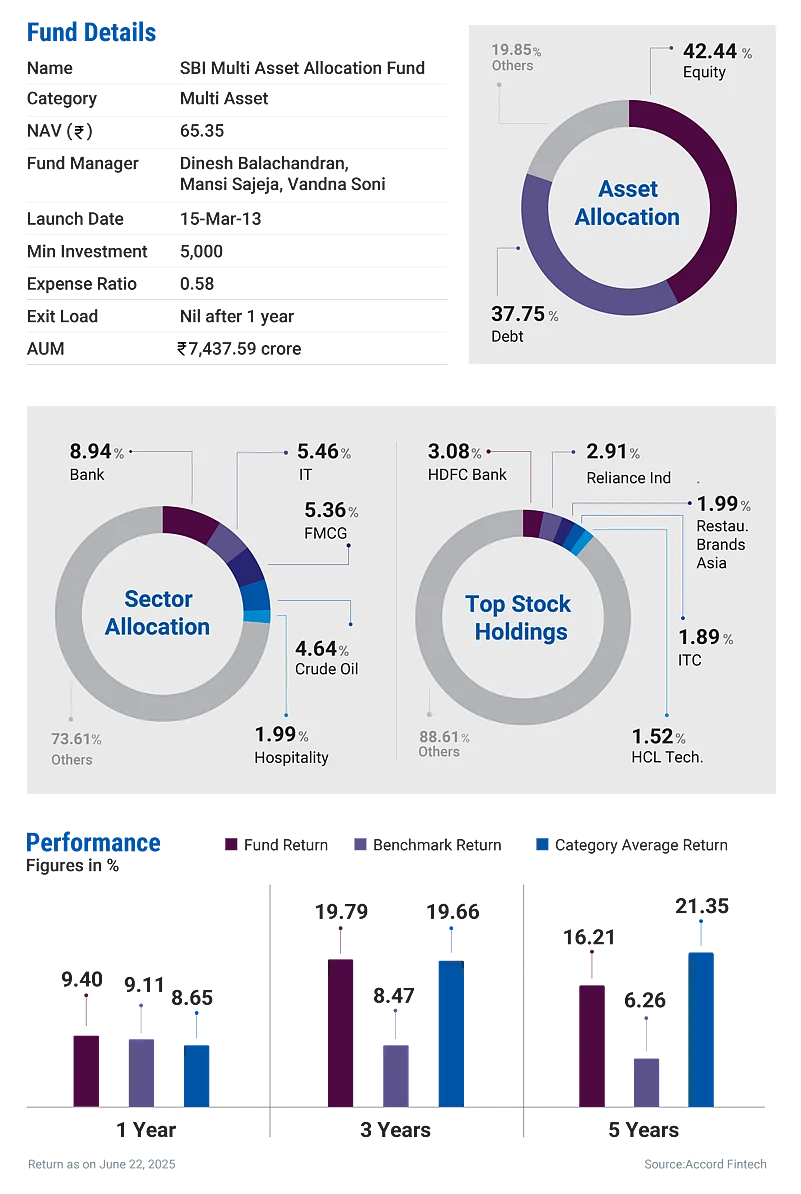

They are ideal for conservative to moderate risk-taking investors looking for long-term capital appreciation. In this space, SBI Multi Asset Allocation Fund could be a decent choice, given its long-term performance track record.

Portfolio

The portfolio composition showcases a mix of asset class, including equity, debt, commodity, and real estate.

The fund is mandated to invest 35-80 per cent in equities. Over the past two years, equity allocation has been maintained in the range of 35-52 per cent. The fund manager also has the flexibility to invest in equity derivatives for up to 50 per cent of the equity portion of the scheme to manage volatility risk.

The debt portfolio is a diversified mix of highly rated non-convertible debentures (NCDs), which form around 30 per cent of the portfolio. There’s a 5 per cent allocation to government securities. In the commodity segment (gold and silver ETF), its exposure is 11.40 per cent.

Performance

The fund has impressed investors both in terms of delivering decent returns and containing the downside. It has delivered compounded annual growth rate (CAGR) of 12.17 per cent over the last 10 years, which is even higher than many pure equity funds. During market volatility between October 1, 2024, and March 31, 2025, driven by elevated valuations and tariff concerns, the broader market index fell by over 8.82 per cent, but this fund restricted its loss to just 2.88 per cent.

kundan@outlookindia.com