Many investors, driven by the desire for strategic diversification and higher returns, continually explore different debt options. Invoice discounting has emerged as a popular choice among such fixed-income options as it offers a unique opportunity to investors to provide immediate liquidity to businesses by purchasing their unpaid invoices at a discount.

Says Suman Lahiri, certified financial planner (CFP), founder and chief investment officer (CIO) of Plan Your Money, a provider of financial products, “The attractiveness of invoice discounting is due to its short-term nature and high returns—11-15 per cent annualised return.”

It became especially popular during the pandemic. Says Yash Roongta, founder of Alt Investor, India’s largest alternate investing community platform: “Invoice discounting is popular among retail investors, as it offers lucrative return compared to fixed deposits on short-term transactions of 30-90 days.”

How Does It Work?

Invoice discounting allows businesses to sell their accounts receivable (unpaid invoices) to a third party at a discount before the payment due date. This provides the business with immediate access to funds tied up in outstanding invoices, enhancing liquidity and enabling more effective cash flow for the business. For investors, it is an opportunity to earn higher returns over a short term.

Let’s take an example: Company A wants a certain product that is manufactured by Company B. So, A commissions an order with B for the product, but says that payments will be cleared 90 days after the delivery. Company B issues the invoice for the product and A confirms it. But Company B needs cash to manufacture the product. So, it sells this invoice to an investor for an immediate cash advance, usually at a discount of 10-15 per cent of the total value of the invoice. So, if the invoice is of Rs 100 crore, Company B will get Rs 85 crore from the investor, if the discount is 15 per cent.

Credit risk is a concern, which arises if the debtor fails to pay the invoice on time due to financial issues. Also, the sector is mostly unregulated

Investors need to evaluate the invoice details and assess the creditworthiness of the business’s customer before agreeing to purchase the invoice. This is crucial to mitigate risk and ensure a profitable return. Once the transaction is approved, the investor provides the business with the needed funds, while waiting for the payment from the customer.

Throughout the transaction process, the business is responsible for collecting the payment from the customer. Once the customer pays the invoice, the investor receives the principal and additional interest or profit from the business. In the above example, B will collect Rs 100 crore from A and pass on the entire amount to the investor.

This process can be cumbersome, which is why invoice discounting platforms serve as marketplaces to streamline these transactions. They provide a space for companies to list their invoices and the funds they need to raise while offering investors a centralised location to access and review all relevant information. This set-up simplifies the process for both parties, facilitating efficient exchanges in the market.

What Makes Them Risky?

The high potential returns from invoice discounting also makes them highly risky. The major concern is credit risk, which arises if the debtor fails to pay the invoice on time, often due to financial troubles or insolvency.

Roongta highlights the real-world consequences of these risks.

“Even experienced people, including myself, have faced defaults where we failed to assess the risks, resulting in significant financial losses,” he says.

It is crucial to understand the promoter’s background and security measures when engaging with unregulated instruments in order to ensure your investments are secure. Says Roongta: “Investors should be prepared for the possibility of loss, especially in the unregulated sectors, of alternative investment where due diligence might not be up to standard.”

Viral Bhatt, CFP and founder of Money Mantra, a financial products distribution firm, who has been engaged in invoice discounting for nearly two years, explains in detail.

He says: “I handle invoice discounting for several of my clients who understand the risks and need quick access to funds. They prefer not to tie up their capital for extended periods; instead, they choose shorter durations—typically 1-4 months—to better manage their cash flows. What’s crucial in invoice discounting is thorough research to ensure we know the company that will ultimately make the payment, which minimises the risk of default.”

Investors also face high entry barriers, as most platforms, except for a couple, require a substantial minimum investment.

Managing these varied risks through diligent partner selection, robust credit policies, and due diligence is crucial for leveraging the benefits of invoice discounting, while minimising potential downsides.

Navigating Platforms?

The Reserve Bank of India (RBI) has established three platforms, which cater exclusively to banks and non-banking financial companies (NBFCs) for invoice discounting.

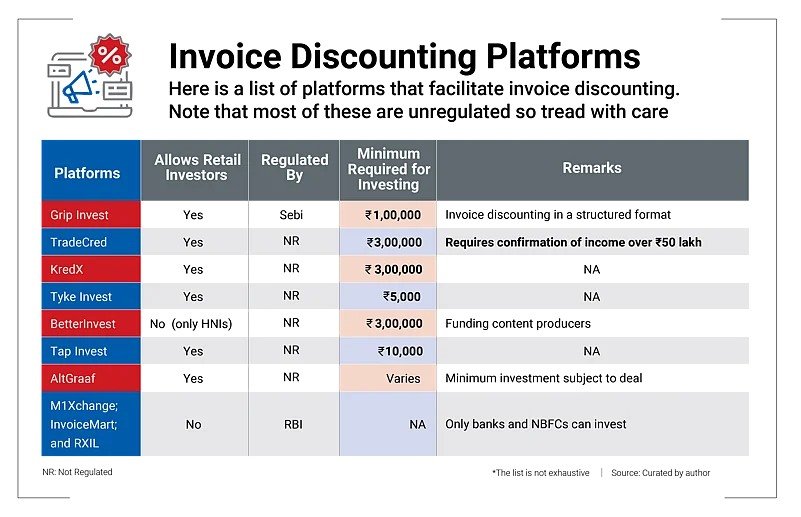

However, retail investors have no other choice but to navigate a landscape populated predominantly by unregulated platforms (see Invoice Discounting Platforms).

Among the platforms, Grip Invest stands out due to its regulatory compliance and structured approach to invoice discounting.

Says Roongta: “For regulated transactions involving invoice discounting, platforms like Grip use securitised debt instruments, which are more structured and offer a layer of security through minimum holding periods and pass-through certificates (PTCs).” These PTCs are backed by a variety of short-term loans secured against approved invoices from various businesses, offering regular returns. They also follow RBI guidelines.

Vaibhav Laddha, chief executive officer (CEO), Grip Invest, elaborates on the advantages of their platform: “There are three benefits for any investor when choosing our platform: (1) We are a regulated platform; (2) As investors choose a structured product, there is diversification; (3) Independent agencies rate all products for a fair review.”

Additionally, all financial transactions are managed by a Securities and Exchange Board of India (Sebi)-registered trust to ensure the security of investors’ funds.

Another innovative approach is seen in AltGraaf, which has incorporated insurance to mitigate risks. Some invoices on their platform are insured, ensuring that investors receive payments in case of defaults.

Also, it is important to keep in mind that many of the platforms, such as Better Invests, focus on ensuring that only high-networth individuals (HNIs) or reputable investors approach their platforms. Meanwhile, TradeCred takes a declaration on signing up: ‘I also confirm that I have an annual income of more than Rs 50 lakh’. This selective approach and additional safeguards like income verification and insurance aim to protect investors beyond the standard disclaimers typically provided by investment platforms.

“Each platform has its own unique risk mitigation strategy,” says Bhatt.

What Should You Do?

When considering investment opportunities like invoice discounting, investors should heed the advice of experienced financial professionals.

Roongta stresses on the importance of sticking with regulated instruments over unregulated ones to mitigate risks. Regulated platforms are supervised by governmental and financial authorities, ensuring more transparency and legal recourse if some issue arises.

On managing risks, Bhatt says, “Assessing the suitability of invoice discounting for clients is very important. Only those who are aware of the high risks that products entail should choose them.”

Asset allocation should be a big consideration when purchasing these. Explaining the importance of asset allocation, Lahiri says, “Only a small portion of the short-term portfolio should be allocated to these high-return, short-term opportunities like invoice discounting. This helps maintain a balanced portfolio, minimising exposure, while capturing potential high returns for a portion of the investment portfolio.”

Investors should consider these factors and consult a financial advisor to understand their own risk tolerance and investment goals before engaging in less traditional investments, such as invoice discounting.

The author is a Freelance Writer and Certified Financial Planner