When we think of investments, the first thing that intuitively comes to our mind is the expected returns. But there is another important aspect that we should consider: diversification. Its benefit lies in the negative correlation between various investment assets. The negative correlation is not a perfect 100 per cent, but even to a lesser extent, negative correlation leads to portfolio diversification. Simply put, in a given market condition, various investment assets behave differently. So, the volatility in your portfolio is reduced to the extent certain components move differently than the others.

In the current context, gold is expected to yield decent returns over the medium to long-term period. Historically, gold has proven to be a good portfolio diversifier, by helping reduce the overall portfolio volatility. Let’s explore why gold is expected to yield better returns and how it can help diversify your portfolio and mitigate risks.

Gold As A Diversifier

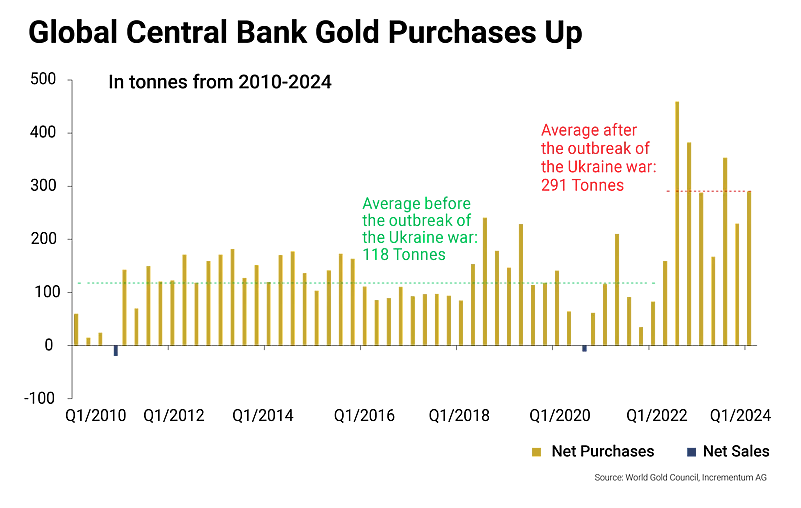

Geo-Political Tension And Diversification From US Dollar: There has been an escalation in the purchase of gold by central banks all over the world. The average of 10 years (2010-2021), prior to the outbreak of Russia-Ukraine war, was 118 tonnes per year. Post the Russia-Ukraine war (Q1 2022 to Q1 2024), the three-year average is 291 tonnes per year. Subsequent to the US forfeiting Russian money, when sanctions were imposed in 2022, it is all the more imperative for central banks to diversify their reserves.

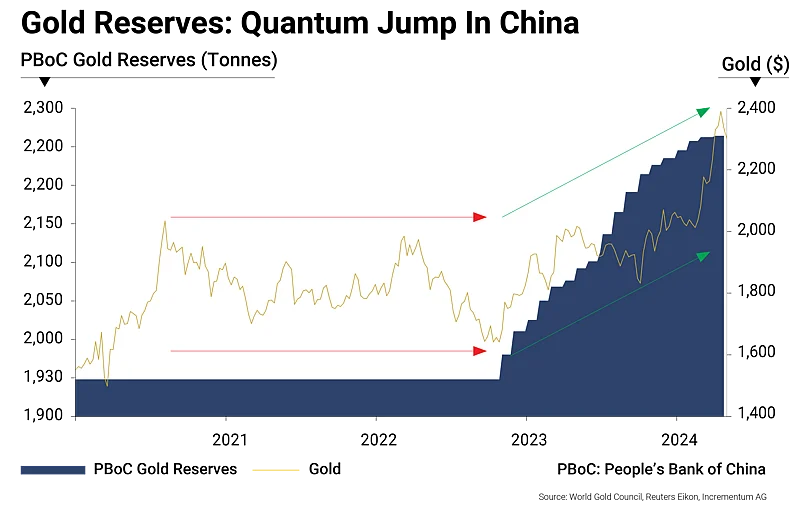

Geo political tensions now seem to be lingering, and China is the biggest driver (2264.32 tonnes in the second quarter of 2024) among the central banks of the world.

Global Equity Bear Market And Gold: Gold acts as a safe haven in times of uncertainty and bear phases in the equity market. When we look at the last 100 years, when the equity market (represented by S&P 500) was in a bear phase, gold was mostly in the positive territory, or marginally negative. For example, during the Great Depression (1929 to 1932), when S&P 500 fell 86 per cent, returns from gold were marginally positive. Similarly, during the global financial crisis of 2008-2009, when S&P 500 fell 57 per cent, gold was up 25 per cent.

Many other similar phases have led to gold getting the epithet of a safe haven in times of uncertainty. We mentioned earlier that the negative correlation between investment assets reduces volatility in your portfolio.

Rupee Depreciation Adds To Gold Returns: Another typical aspect, leading to enhanced returns from gold for investors in India, is the depreciation of rupees against the US dollar.

Globally, gold price is denominated in US dollars by the London Bullion Market Association (LBMA). Gold price in India is derived by converting that to our currency. When we import, the landed cost is as per the prevailing level of the currency. Since the rupee has been depreciating, it eventually adds up to the returns.

Data shows that US dollar return from gold since 2000 is 8.9 per cent annualised, whereas the rupee return is 11.9 per cent annualised. For a perspective, for the same period, returns from gold in Japanese yen is 10.9 per cent, in pounds is 10 per cent and in euro is 8.6 per cent.

What Should You Do?

You can pick and choose the method (see Gold Investment Options) that suits you. Generally, non-physical forms of exposure are better.

Among the non-physical forms of holding gold, sovereign gold bond (SGB) is the only one that pays an interest over and above market-based returns of gold. SGBs are available in the secondary market, but fresh primary issuances are unlikely in the immediate future.

For portfolio diversification and smoothening out your investment journey, you should have some allocation of gold in your portfolio. The ideal percentage of allocation be around 10-15 per cent of your portfolio; the bulk of it should go into staple assets, including equity and debt. This would stabilise your portfolio during bear phases in the equity market, apart from yielding returns due to the reasons mentioned earlier.

By Joydeep Sen, Corporate Trainer and Author